Pound Sterling Price News and Forecast: GBP/USD time to hit highest level since 2018? US data, UK vaccines key

GBP/USD drops toward 1.4150 as the US dollar strengthens on economic data

Cable retreats from monthly highs, turns negative for the day. US dollar rises across the board supported by US economic data. The GBP/USD dropped to 1.4153 amid a rally of the US dollar across the board. Cable retreated sharply after hitting at 1.4233 the highest level since February. An impressive reading of the preliminary IHS Markit for May of the service sector boosted the dollar. Also a rebound in US yields contributed to the rally of the greenback. Read more...

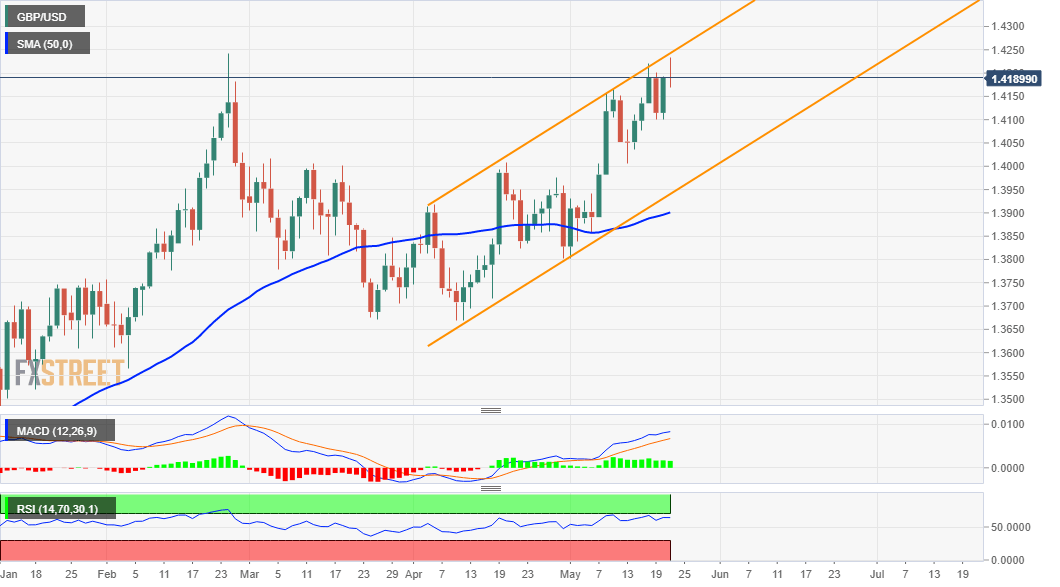

GBP/USD Weekly Forecast: Time to hit highest level since 2018? US data, UK vaccines key

GBP/USD has been grinding its way higher amid twin Fed and UK reopening speculation. To taper or not to taper? That has been the question for the Federal Reserve and the dollar, while uncertainty about the UK reopening played a role in moving the pound. US economic releases such as GDP and Durable Goods Orders are set to rock the greenback in the last full week of May. Read more...

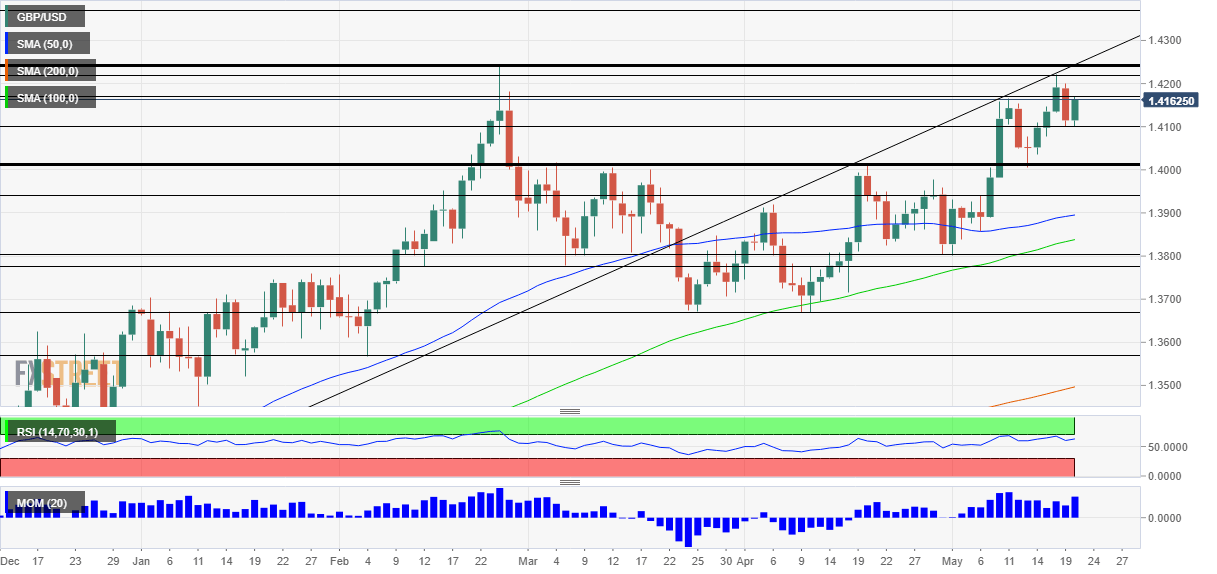

GBP/USD Price Analysis: Refreshes multi-month tops and retreats, back below 1.4200

GBP/USD added to the overnight strong move up and gained traction for the second straight day. The intraday uptick stalled near a resistance marked by the top end of an ascending trend channel. The set-up seems titled in favour of bullish traders and supports prospects for an eventual breakout.

The GBP/USD pair shot to fresh three-month tops during the mid-European session, albeit quickly retreated few pips thereafter. Read more...

Author

FXStreet Team

FXStreet