Pound Sterling Price News and Forecast: GBP/USD tests critical support level

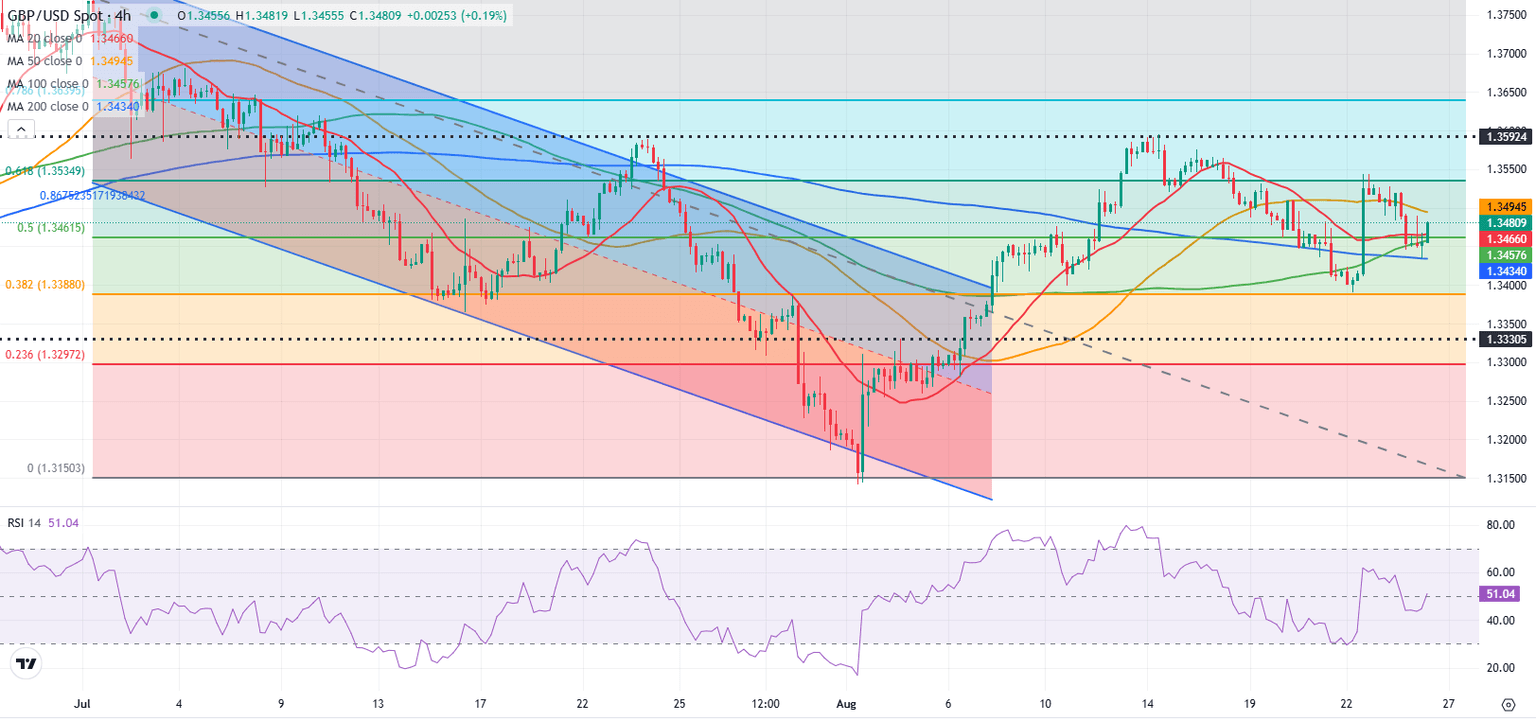

GBP/USD Forecast: Pound Sterling tests critical support level

GBP/USD trades in the red below 1.3450 after posting small gains on Tuesday. The pair faces a key support level at 1.3430. The US Dollar (USD) struggled to find demand on Tuesday as investors reacted to the escalating conflict between United States (US) President Donald Trump and Federal Reserve (Fed) Governor Lisa Cook.

Cook will reportedly file a lawsuit challenging Trump's decision to remove her. While speaking at a Cabinet meeting late Tuesday, Trump noted that he is prepared to abide by any court decision but indicated he was not concerned about Cook’s challenge. Read more...

GBP/USD Forecast: Pound Sterling loses bullish momentum but finds support

GBP/USD lose more than 0.5% on Monday and erased a large portion of the gains it recorded on Friday. After finding support near 1.3430, the pair staged a rebound and was last seen trading above 1.3450.

Safe-haven flows dominated the action in financial markets late Monday and early Tuesday after United States (US) President Donald Trump renewed his threats of imposing tariffs on countries that discriminate against US technology firms. Additionally, Trump said that they will have to charge China "200% tariff or something" if they don't give them more magnets, referencing to rare earth metals. Read more...

Author

FXStreet Team

FXStreet