Pound Sterling Price News and Forecast: GBP/USD struggles to capitalize on its gains

GBP/USD Price Forecast: Slides to mid-1.3300s amid some USD buying ahead of Fed decision

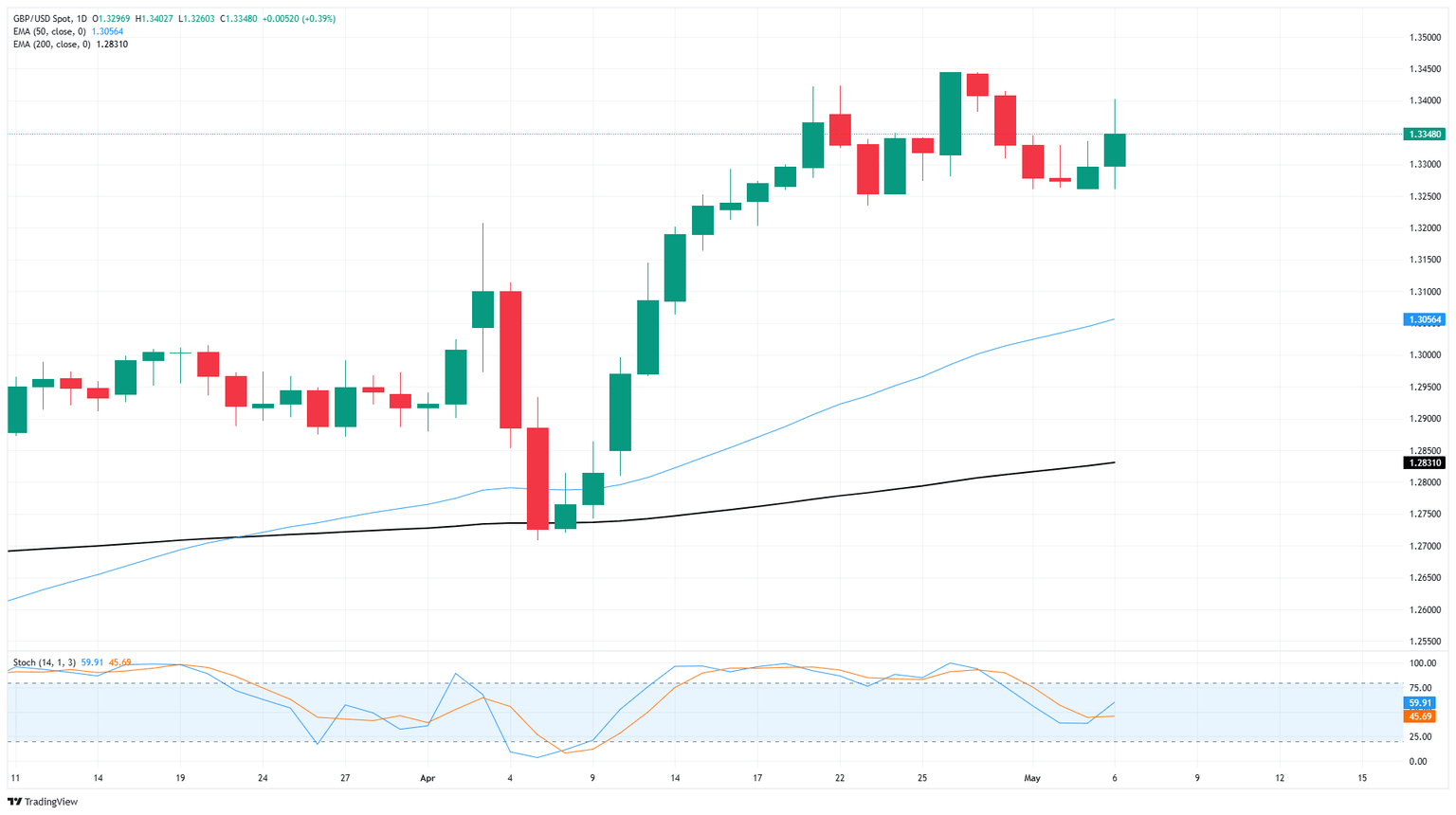

The GBP/USD pair attracts some sellers during the Asian session on Wednesday and erodes a part of its weekly gains registered over the past two days, to the 1.3400 mark. The intraday slide is sponsored by a modest US Dollar (USD) strength and drags spot prices below mid-1.3300s in the last hour.

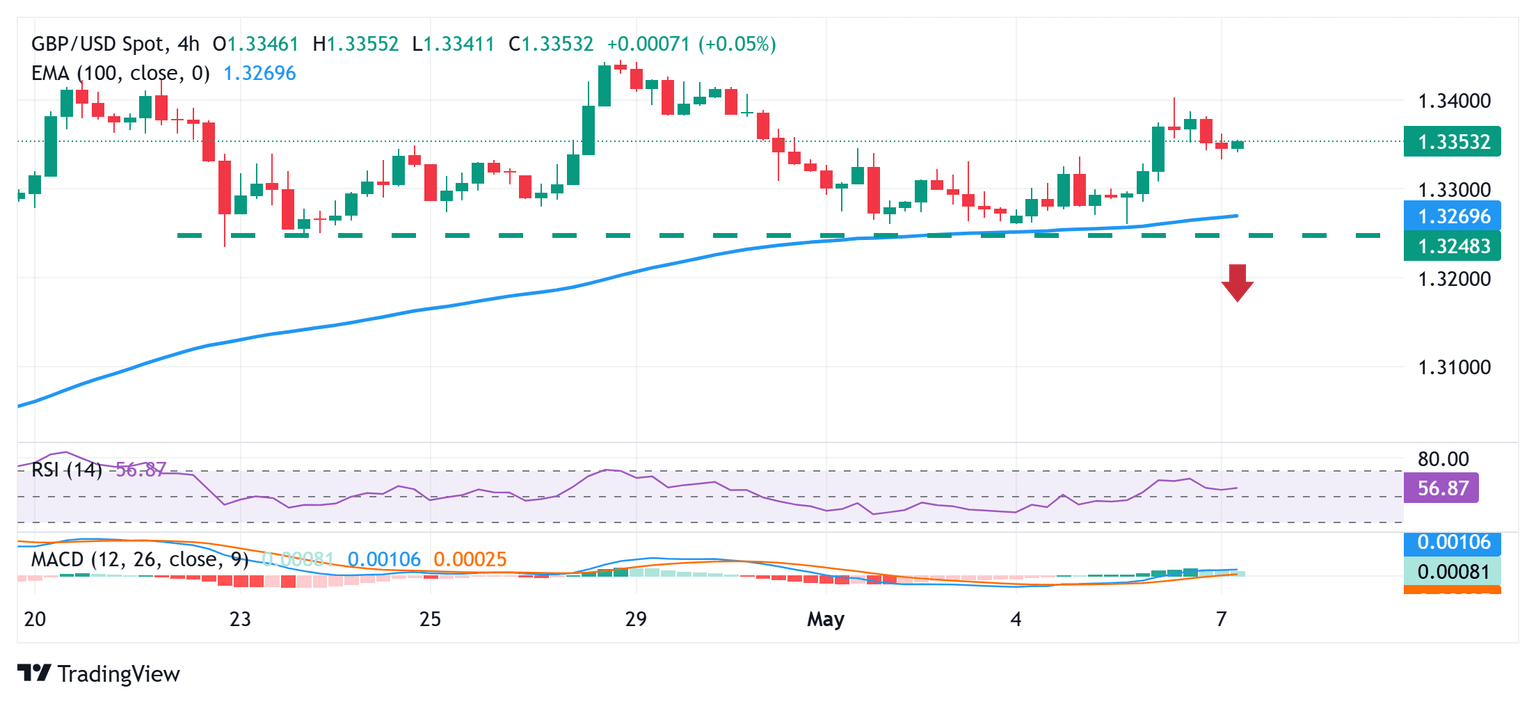

From a technical perspective, the GBP/USD pair earlier this week showed some resilience near the 1.3250-1.3245 support and bounced off the 100-period Exponential Moving Average (SMA) on the 4-hour chart. Moreover, oscillators on daily/hourly charts are holding in positive territory. This, in turn, suggests that any subsequent slide might be seen as a buying opportunity near the 1.3300 round figure and remain limited. Read more...

GBP/USD catches some lift on hopes for a US-UK trade deal

GBP/USD rose on Tuesday, climbing four-tenths of one percent on the day and testing the 1.3400 handle on headlines of a possible US-UK trade deal that would see the UK avoid the brunt of trade tariffs being actively pursued by the Trump administration.

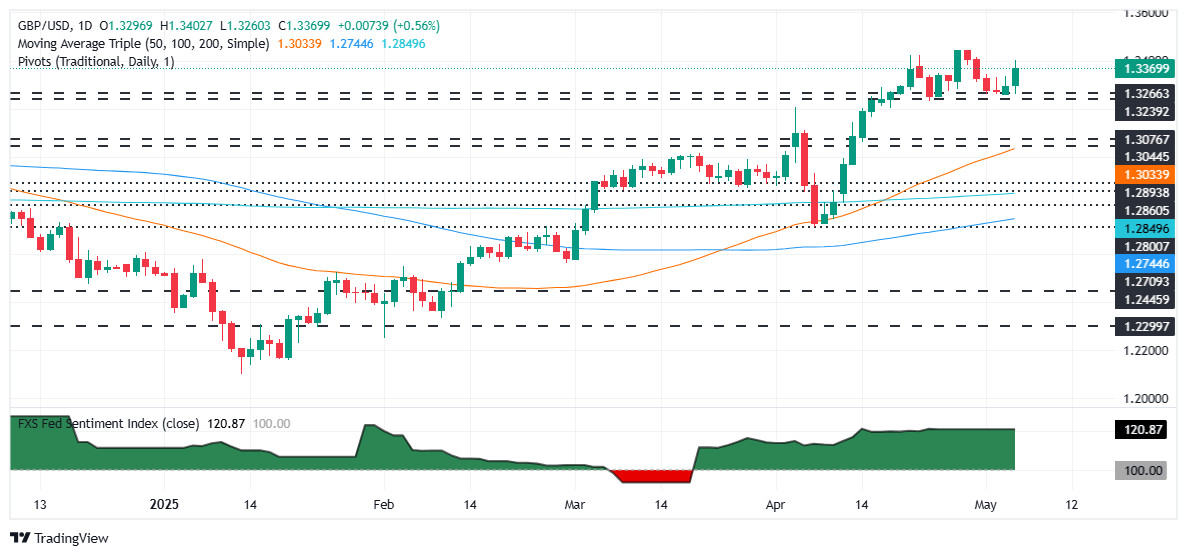

The Federal Reserve’s (Fed) upcoming rate call due on Wednesday still hangs over markets as the key market event of the week. Despite markets broadly anticipating another hold on Fed rates, investors will be taking a close look at policymaker comments, specifically Fed Chair Jerome Powell’s statement, for any signs that the Fed might be pivoting toward a rate-cutting cycle sooner rather than later. Read more...

GBP/USD rises past 1.3350 as traders brace for Fed, BoE rate decisions

The Pound Sterling advanced for the second consecutive day, gaining over 0.65% against the US Dollar amid a scarce economic docket on both sides of the Atlantic. Major central banks like the Federal Reserve and the Bank of England (BoE) are preparing for their policy meetings. At the time of writing, the GBP/USD trades at 1.3381 shy of the 1.34 mark.

US trade-related news continued to grab the headlines. US Treasury Secretary Scott Bessent said the US is negotiating with 17 trading partners but not yet with China. He said that some deals could be announced during the week. Read more...

Author

FXStreet Team

FXStreet