Pound Sterling Price News and Forecast: GBP/USD weakened as the USD is buoyed by optimistic tone from Trump

GBP/USD trades lower around 1.3300, retreats from seven-month highs due to US optimism

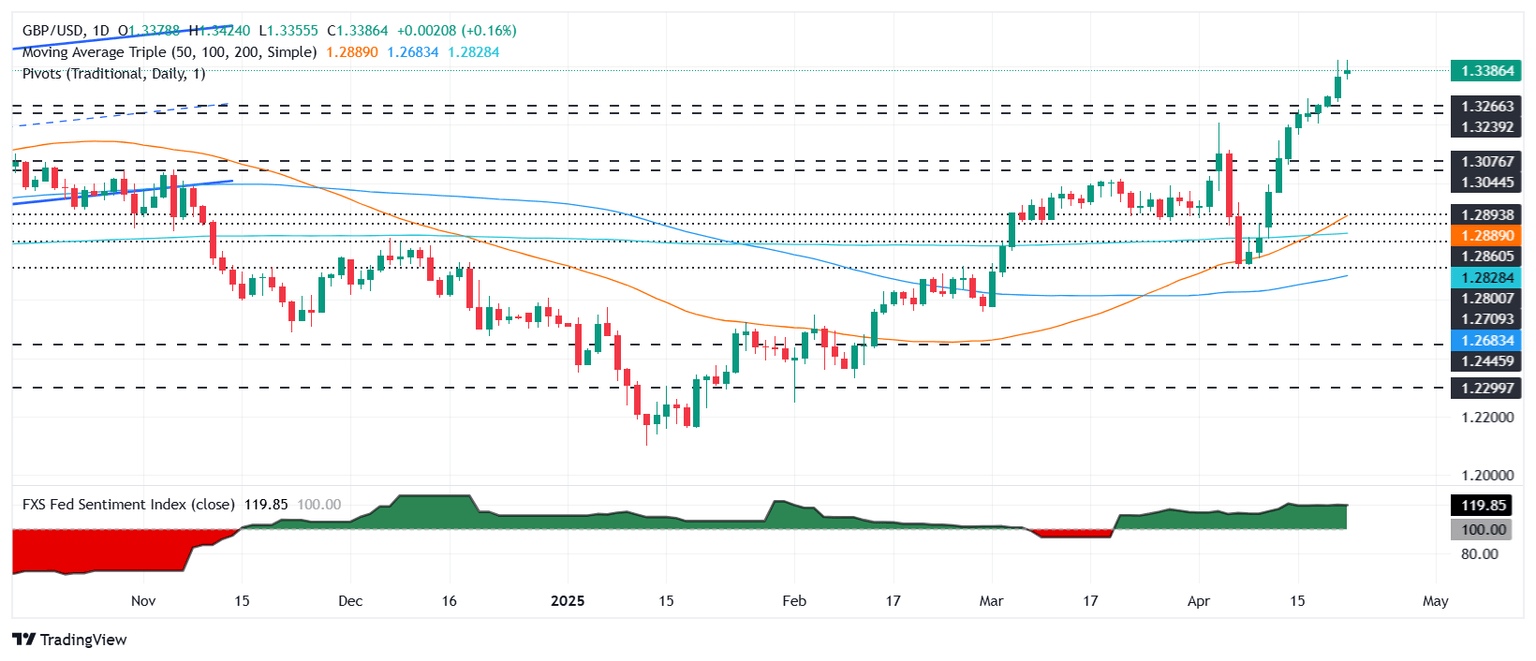

GBP/USD extended its losses during Wednesday’s Asian session, trading around 1.3300 after pulling back from a seven-month high of 1.3424 recorded in the previous session. The pair weakened as investor appetite shifted back toward US assets, including the US Dollar (USD), buoyed by a more optimistic tone from US President Donald Trump.

President Trump helped ease market concerns by affirming his support for Federal Reserve (Fed) Chair Jerome Powell, stating, “The press runs away with things. No, I have no intention of firing him. I would like to see him be a little more active in terms of his idea to lower interest rates.” Read more...

GBP/USD weakens below 1.3300 as US Dollar rises

The GBP/USD pair remains weak near 1.3280 during the early Asian session on Wednesday. Comments by US Treasury Secretary Scott Bessent hint at a thaw in US-China trade tensions, fueling optimism in markets and strengthening the US Dollar (USD) against the Pound Sterling (GBP).

Scott Bessent said on Tuesday that he expects a de-escalation in US President Donald Trump’s trade war with China in the very near future. He further stated that the tariff standoff with China cannot be sustained by both sides and that the world’s two largest economies will have to find ways to de-escalate. Read more...

GBP/USD retreats from YTD high past 1.34 on Fed turmoil

The Pound Sterling (GBP) reverses its course after reaching a daily high of 1.3423 due to concerns over the Federal Reserve (Fed) independence, spurred by United States (US) President Donald Trump's harsh comments against Fed Chair Jerome Powell. At the time of writing, GBP/USD is trading at 1.3383, up 0.17%.

Market participants continued to digest White House Economic Adviser Kevin Hassett's comments about US President Donald Trump looking for ways to oust Powell. This pushed GBP/USD to re-test the current year-to-date (YTD) peak before falling below 1.3400. Read more...

Author

FXStreet Team

FXStreet