GBP/USD surges amidst US labor market data, BoE rate hike bets

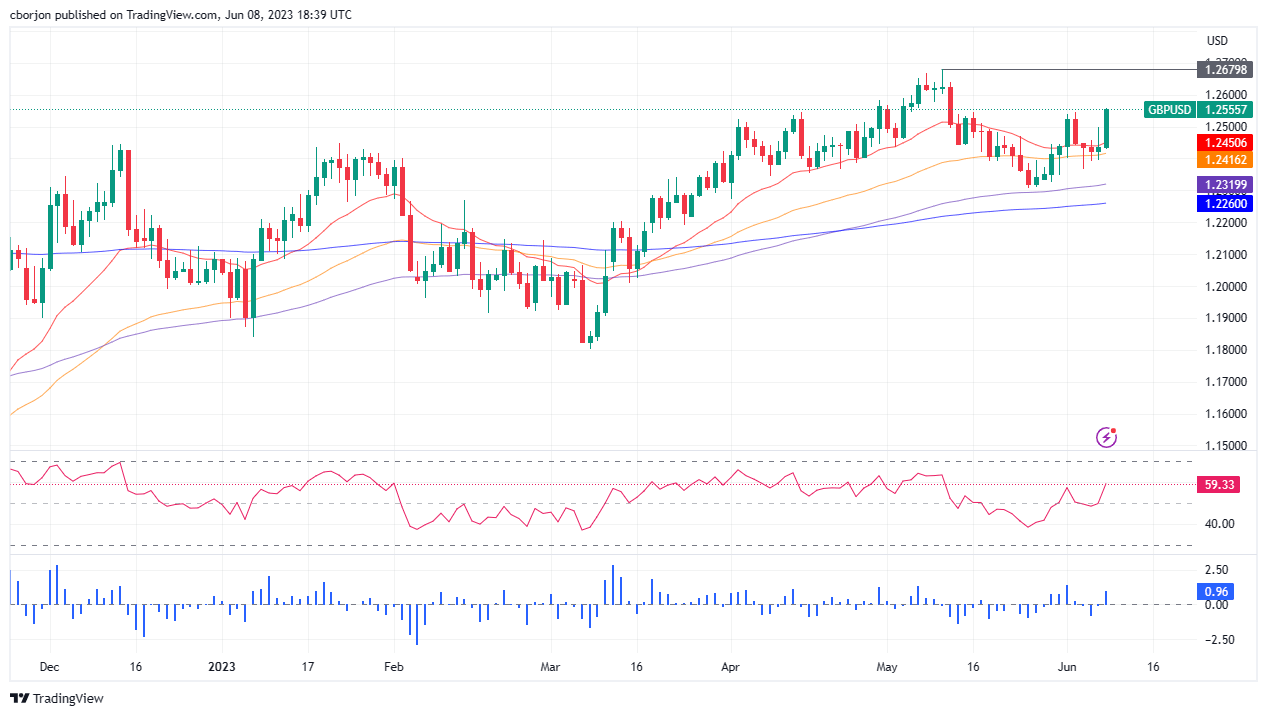

GBP/USD rallies above 1.2500 as labor market data from the United States (US) keeps investors expecting a pause on the Federal Reserve (Fed) hiking cycle. The lack of economic data to be revealed in the UK, alongside traders betting for Bank of England’s (BoE) additional tightening, underpins the GBP/USD. The GBP/USD trades at 1.2550 after hitting a low of 1.2429.

Read More...

GBP/USD marches towards 1.2500 as USD Index refreshes day’s low

The

GBP/USD pair is approaching the psychological resistance of 1.2500 in the European session. The Cable has been awarded strength as

the US Dollar Index (DXY) has extended its downside journey. The USD Index has come under intense pressure as the street is majorly divided about Federal Reserve’s (Fed) interest rate policy for June.

Read More...

GBP/USD is now seen within 1.2350-1.2550 – UOB

GBP/USD is now expected to navigate between 1.2350 and 1.2550 in the short term, note UOB Group’s Economist Lee Sue Ann and Markets Strategist Quek Ser Leang.

Read More...