Pound Sterling Price News and Forecast: GBP/USD softens to around 1.3530 amid escalating Israel-Iran tensions

GBP/USD tumbles below 1.3550 amid risk-off sentiment

The GBP/USD pair loses ground to near 1.3530 during the early European session on Friday. The Pound Sterling (GBP) weakens against US Dollar (USD) due to heightened geopolitical tensions in the Middle East. Investors brace for the preliminary reading of the US Michigan Consumer Sentiment report, which is due later on Friday.

Israeli Defense Minister Israel Katz said late Thursday that there had been a “preemptive strike against Iran” and declared a state of emergency as the country prepared for retaliation. Meanwhile, Israel's Prime Minister Benjamin Netanyahu noted that the operation will continue for as many days as it takes. Read more...

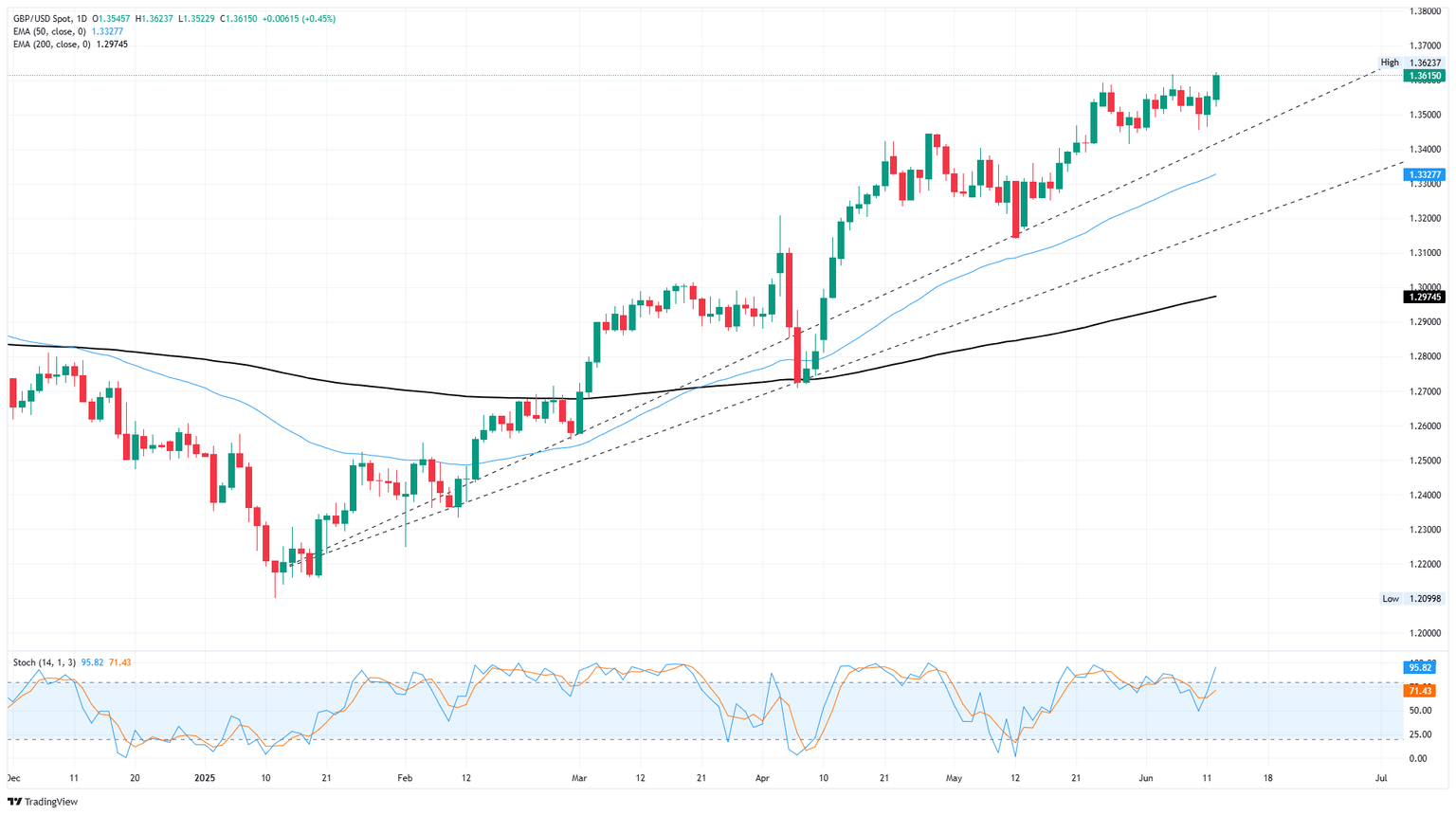

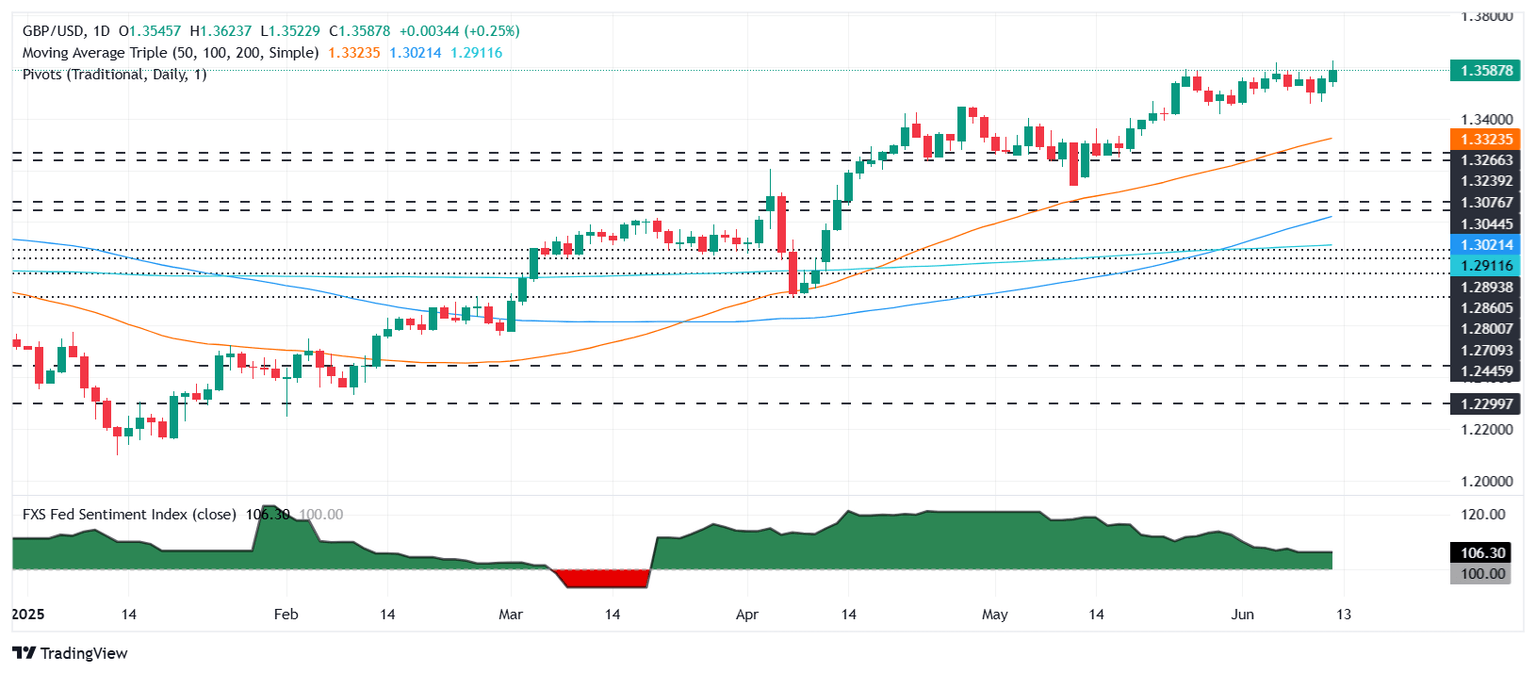

GBP/USD taps fresh 40-month high on renewed Greenback softness

GBP/USD climbed into fresh 40-month highs on Thursday, closing above the 1.3600 handle for the first time in over three years. Broad-market investor sentiment climbed after US Producer Price Index (PPI) inflation figures came in cooler than expected, pummeling the US Dollar as investors pile back into bets of a Federal Reserve (Fed) rate cut in September.

UK Industrial and Manufacturing Production figures continue to sink, contracting at a faster pace than expected in April. US PPI inflation also chilled in May, pushing off immediate concerns of a tariff-fueled spark of inflation. However, tumultuous policy choices by the Trump administration could still kick off a fresh round of price volatility, and are expected to push inflation metrics higher in the months ahead. Read more...

GBP/USD hits 1.36 as soft US PPI, jobless claims fuel rate cut bets

GBP/USD extended its gains on Thursday following the release of another inflation report in the United States (US), which increased the odds that the Federal Reserve (Fed) could resume its easing cycle sooner than expected. This, along with a rise in jobless claims, was a tailwind for the Sterling, which trades at 1.3600 against the US Dollar (USD), up by over 0.47%.

The US Bureau of Labor Statistics (BLS) revealed that the Producer Price Index (PPI) in May increased by 2.6% YoY, one-tenth above April’s reading. At the same time, core PPI, which excludes volatile items like food and energy, dipped from 3.1% to 3% YoY. Read more...

Author

FXStreet Team

FXStreet