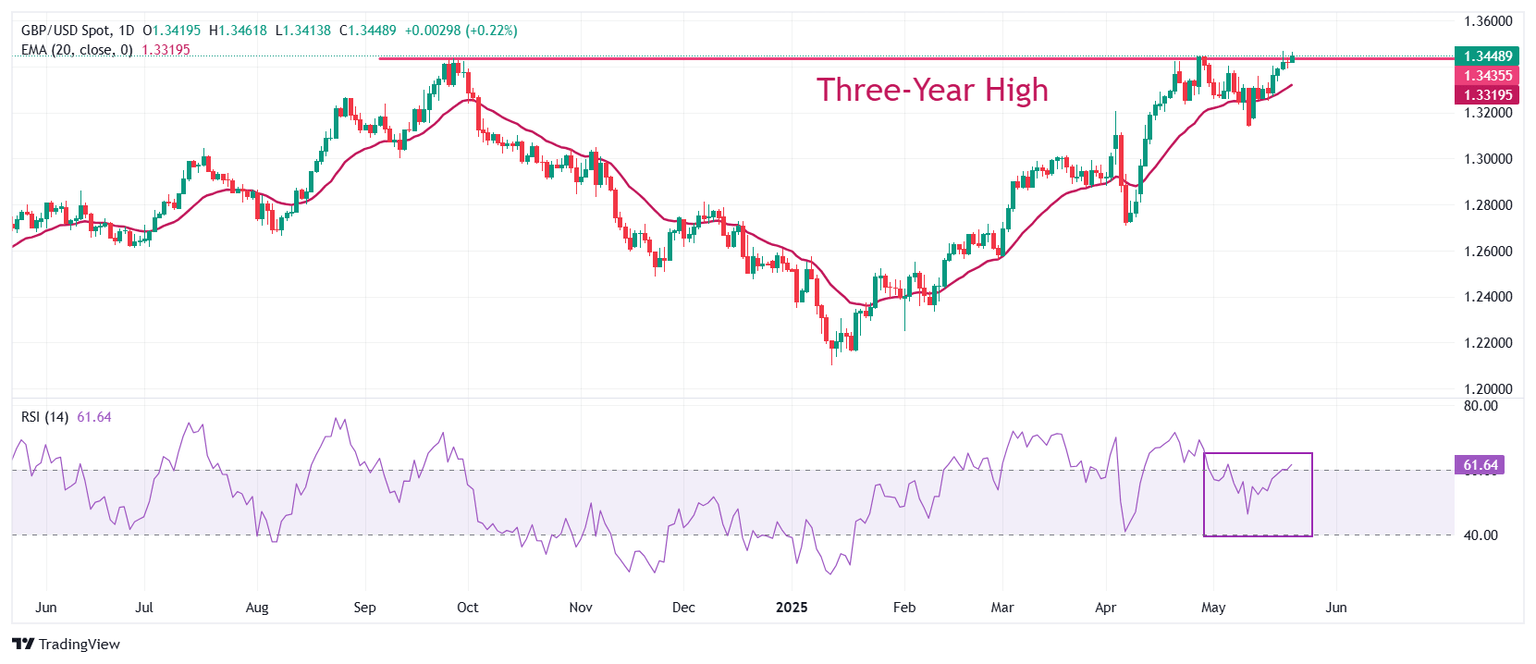

Pound Sterling Price News and Forecast: GBP/USD surges past 1.3500

GBP/USD surges past 1.3500 to a three-year high on strong UK Retail Sales, weak US Dollar

The British Pound (GBP) rises sharply against the US Dollar (USD) to its highest level in three years on Friday. The pair has broadly traded on the front foot over the last five days, with GBP/USD breaking above 1.3500 to trade around 1.3538, up nearly 0.80% at the time of writing during the American session. The surge in spot prices is mainly attributed to a broad-based weak US Dollar and a stronger-than-expected United Kingdom’s (UK) Retail Sales data. Read More...

Pound Sterling advances as UK Retail Sales data beats estimates

The Pound Sterling (GBP) outperforms its peers, except antipodeans, in European trading hours on Friday after the release of the stronger-than-projected United Kingdom (UK) Retail Sales data for April. Read More...

GBP/USD rebounds above 1.3450 toward 39-month highs, UK Retail Sales eyed

GBP/USD posts gains of about a quarter of a percent in the Asian hours on Friday, trading around 1.3450 at the time of writing. The pair edges higher as the Pound Sterling (GBP) attracts buyers after the GfK better-than-expected Consumer Confidence Index for the United Kingdom (UK) was released. Traders await UK Retail Sales, scheduled to be released later in the day, expecting a monthly decline for the third consecutive period in April. Read More...

Author

FXStreet Team

FXStreet