Pound Sterling Price News and Forecast: GBP/USD turns lower for the third consecutive day

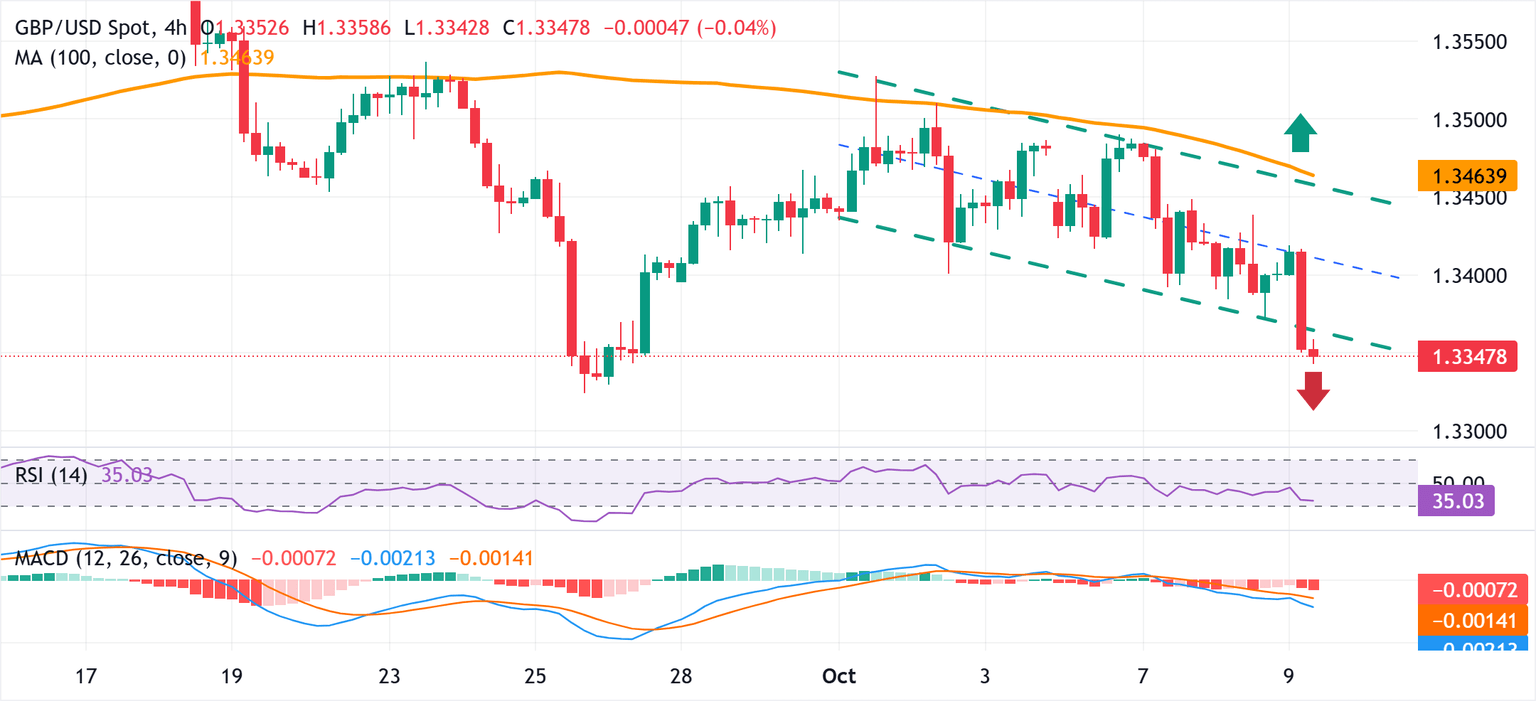

GBP/USD Price Forecast: Descending channel breakdown comes into play ahead of Fed’s Powell

The GBP/USD pair turns lower for the third consecutive day and drops to a nearly two-week trough, below mid-1.3300s during the first half of the European session on Thursday amid the emergence of fresh US Dollar (USD) buying. In fact, the USD Index (DXY), which tracks the Greenback against a basket of currencies, has climbed to a fresh high since early August despite dovish Federal Reserve (Fed) expectations and concerns about a prolonged US government shutdown.

Minutes from the September FOMC policy meeting published on Wednesday indicated near unanimity among participants to lower interest rates amid concern about labour market risks and a more balanced inflation outlook. Policymakers, however, remained split on whether there should be one or two more rate reductions before the end of this year. Nevertheless, the overall tone was cautious and pointed to a continued easing bias. Read more...

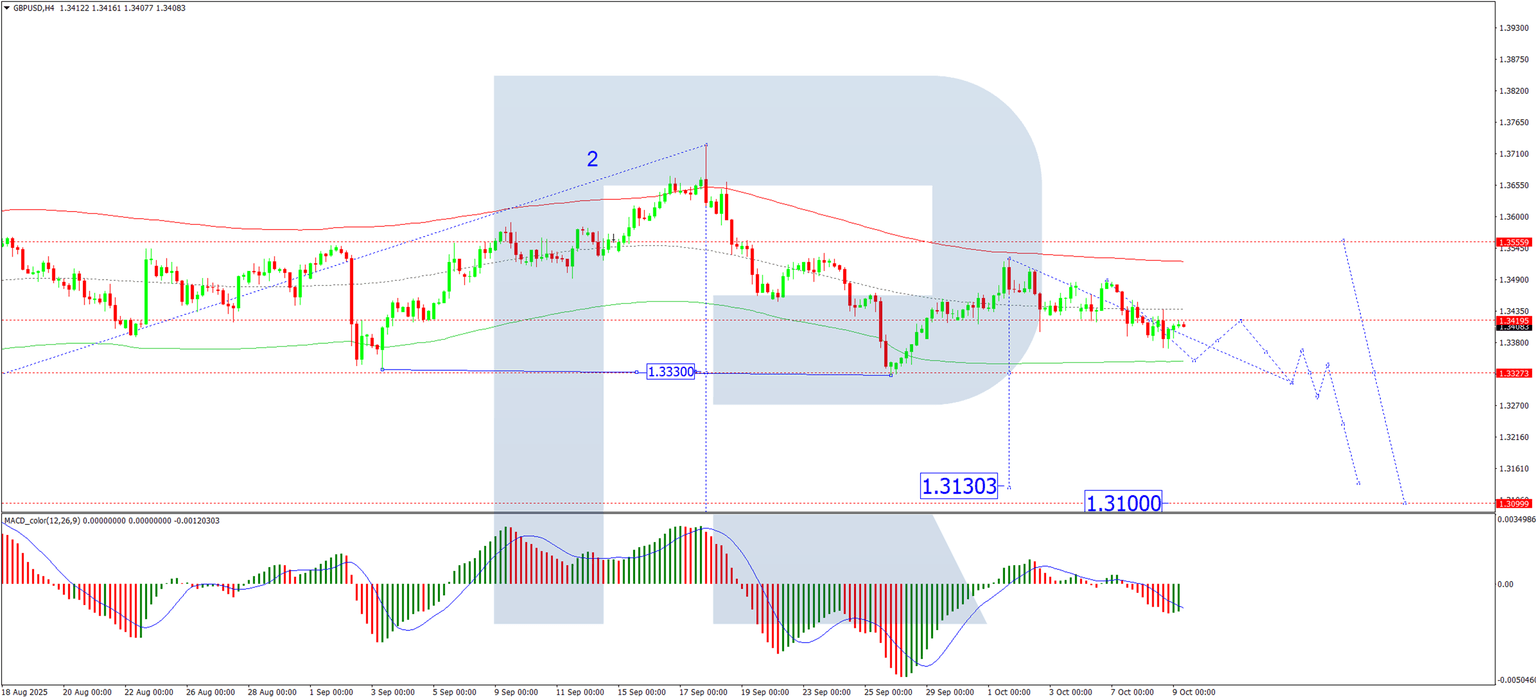

GBP/USD halts decline but inflation risks linger

The GBP/USD pair attempted to stabilise on Thursday, trading around 1.3413 USD. However, investor sentiment remains cautious amid a weak outlook for the UK economy and uncertainty surrounding the government's November budget.

UK GDP growth is projected to remain moderate through year-end, while inflation is forecast to rise to 4% – double the Bank of England's target. Recent data confirm the economy is losing momentum after a strong start to 2025. Read more...

GBP/USD pair stuck in narrow range amid US govt shutdown

Sterling continues to be largely driven by news headlines elsewhere, and has subsequently tracked the euro fairly closely in the past few weeks.

The GBP/USD pair has also been stuck in a fairly narrow range in the past fortnight, with the government shutdown across the Atlantic so far exerting very minimal selling pressure on the greenback. Read more...

Author

FXStreet Team

FXStreet