Pound Sterling Price News: GBP recovers against US Dollar amid increase in dovish Fed bets

Pound Sterling recovers against US Dollar amid increase in dovish Fed bets

The Pound Sterling (GBP) regains ground against its major currency peers on Friday after a sharp fall the previous day, which was driven by the Bank of England’s (BoE) signal that there is a high chance of an interest-rate cut in the near term.

In the monetary policy announcement on Thursday, the BoE unanimously decided to leave interest rates unchanged at 3.75%, with a 5-4 vote split. The BoE was widely expected to maintain the status quo, but the number of Monetary Policy Committee (MPC) members supporting keeping rates unchanged was lower than the seven expected by markets. Read more...

GBP/USD: Dovish BOE tilt opens downside – BBH

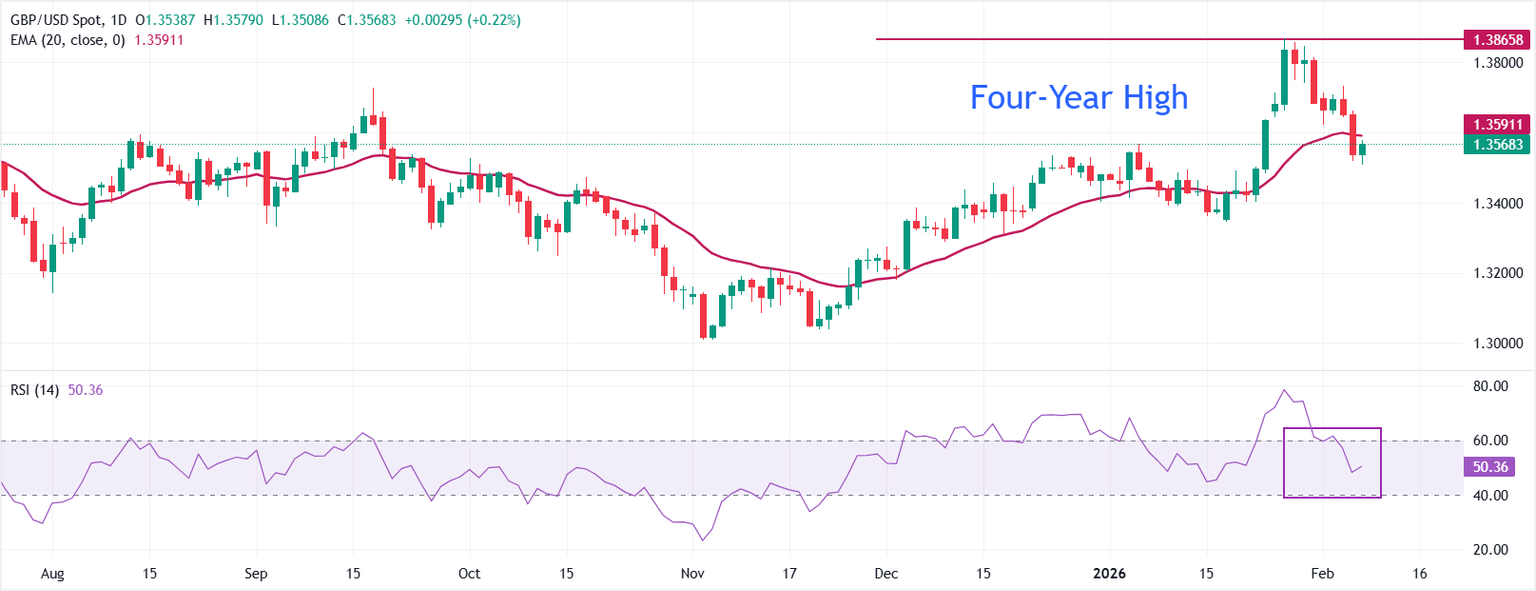

Brown Brothers Harriman (BBH) analysts note GBP/USD has recovered part of its prior drop after a dovish Bank of England hold and heightened UK political uncertainty. The BOE kept rates at 3.75% but lowered the bar for further easing by tweaking guidance and cutting inflation forecasts. BBH analysts see scope for GBP/USD to test its 200-day moving average as rate expectations adjust.

"GBP/USD clawed back some of yesterday’s losses triggered by the double whammy of heightened UK political uncertainty and a surprisingly dovish BOE hold. As was widely expected, the BOE left the policy rate unchanged at 3.75%. Read more...

Author

FXStreet Team

FXStreet