Pound Sterling Price News and Forecast: GBP/USD strengthens to near 1.3560 during early European session

GBP/USD attracts some buyers above 1.3550 after Middle East ceasefire

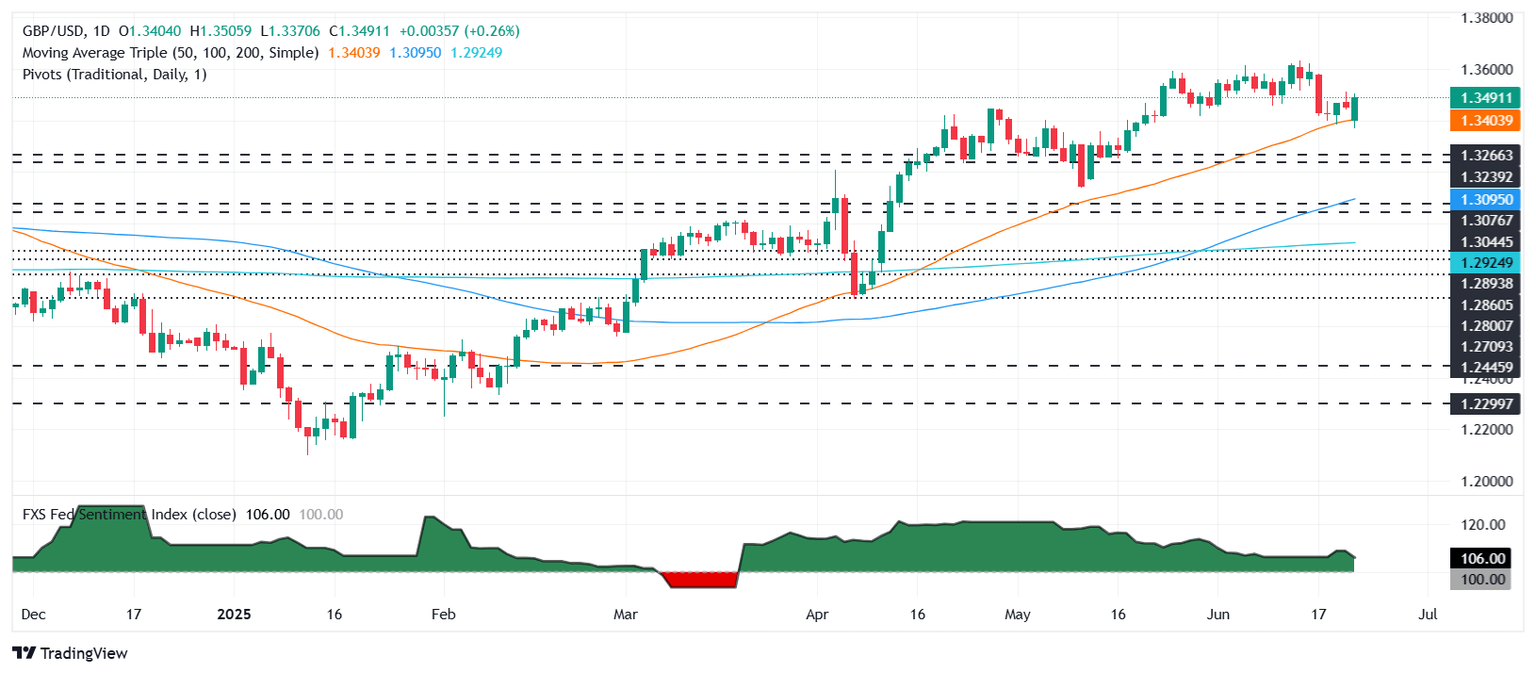

The GBP/USD pair gains traction to around 1.3560 during the early European session on Tuesday, bolstered by the weaker US Dollar (USD). Traders will closely watch the Bank of England's (BoE) Governor Bailey speech, along with the Federal Reserve's (Fed) Chair Jerome Powell’s semiannual testimonies later on Tuesday.

Federal Reserve (Fed) Governor Michelle Bowman said Monday she would favor an interest rate reduction at the next policy meeting in July so long as inflation pressures stay muted. Bowman's comments echo those of Fed Governor Christopher Waller, who said on Friday that he believes the US central bank could consider a rate cut in July. Read more...

GBP/USD gains ground as investor sentiment bets on Middle East cooldown

GBP/USD gained ground on Monday, lurching higher after the US chose to get directly involved in the spiraling Israel-Iran conflict that started recently. The Trump administration, skirting around congressional authority, ordered a barrage of attacks on Iranian nuclear facilities over the weekend, sparking a surge in crude oil markets. Following Iran’s retaliatory attacks early Monday on US Air Force installations in Qatar, all parties have tentatively agreed to a ceasefire, and talks between Iran and Israel are expected to begin.

The tumultuous evolution of Middle East conflicts sparked a bearish pivot in Greenback markets as investors banked on a slowdown in tit-for-tat missile attacks. The global pivot out of the US Dollar sent Cable bids back above the 1.3500 handle. Read more...

GBP/USD rebounds to 1.3500 as Fed’s Bowman backs July cut, Iran tensions flare

The Pound Sterling (GBP) advances during the North American session, up 0.37% against the US Dollar, as risk appetite improved amid developments in the Middle East. At the time of writing, GBP/USD trades at 1.3500.

On Saturday, the United States (US) attacked Iran’s nuclear facilities, triggering a risk-off open in the current trading week. The Greenback rose, while Oil prices gapped up; however, WTI has recently been facing downward pressure. Read more...

Author

FXStreet Team

FXStreet