GBP/USD steady despite US jobs surprise, Reeves uncertainty caps gains

- GBP/USD dipped below 1.3600 before recovering, despite a strong NFP report.

- The US economy added 147K jobs in June and the Unemployment Rate fell to 4.1%.

- Fed is seen holding in July as markets trim rate cut bets to 50 bps.

The Pound Sterling (GBP) remains steady against the US Dollar (USD) on Thursday, after a solid Nonfarm Payrolls (NFP) report in the United States (US) cemented the case for the Federal Reserve (Fed) to hold rates in July, as the Unemployment Rate ticked lower. At the time of writing, GBP/USD is trading at 1.3634, virtually unchanged.

Strong NFP and falling US unemployment lift yields and the Dollar, while UK political jitters weigh on Sterling

The US Bureau of Labor Statistics (BLS) reported that the US economy added 147,000 people to the workforce, exceeding estimates of 110,000 and May’s 144,000 print. The Unemployment Rate came at 4.1% down from 4.2%. The data fortifies the Fed Chair Jerome Powell's stance of wait-and-see and assesses the potential impact of tariffs on inflation.

Investors had reacted to the data, slashing bets that the Fed would cut rates by 50 basis points (bps) instead of the 65 bps priced in at the beginning of July. Consequently, US Treasury bond yields soared, with the 10-year note yielding 4.336%, up five basis points, while the US Dollar hit a four-day high, according to the US Dollar Index (DXY).

The DXY, which tracks the performance of the buck against six other currencies, hit 97.42 before settling at around 97.10, posting gains of 0.34%.

Other data revealed that Initial Jobless Claims for the week ending June 28 were lower than the forecasted 240,000, coming in at 233,000, below the prior reading reported. The Institute for Supply Management (ISM) reported that the Services PMI increased in June to 50.8, up from 49.9 in May.

Cable was pressured by the strength of the US Dollar, but also by uncertainty about Britain’s finance minister, Rachel Reeves. Discussions in parliament forced the Prime Minister, Keir Starmer, to refrain from significant spending cuts, leaving a hole in public finances.

Fears that Reeves would be replaced sent Gilt yields skyrocketing by over 25 bps, and the Pound plunged to six-day lows of 1.3562.

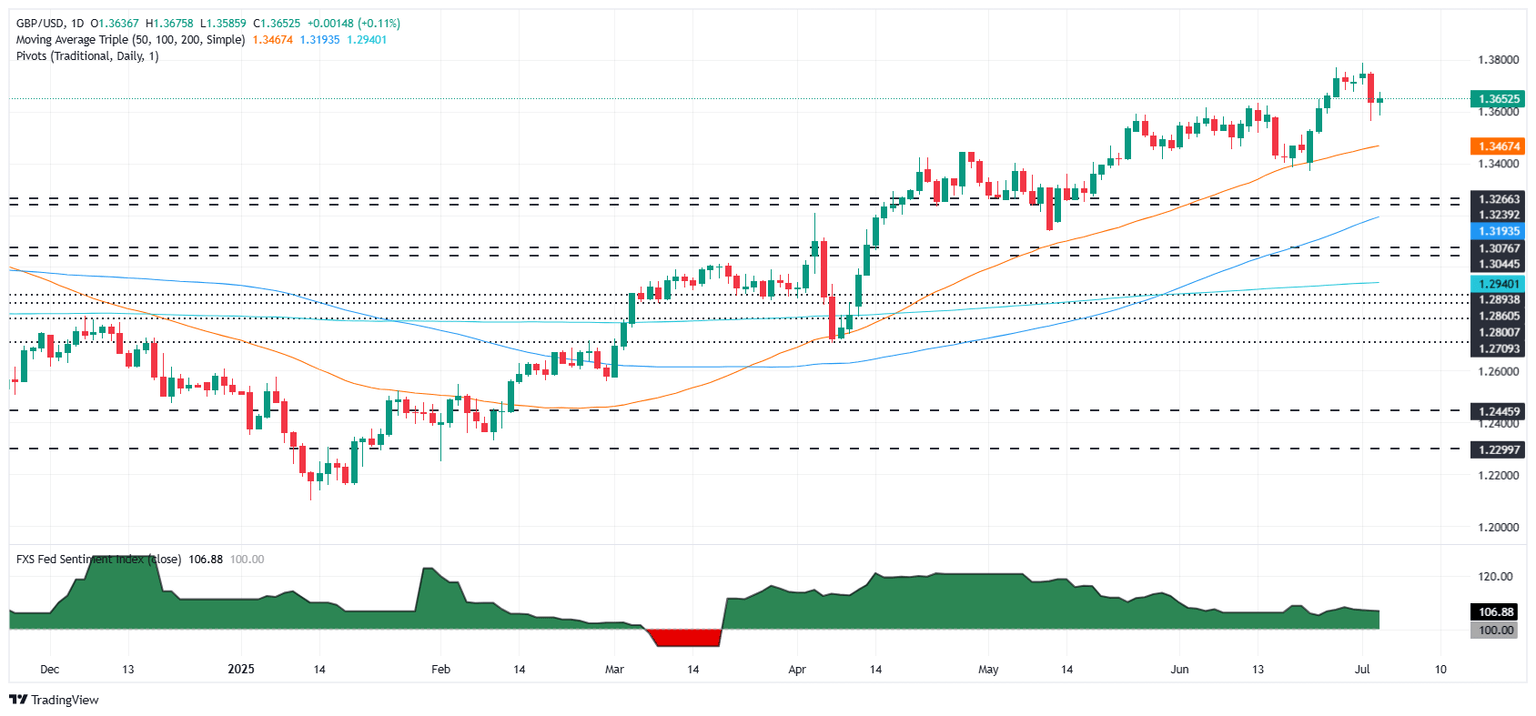

GBP/USD Price Forecast: Technical outlook

GBP/USD fell below 1.3600 but has so far regained composure. However, it lacks the strength to test the highs of the week, near 1.3750 – 1.3790. The blow to the UK fiscal budget could make it difficult for buyers to challenge yearly highs near 1.3800.

Support, on the other hand, is seen at the 20-day SMA at 1.3610. A breach of the latter will expose 1.3562; below here lies the 50-day SMA at 1.3462.

(This story was corrected on July 3 at 16:35 GMT to say, in the second bullet point and the body text, that the Nonfarm Payrolls report showed the US economy added 147K new jobs in June, not 149K)

British Pound PRICE This week

The table below shows the percentage change of British Pound (GBP) against listed major currencies this week. British Pound was the strongest against the Japanese Yen.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.26% | 0.43% | 0.43% | -0.88% | -0.48% | -0.16% | -0.41% | |

| EUR | 0.26% | 0.65% | 0.72% | -0.63% | -0.25% | 0.11% | -0.16% | |

| GBP | -0.43% | -0.65% | -0.16% | -1.27% | -0.90% | -0.56% | -0.81% | |

| JPY | -0.43% | -0.72% | 0.16% | -1.31% | -0.86% | -0.55% | -0.78% | |

| CAD | 0.88% | 0.63% | 1.27% | 1.31% | 0.34% | 0.72% | 0.48% | |

| AUD | 0.48% | 0.25% | 0.90% | 0.86% | -0.34% | 0.34% | 0.09% | |

| NZD | 0.16% | -0.11% | 0.56% | 0.55% | -0.72% | -0.34% | -0.24% | |

| CHF | 0.41% | 0.16% | 0.81% | 0.78% | -0.48% | -0.09% | 0.24% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.