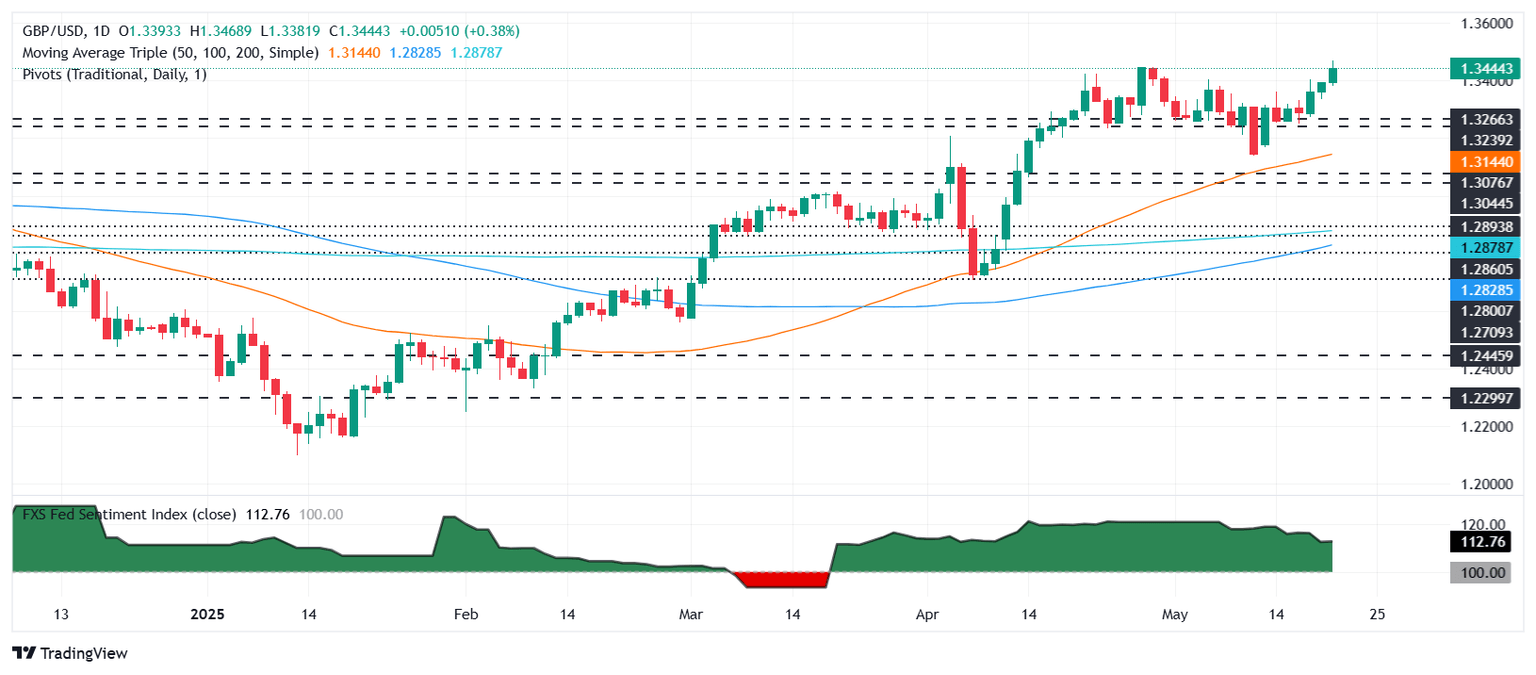

Pound Sterling Price News and Forecast: GBP/USD strengthens as the US Dollar continues to weaken

GBP/USD rises to near 1.3450 ahead of UK PMI data

GBP/USD trades higher for the fourth successive day with trading around 1.3430 during the Asian hours on Thursday. The upside of the pair is attributed to the weaker US Dollar (USD), which continues to face challenges after Moody’s downgraded the US credit rating from Aaa to Aa1, following similar downgrades by Fitch Ratings in 2023 and Standard & Poor’s in 2011.

As per Moody’s, US federal debt is expected to climb to around 134% of GDP by 2035, up from 98% in 2023, with the budget deficit expected to widen to nearly 9% of GDP. This deterioration is attributed to rising debt-servicing costs, expanding entitlement programs, and falling tax revenues. Read more...

GBP/USD soars to new yearly high as UK inflation surges, BoE rate cuts in doubt

The Pound Sterling (GBP) rose to a new year-to-date (YTD) high of 1.3468 against the US Dollar (USD) on Wednesday as United Kingdom (UK) inflation rose, drifting away from the Bank of England's (BoE) 2% target, which had led to interest rate reductions earlier in the month. At the time of writing, GBP/USD trades at 1.3446, up 0.40%.

Data from the UK has pushed aside the BoE’s intentions to continue reducing interest rates at forward meetings. The Consumer Price Index (CPI) in April rose 3.5% YoY, up from 2.6% in March, revealed the Office for National Statistics (ONS). The core CPI rose by 3.8% YoY, exceeding the 3.4% increase in March. Read more...

Author

FXStreet Team

FXStreet