Pound Sterling Price News and Forecast: GBP/USD stabilizes as market focus shifts to Fed and BoE

GBP/USD Forecast: Pound Sterling stabilizes as market focus shifts to Fed and BoE

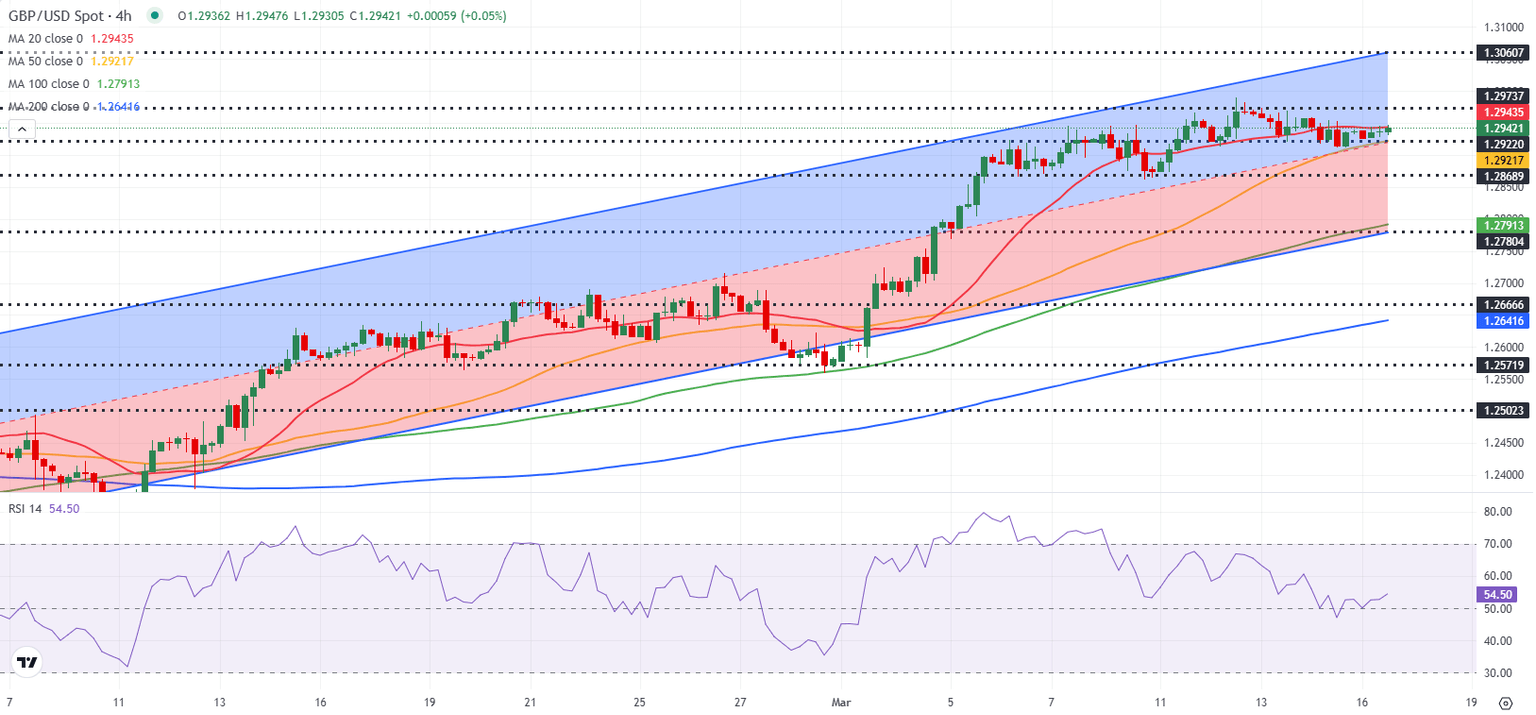

Although GBP/USD registered modest losses on Thursday and Friday, the pair managed to end the previous week in positive territory. Early Monday, the pair moves sideways at around 1.2950.

During the European trading hours, US stock index futures lose about 0.5% on the day, pointing to a cautious market stance. Nevertheless, GBP/USD's downside remains supported for now, with investors refraining from taking large positions in anticipation of this week's key macroeconomic events. Read more...

GBP/USD Weekly Outlook: Pound Sterling braces for Fed and BoE policy announcements

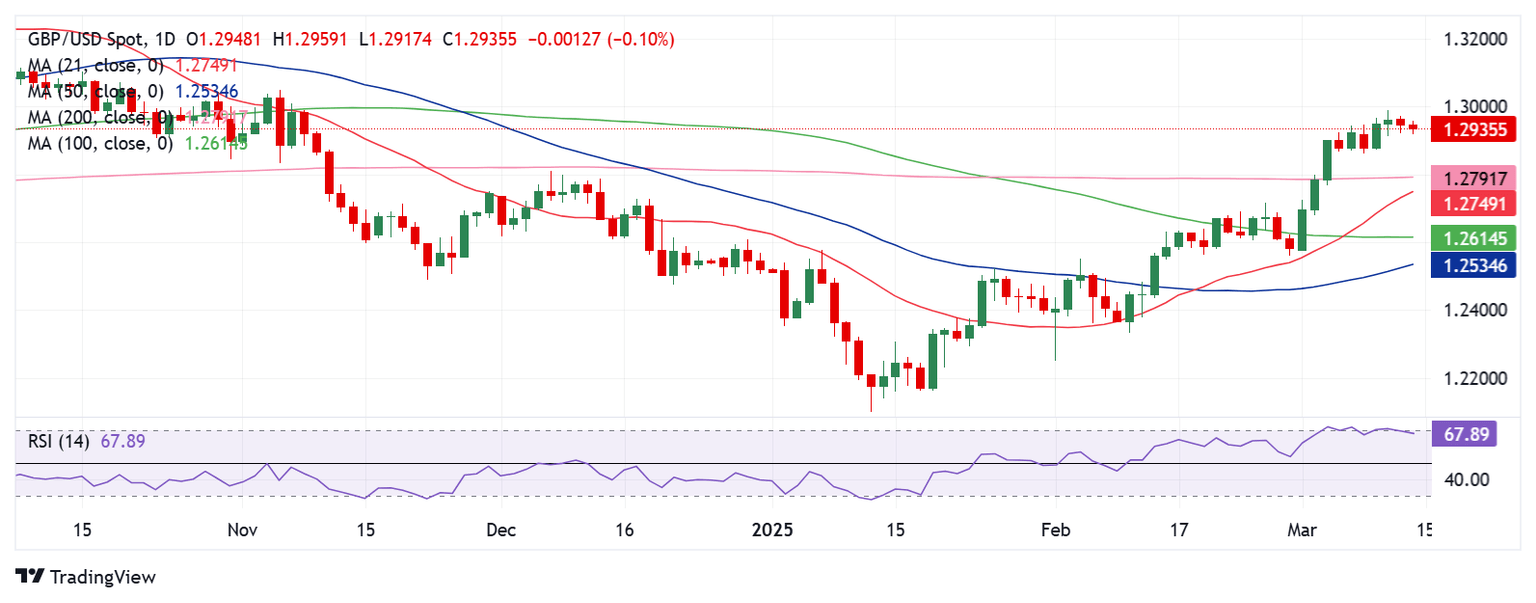

The Pound Sterling (GBP) almost tested the critical 1.3000 level against the US Dollar (USD) in the past week, driving the GBP/USD pair to its highest level in four months.

GBP/USD stretched its previous week’s positive momentum and reached four-month highs just shy of the 1.3000 threshold on Wednesday before entering an upside consolidative phase in the remainder of the week. Read more...

Author

FXStreet Team

FXStreet