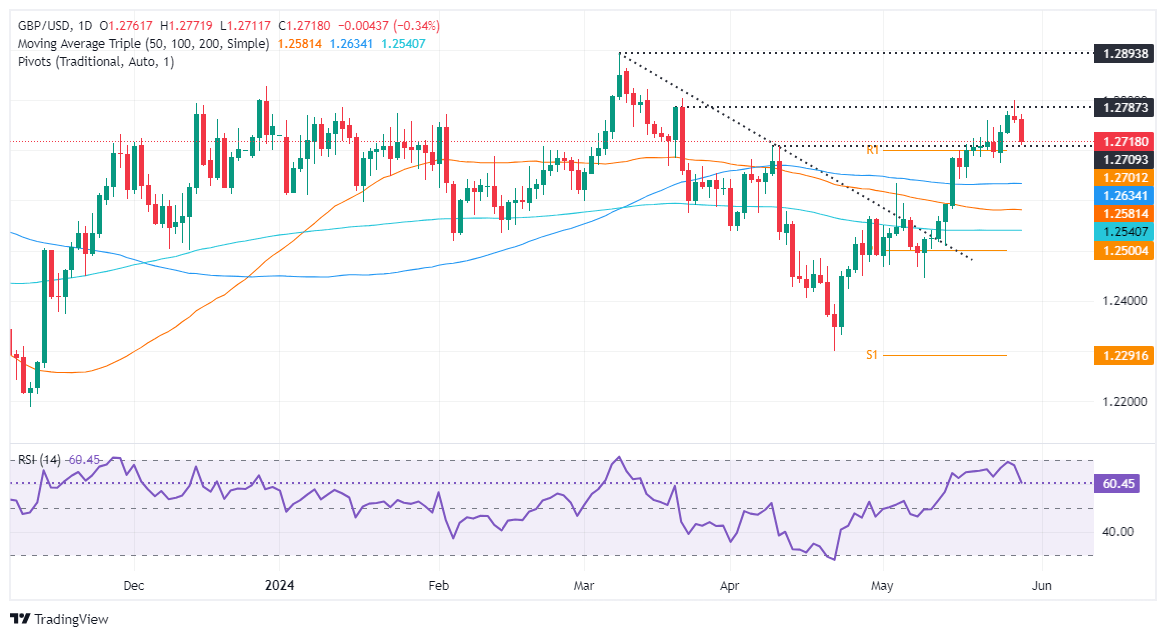

GBP/USD Price Analysis: Slumps to fresh weekly lows as bears eye 1.2700

The British Pound fell to a new weekly low against the Greenback on Wednesday as US Treasury bond yields continued to climb. Federal Reserve officials remained cautious and influenced traders' expectations of just 25 basis points of rate cuts seen toward the end of 2024. The GBP/USD trades at 1.2719, down 0.33%.

Read More...

Pound Sterling corrects further against US Dollar ahead of US core PCE inflation

The

Pound Sterling (GBP) corrects to 1.2740 against the US Dollar (USD) in Wednesday’s American session after posting a fresh 10-week high at 1.2800 on Tuesday. The rally in the GBP/USD pair stalls as the United Kingdom (UK) inflation outlook softens and the US Dollar (USD) comes out of the woods.

Read More...

GBP/USD trims gains above 1.2750 amid US Dollar rebounds

The GBP/USD pair trades with mild losses around 1.2760 during the Asian session on Wednesday. The modest recovery of the US Dollar (USD) and US yields amid the diminishing expectations of a rate cut by the US Federal Reserve (Fed) in September weighs on the major pair. The Fed’s Beige Book is due later on Wednesday and the Fed’s John Williams is due to speak.

Read More...