Pound Sterling Price News and Forecast: GBPUSD testing levels above 1.1400 as the US Dollar trims gains

GBPUSD testing levels above 1.1400 as the US Dollar trims gains

The Pound has bounced up from session lows at the mid-range of the 113.00s on Wednesday’s US trading session, returning above 114.00 amid a broad-based US Dollar pullback. The pair, however, is still 1% lower on the daily chart, after having peaked right above 1.1600 on Tuesday. Read more...

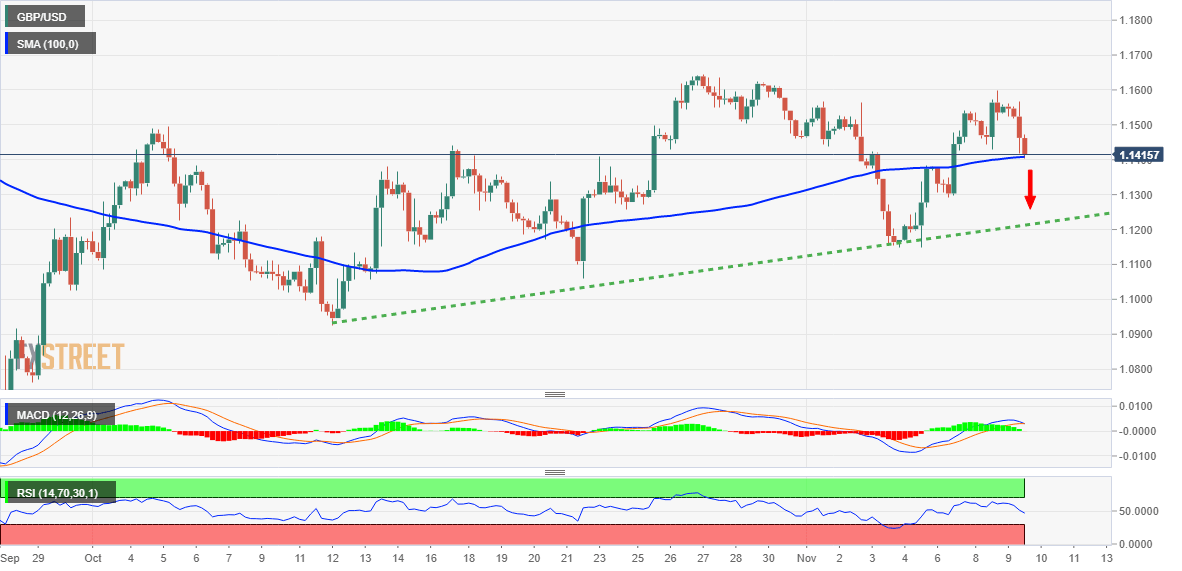

GBPUSD Forecast: Sellers look to take action as Pound Sterling tests key support

GBPUSD has reversed its direction and retreated below 1.1500 early Wednesday after having managed to close in positive territory on Tuesday. Following the latest pullback, the pair's near-term technical outlook suggests that buyers are struggling to retain control of the action. In case safe-haven flows start to dominate the financial markets, GBPUSD could extend its slide in the second half of the day. The upbeat market mood didn't allow the safe-haven US Dollar (USD) to outperform its rivals in the American session on Tuesday and helped GBPUSD erase its daily losses. The US stock index futures are down 0.2% during the European trading hours, pointing to a cautious sentiment. Read more...

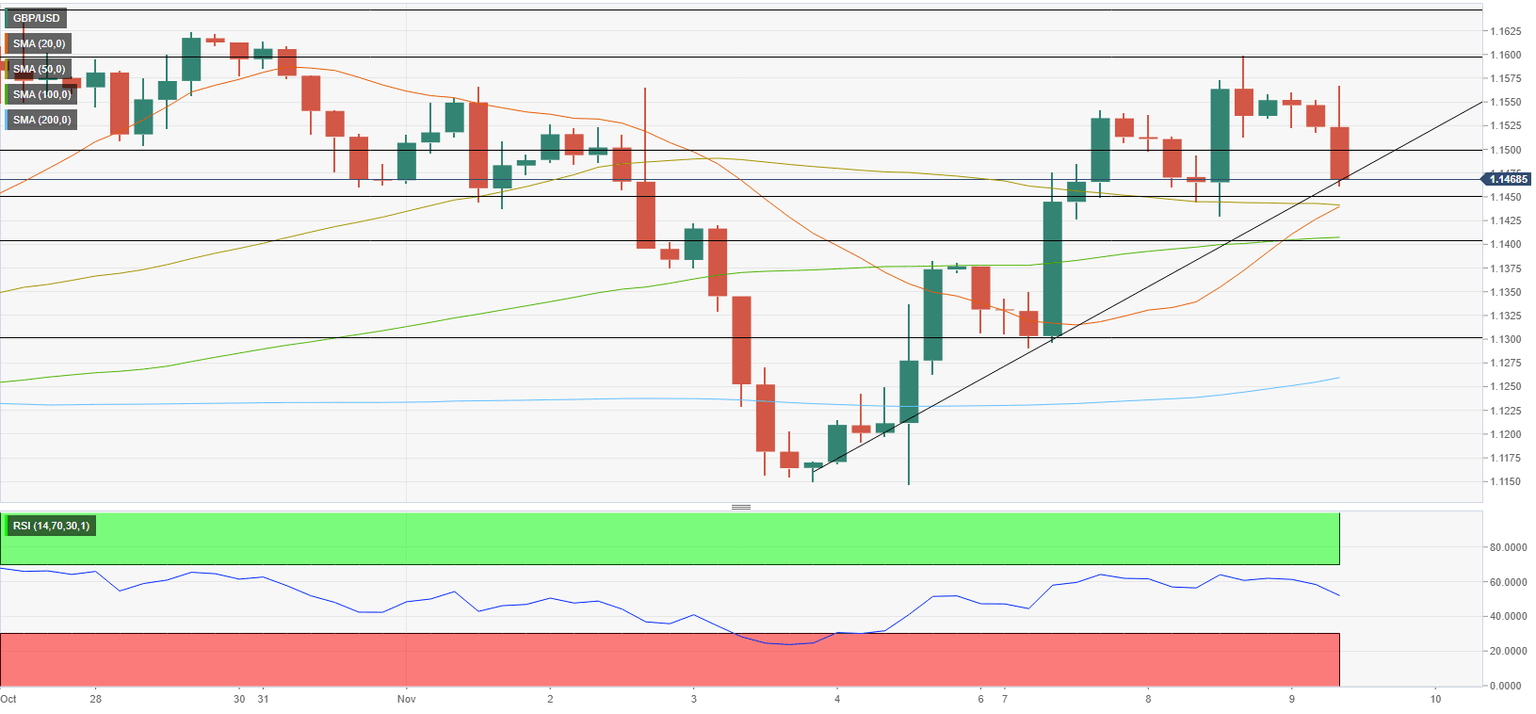

GBPUSD Price Analysis: Bears look to seize back control, break below 1.1400 awaited

The GBPUSD pair comes under heavy selling pressure on Wednesday and stalls a three-day-old bullish trend to over a one-week high touched the previous day. The intraday downfall picks up pace during the early North American session and drags spot prices to a fresh daily low, with bears now awaiting a sustained weakness below the 1.1400 mark. A fresh leg up in the US Treasury bond yields, along with a generally weaker tone around the equity markets, assists the US Dollar to stage a goodish recovery from a multi-week low. The British pound, on the other hand, is weighed down by the Bank of England's gloomy outlook for the UK economy. The combination of the aforementioned factors attracts fresh sellers around the GBPUSD pair and supports prospects for additional losses. Read more...

Author

FXStreet Team

FXStreet