Pound Sterling Price News and Forecast: GBP/USD trades with mild losses around 1.3450 on Tuesday

GBP/USD Price Forecast: Bullish outlook remains in play near 1.3450

The GBP/USD pair edges lower to near 1.3450 during the early European session on Tuesday. The potential downside for the major pair might be limited after US President Donald Trump announced he was firing a Federal Reserve (Fed) Governor, Lisa Cook. This, in turn, might raise concerns over the Fed’s independence and undermine the US Dollar (USD) in the near term.

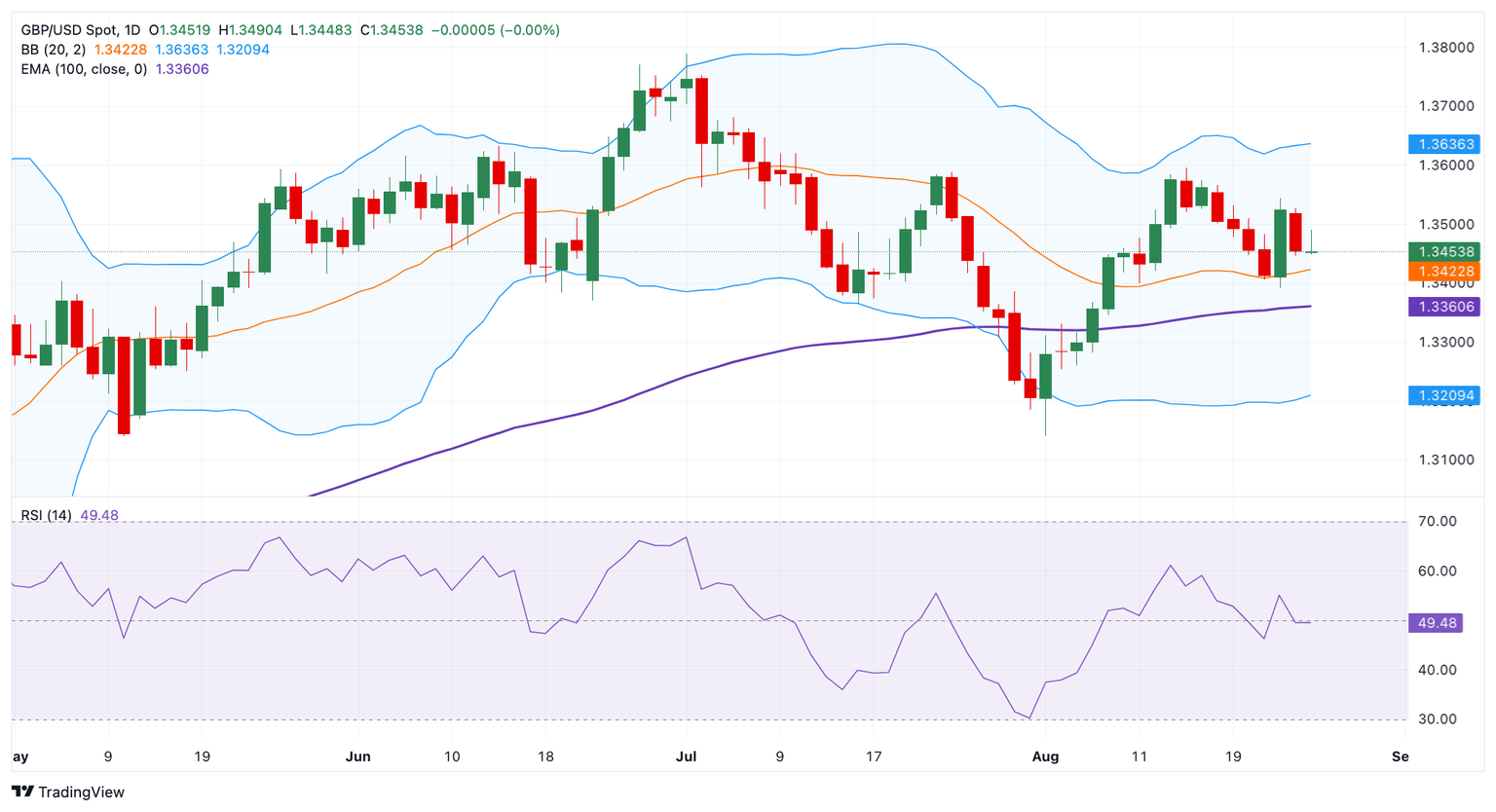

Technically, the constructive outlook of GBP/USD remains in place as the major pair is well-supported above the key 100-day Exponential Moving Average (EMA) on the daily chart. Nonetheless, further consolidation cannot be ruled out, with the 14-day Relative Strength Index (RSI) hovering around the midline. This displays the neutral momentum in the near term. Read more...

GBP/USD pares gains as markets weigh rate cut bets

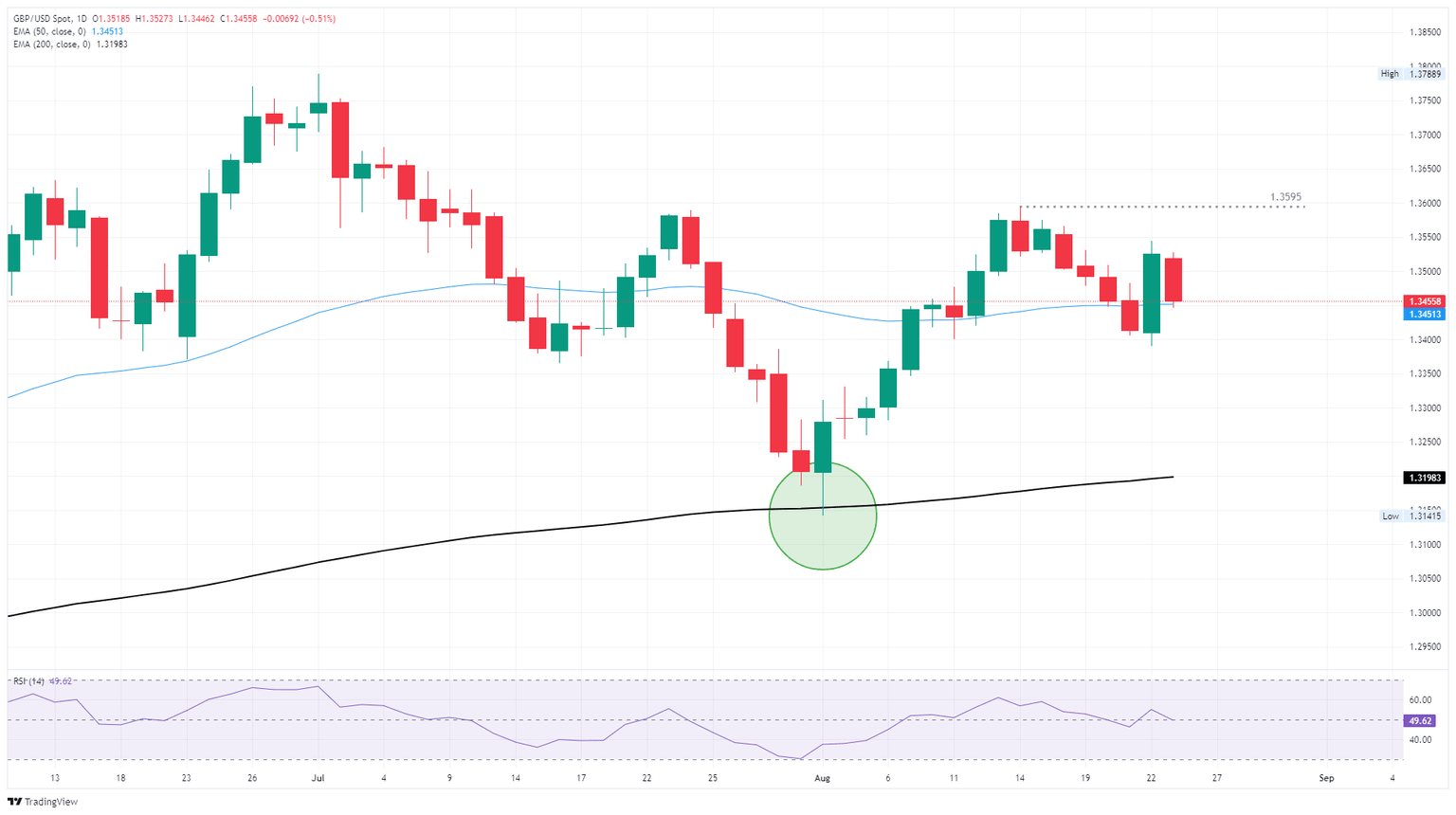

GBP/USD backslid on Monday, falling back into the 1.3450 region after global markets reconsidered their rate cut frenzy sparked by perceptions of a dovish Federal Reserve (Fed) Chair Jerome Powell late last week. Powell’s appearance at the Jackson Hole Economic Symposium fanned the flames of interest rate cut expectations heading into the weekend, but now the latest batch of key US Personal Consumption Expenditure Price Index (PCE) inflation data looms large ahead of investors this week.

It’s a fairly sedate showing on the economic data docket for Cable traders on the UK side; London markets were shuttered for an extended weekend, making Tuesday the first day that GBP domestics will be back on the books since Friday. The data docket is dominated by a decent spread of US economic figures, culminating in the latest PCE inflation print slated for Friday. Read more...

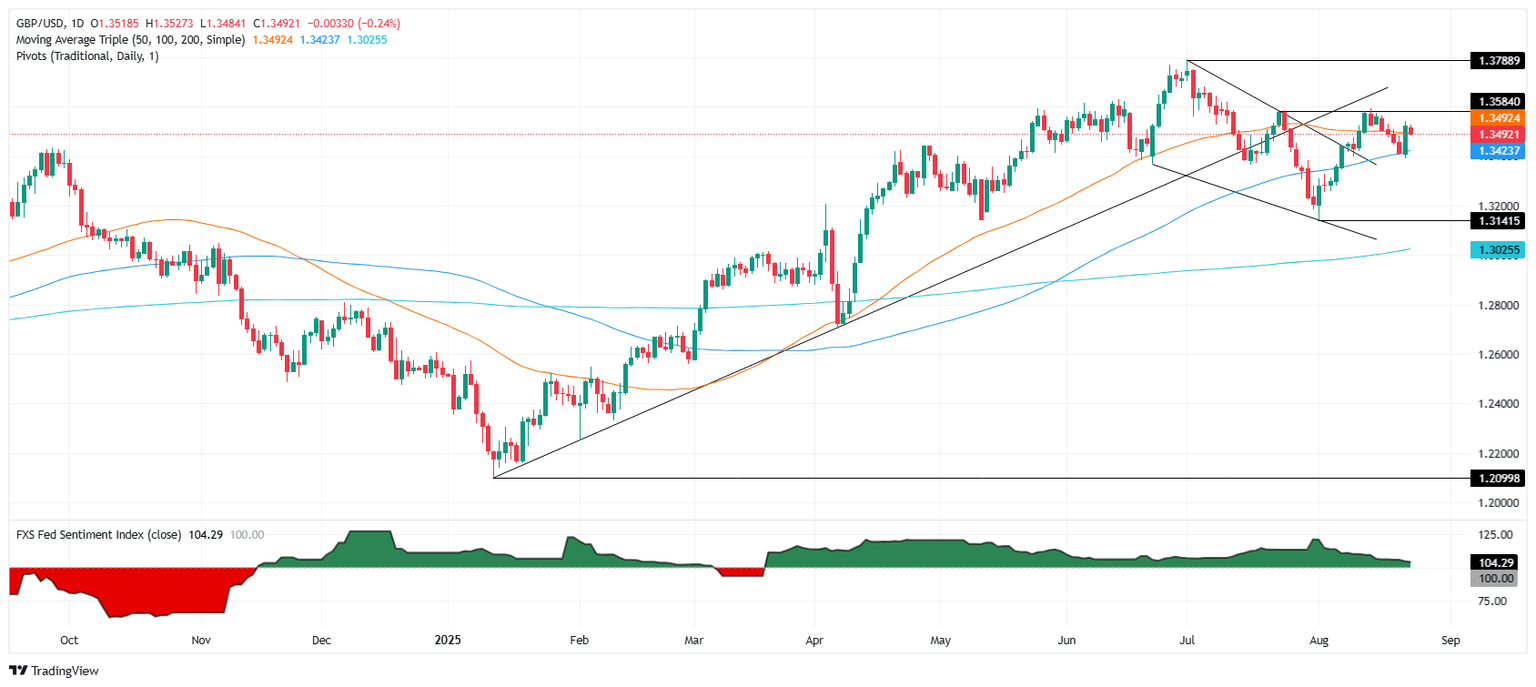

GBP/USD steady near 1.35 as Powell hints at Fed cut

GBP/USD consolidates during the North American session on Monday after last Friday’s dovish tilt by the Federal Reserve Chair Jerome Powell, who said that risks to the labor markets are rising, an indication that monetary policy is cooling the jobs market. At the time of writing, the pair trades at 1.3499, down 0.15%. Price action remained muted due to the United Kingdom (UK) summer bank holiday. Despite this, Bank of England (BoE) Governor Andrew Bailey said that the economy faces an “acute challenge” due to the economy's weakness and a reduced labor force participation.

Earlier on Friday, the Fed Chair Jerome Powell flirted with a September interest rate cut as he said “downside risks to the labor market are rising” and that “the baseline outlook and the shifting balance of risks may warrant adjusting our policy stance.” Additionally, he said that tariffs could create a “one-time” effect on inflation and could dissipate, warranting a less restrictive policy. Nonetheless, Powell said that risks of inflation are tilted to the upside and risks of employment to the downside. Read more...

Author

FXStreet Team

FXStreet