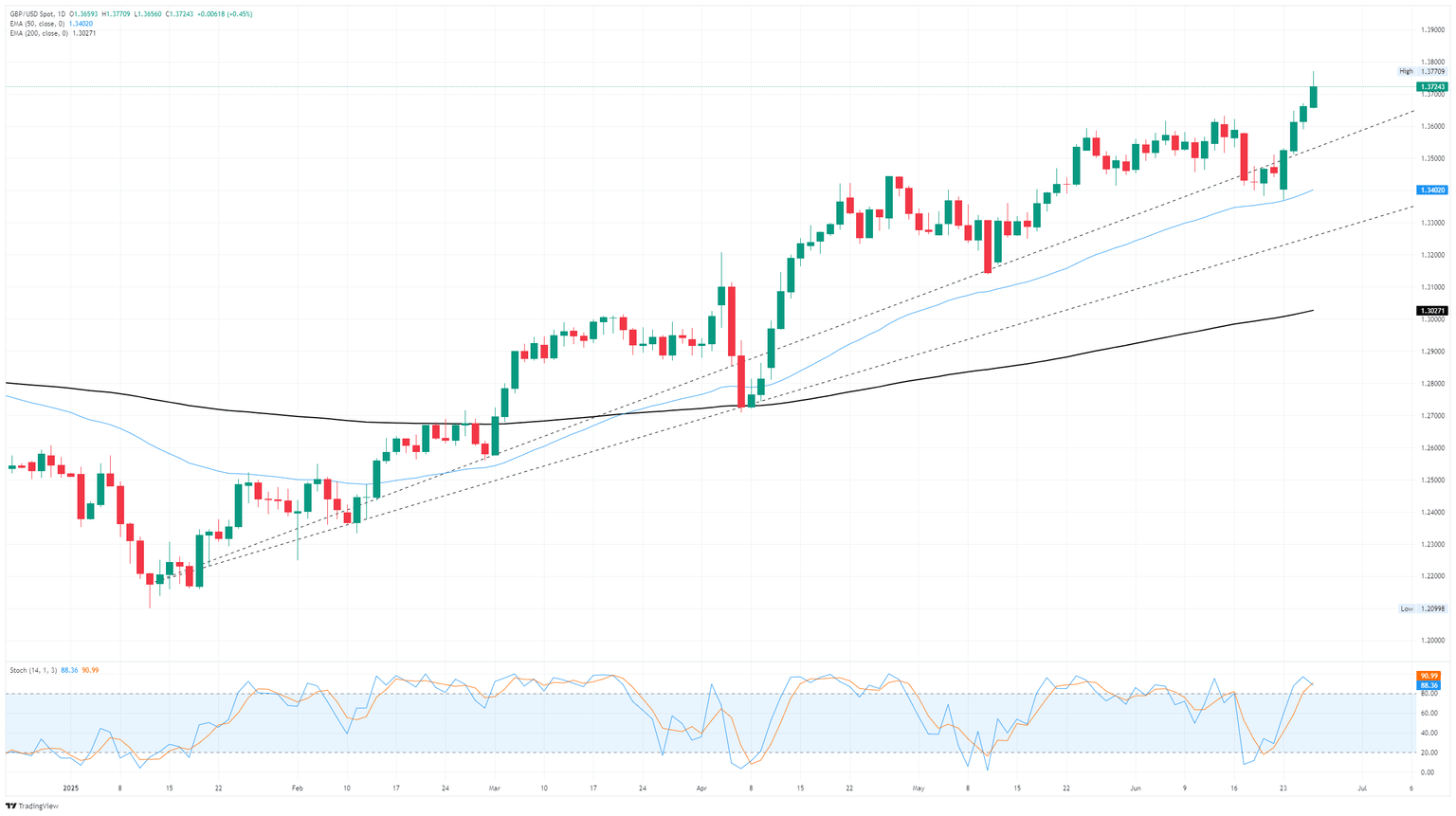

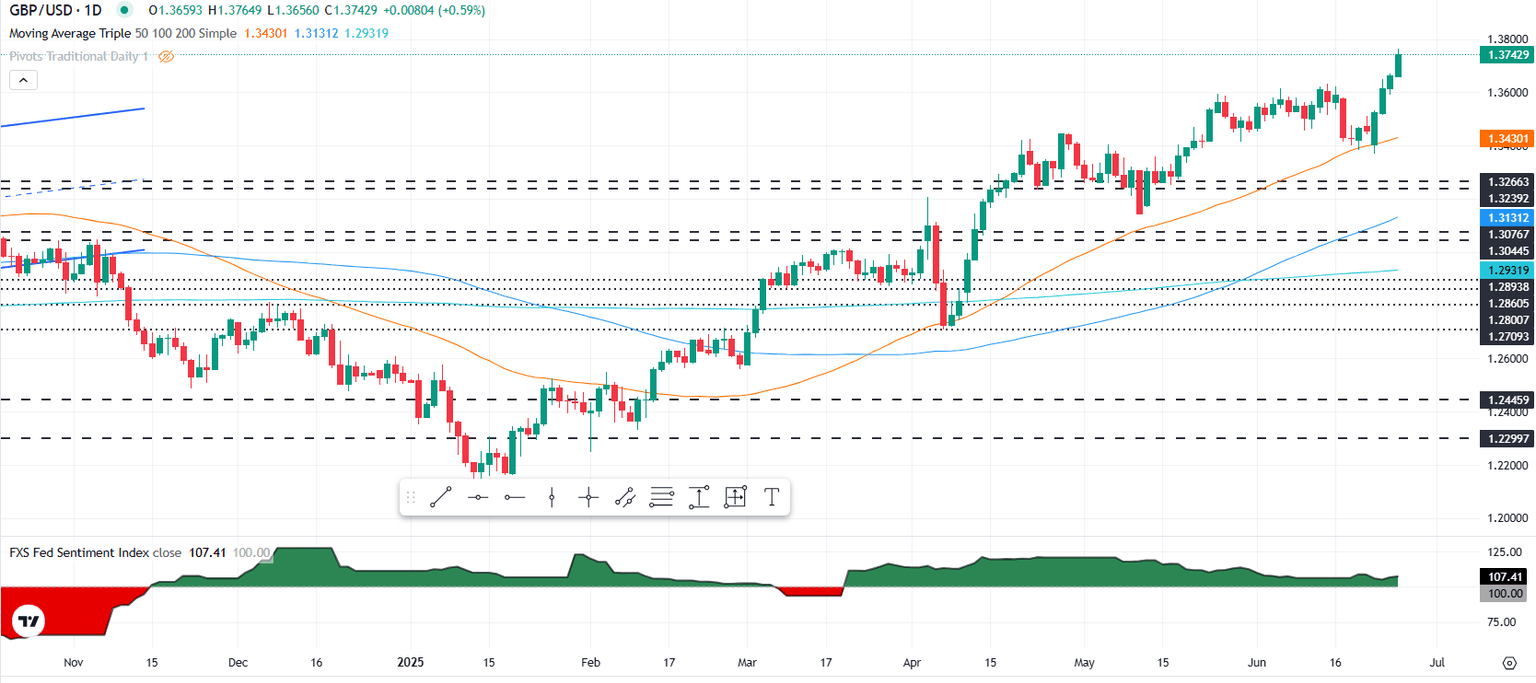

Pound Sterling Price News and Forecast: GBP/USD strengthens to around 1.3735 on Friday

GBP/USD holds positive ground above 1.3700, all eyes on US PCE release

The GBP/USD pair holds positive ground near 1.3735 during the Asian trading hours on Friday. The prospect of Trump announcing the next Fed Chair weighs on the US Dollar (USD) against the Pound Sterling (GBP). The US Personal Consumption Expenditures (PCE) - Price Index data for May will be in the spotlight later on Friday.

The concerns over the future independence of the Fed continue to undermine the Greenback and create a tailwind for the major pair. US President Donald Trump said that he was considering selecting the next Fed Chair early fuelled fresh bets on US rate cuts. Trump said that he has a list of potential Powell successors down to “three or four people,” without naming the finalists. Read more...

GBP/USD continues its march up the charts for a fourth straight day

GBP/USD rose on Thursday, stepping into a fourth straight day of firm gains and clipping 44-month highs near 1.3770. A broad sell-off in the US Dollar is bolstering the Greenback’s major counter-currencies, helping to push Cable into its highest bids in nearly four years.

Market sentiment has recovered its footing following a tense start to the week: easing Middle East tensions and continued waffling on trade barriers by the Trump administration are helping to keep risk appetite on the high end. White House Press Secretary Karoline Leavitt floated the idea of the July 9 deadline for the return of reciprocal tariffs to not be a hard barrier, signaling to markets that the Trump administration has been pushed off of its high-tariff threats, even though prospects for the firm trade deals that President Trump was promising remain fairly anemic. Read more...

GBP/USD hits near 4-year high as Trump eyes Powell successor, Dollar sinks

The Pound Sterling advances to near four-year highs against the US Dollar on Thursday, as breaking news revealed by the Wall Street Journal (WSJ) suggests that US President Donald Trump might name Jerome Powell's successor to the Federal Reserve Chair in October and September. At the time of writing, the GBP/USD trades at 1.3746, up 0.61%.

The potential replacements for Fed Chair Powell, according to the article, include former Fed Governor Kevin Warsh, National Economic Council Director Kevin Hassett, and Secretary of the Treasury Scott Bessent. The news dragged the Dollar lower, as this would create confusion amongst investors, who would need to monitor comments from Powell, alongside the upcoming Fed Chair. Read more...

Author

FXStreet Team

FXStreet