Pound Sterling Price News and Forecast: GBP/USD sticks to modest intraday gains above 1.2400

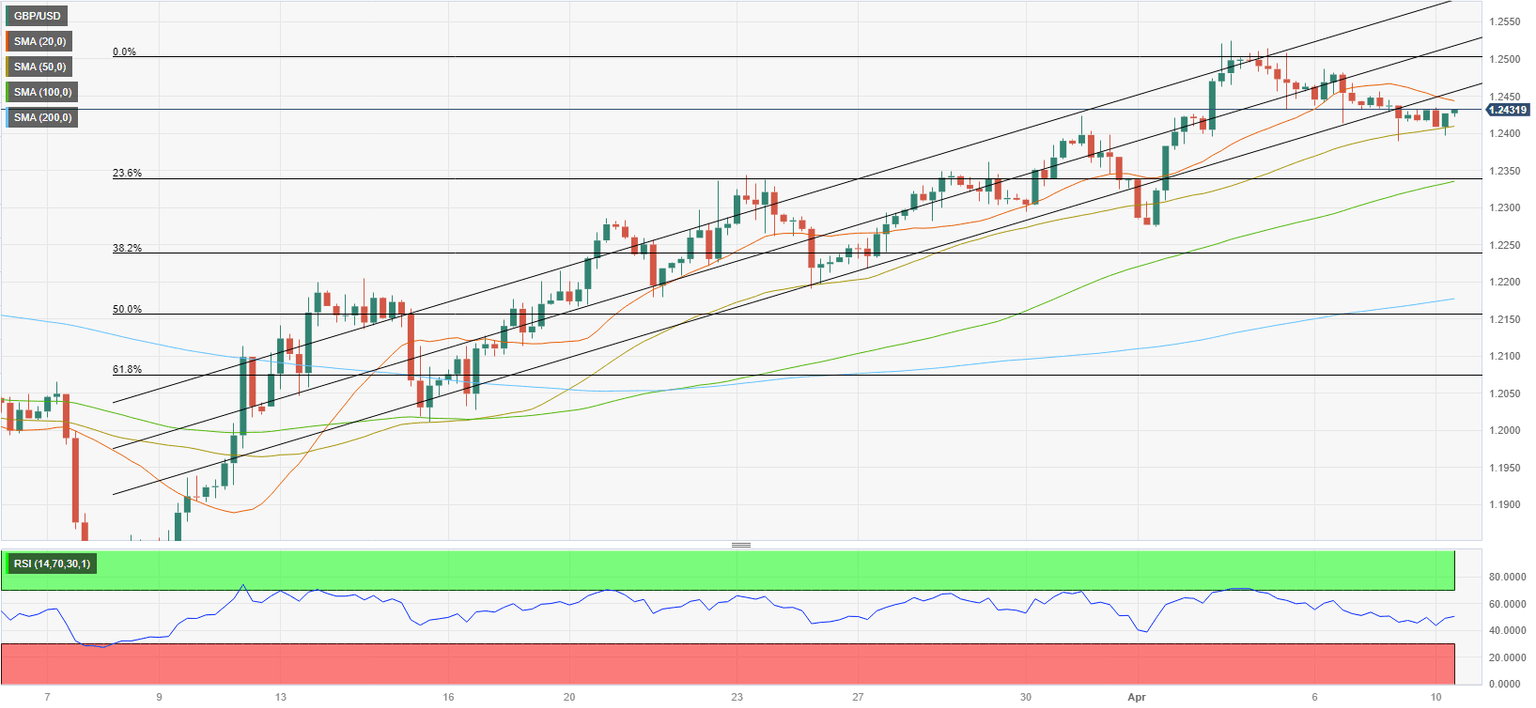

GBP/USD Forecast: Pound Sterling faces extended correction below 1.2400

After having closed in negative territory on Friday, GBP/USD has managed to stage a rebound early Monday. The pair seems to have stabilized above 1.2400 on Easter Monday but it is likely to fluctuate in a tight range amid subdued market action.

The US Bureau of Labor Statistics reported on Friday that Nonfarm Payrolls (NFP) in the US increased by 236,000 in March, compared to the market estimate of 240,000. The Unemployment Rate declined to 3.5% from 3.6% and the Labor Force Participation Rate edged higher to 62.6% from 62.5%. Furthermore, annual wage inflation, as measured by the Average Hourly Earnings, fell to 4.2% from 4.6%. Read more...

GBP/USD sticks to modest intraday gains above 1.2400, lacks follow-through

The GBP/USD pair reverses an intraday dip to sub-1.2400 levels and turns positive during the first half of the European session, though lacks follow-through. The pair currently trades around the 1.2420-1.2425 region, up less than 0.10%, and for now, seems to have snapped a three-day losing streak.

The US Dollar (USD) struggles to preserve its modest intraday gains amid the uncertainty over the Federal Reserve's (Fed) rate-hike path and turns out to be a key factor lending some support to the GBP/USD pair. The mostly upbeat US NFP released on Friday revived bets for another 25 bps lift-off at the next FOMC meeting in May. Market participants, however, seem convinced that the Fed will cut rates in the second half of the year amid signs of slowing economic growth. This is reinforced by a fresh leg down in the US Treasury bond yields, which acts as a headwind for the Greenback. Read more...

GBP/USD extends four-day downtrend to 1.2400 despite Easter Monday holiday

GBP/USD takes offers to refresh the intraday low near 1.2400 during early Easter Monday morning in London. In doing so, the Cable pair drops for the fourth consecutive day as the US Dollar recovers amid the risk-off mood. Adding strength to the pullback moves could be the hawkish hopes from the US Federal Reserve (Fed), versus recent doubts about the Bank of England’s (BoE) next move.

That said, fears emanating from China, mainly due to the dragon nation’s military drills near the Taiwan Strait, seem to underpin the US Dollar’s rebound. Taiwan President Tsai Ing-wen’s US visit triggered a fresh bout of US-China woes as Beijing conducts strong military drills near Taiwan Strait. “China's military simulated precision strikes against Taiwan in a second day of drills around the island on Sunday, with the island's defense ministry reporting multiple air force sorties and that it was monitoring China's missile forces,” reported Reuters. Read more...

Author

FXStreet Team

FXStreet