Pound Sterling Price News and Forecast: GBP/USD trades weaker around 1.2805

GBP/USD loses traction near 1.2800 amid modest recovery of US Dollar

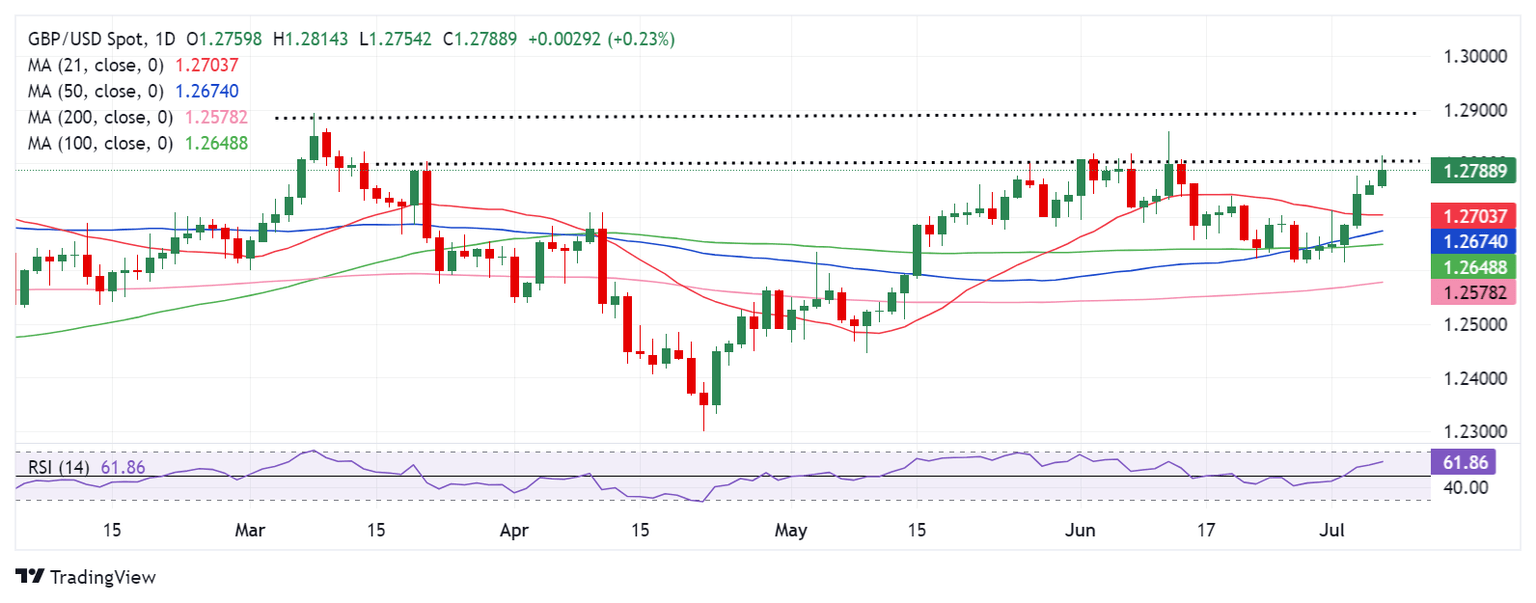

The GBP/USD pair trades on a softer note near 1.2805, snapping the seven-day winning streak during the early Asian session on Monday. The recovery of the Greenback drags the major pair lower. However, the downside for the pair might be limited amid the rising bet that the Federal Reserve (Fed) will cut the interest rate in the third quarter.

Friday’s US Nonfarm Payrolls (NFP) came in stronger than expected, adding 206K net new jobs in June, according to the US Bureau of Labor Statistics (BLS). The previous month saw a sharp downside revision to 218K from the initial reading of 272K. Read more...

GBP/USD Weekly Forecast: Pound Sterling looks to US CPI and 1.2900 again

The Pound Sterling (GBP) built on the previous week’s rebound against the US Dollar (USD), driving the GBP/USD pair back toward 1.2800, the highest level in nearly three weeks.

GBP/USD staged a solid comeback from a six-week trough to reach multi-week highs, mainly due to a steep correction in the US Dollar across its main currency rivals. Read more...

Author

FXStreet Team

FXStreet