Pound Sterling Price News and Forecast: GBP/USD steady despite US jobs surprise, Reeves uncertainty caps gains

GBP/USD steady despite US jobs surprise, Reeves uncertainty caps gains

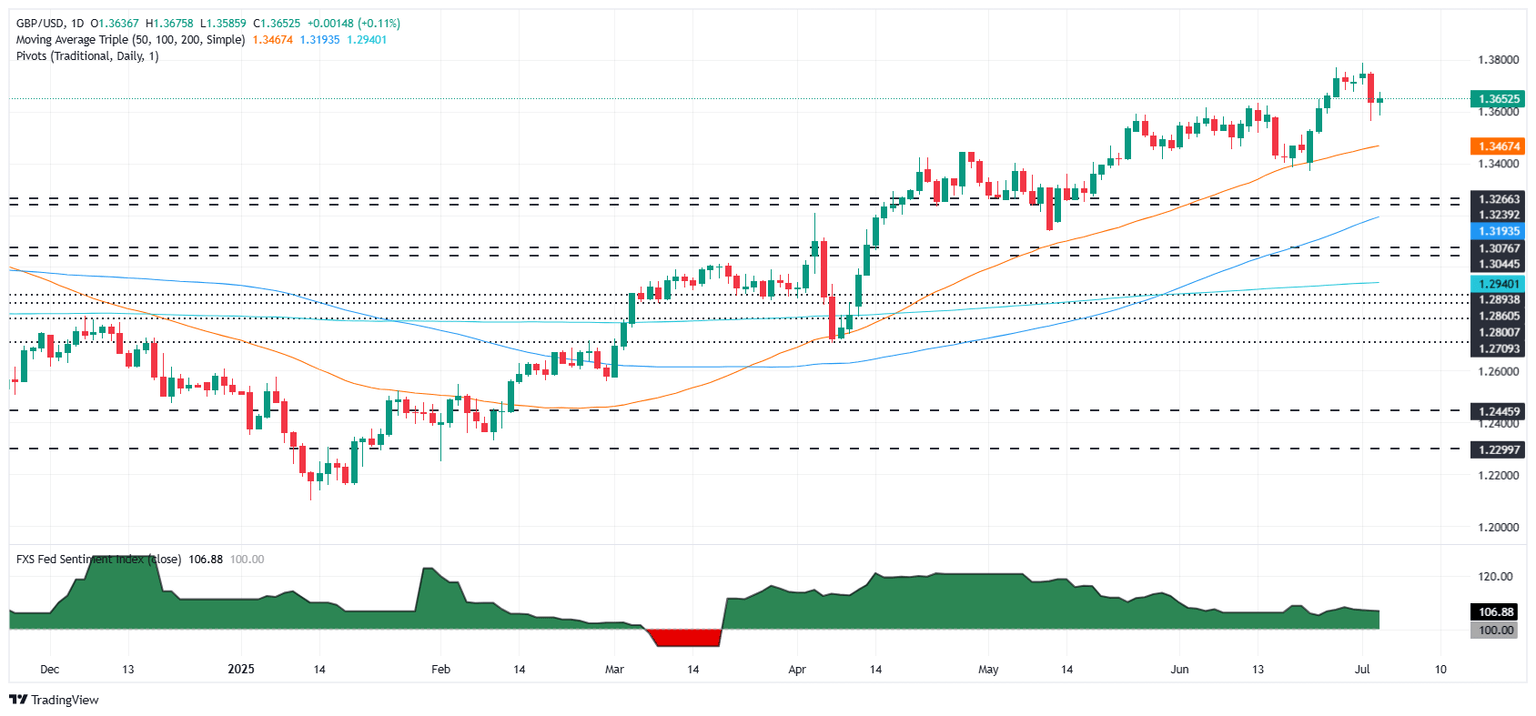

The Pound Sterling (GBP) remains steady against the US Dollar (USD) on Thursday, after a solid Nonfarm Payrolls (NFP) report in the United States (US) cemented the case for the Federal Reserve (Fed) to hold rates in July, as the Unemployment Rate ticked lower. At the time of writing, GBP/USD is trading at 1.3634, virtually unchanged. Read More...

Pound Sterling trades higher against US Dollar, US NFP under spotlight

The Pound Sterling (GBP) moves higher to near 1.3665 against the US Dollar (USD) during European trading hours on Thursday. The GBP/USD pair seems to have found a floor after Wednesday's slump, in a broad sell-off in UK assets due to growing question marks around the continuity of Chancellor of the Exchequer Rachel Reeves. Read More...

GBP/USD weakens below 1.3650 amid concerns over the UK debt position, US NFP data in focus

The GBP/USD pair extends the decline to near 1.3625 during the Asian trading hours on Thursday. The Pound Sterling (GBP) faces some selling pressure amid a selloff in British government bonds. Traders will closely watch the US June employment data later on Thursday, including Nonfarm Payrolls (NFP), Unemployment Rate and Average Hourly Earnings. Read More...

Author

FXStreet Team

FXStreet