Pound Sterling Price News and Forecast GBP/USD: US inflation and UK virus data hold the key

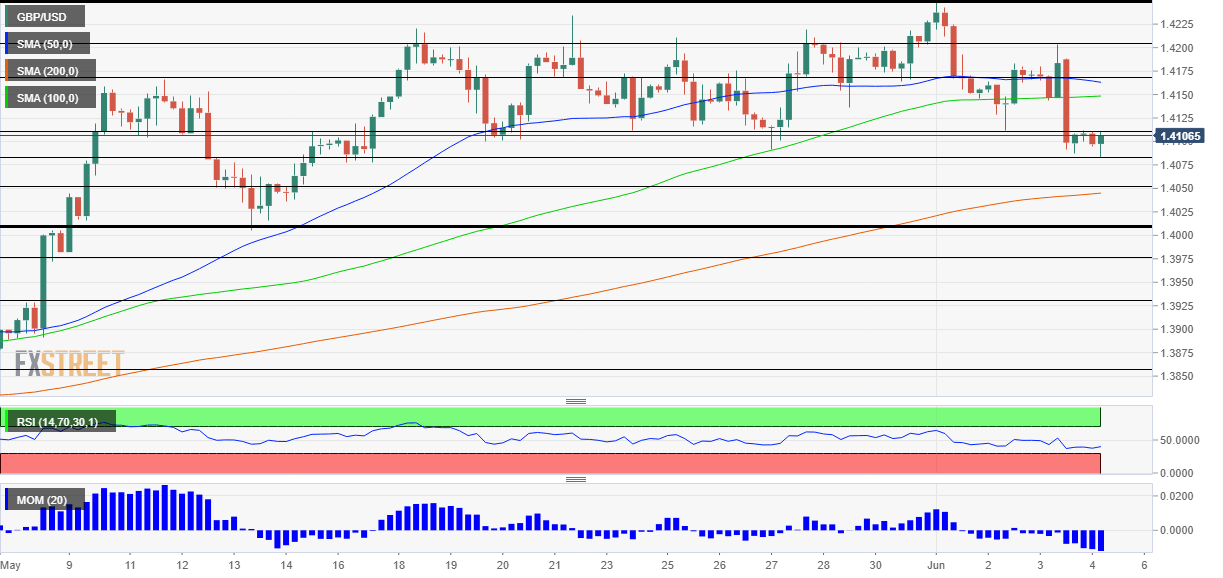

GBP/USD Forecast: To 1.40 or 1.42? All eyes on US Nonfarm Payrolls

Sterling has succumbed to data and Fed-related dollar strength. Nonfarm Payrolls and also worries about the Delta variant are set to move the currency pair. Friday's four-hour chart is showing that cable is at crossroads. Down but not out – that is probably the feeling of GBP/USD bulls after Thursday's blows. The greenback staged a comeback after a trio of US figures beat estimates and as the Federal Reserve seems to be more open to at least talking about tapering its bond buys. Read more...

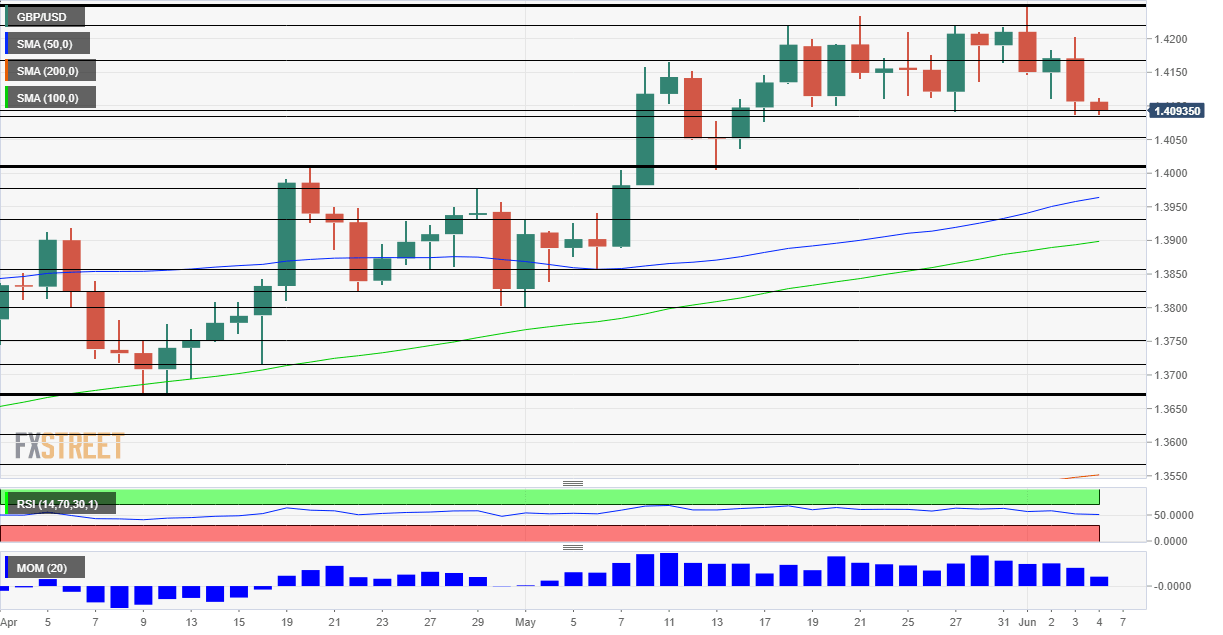

GBP/USD Weekly Forecast: How low can it go? US inflation and UK virus data hold the key

GBP/USD has whipsawed by US data and concerns about Britain's reopening. US inflation data, Fed speculation and UK virus headlines are eyed now. Early June's daily chart shows that bulls remain in the lead. The FX Poll is pointing to steady trading down the road. Taper tantrum – this fear of tightening from the Federal Reserve has been supporting the dollar and overwhelming markets, at least until jobs data missed estimates. Evidence of inflation is set to be crucial to the next GBP/USD moves, alongside ongoing speculation about Britain's reopening. Read more...

GBP/USD fails to recover 1.4200, holds onto important daily gains

Cable rebounds further, finds resistance at the 1.4200 area. Pound also faces resistance against the euro and losses momentum. The GBP/USD rose further during the American session and peaked at 1.4200. Like Thursday, it was unable to break the 1.4200 area and pulled back. The retracement found support at 1.4165 and the pair is about to end the week flat hovering around 1.4160/70. Read more...

Author

FXStreet Team

FXStreet