Pound Sterling Price News and Forecast: GBP/USD slips below 1.33 as US consumer sentiment turns negative

GBP/USD slips below 1.33 as US consumer sentiment turns negative, boosts USD

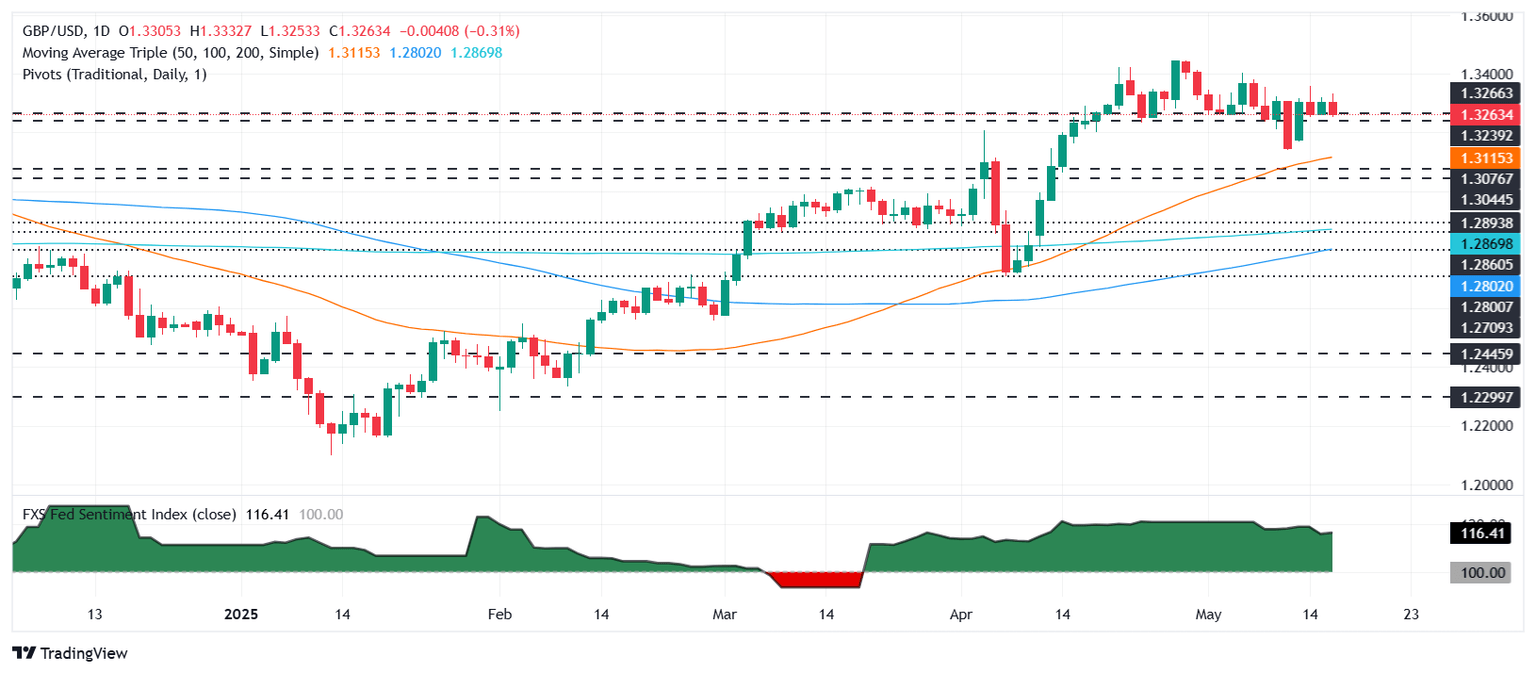

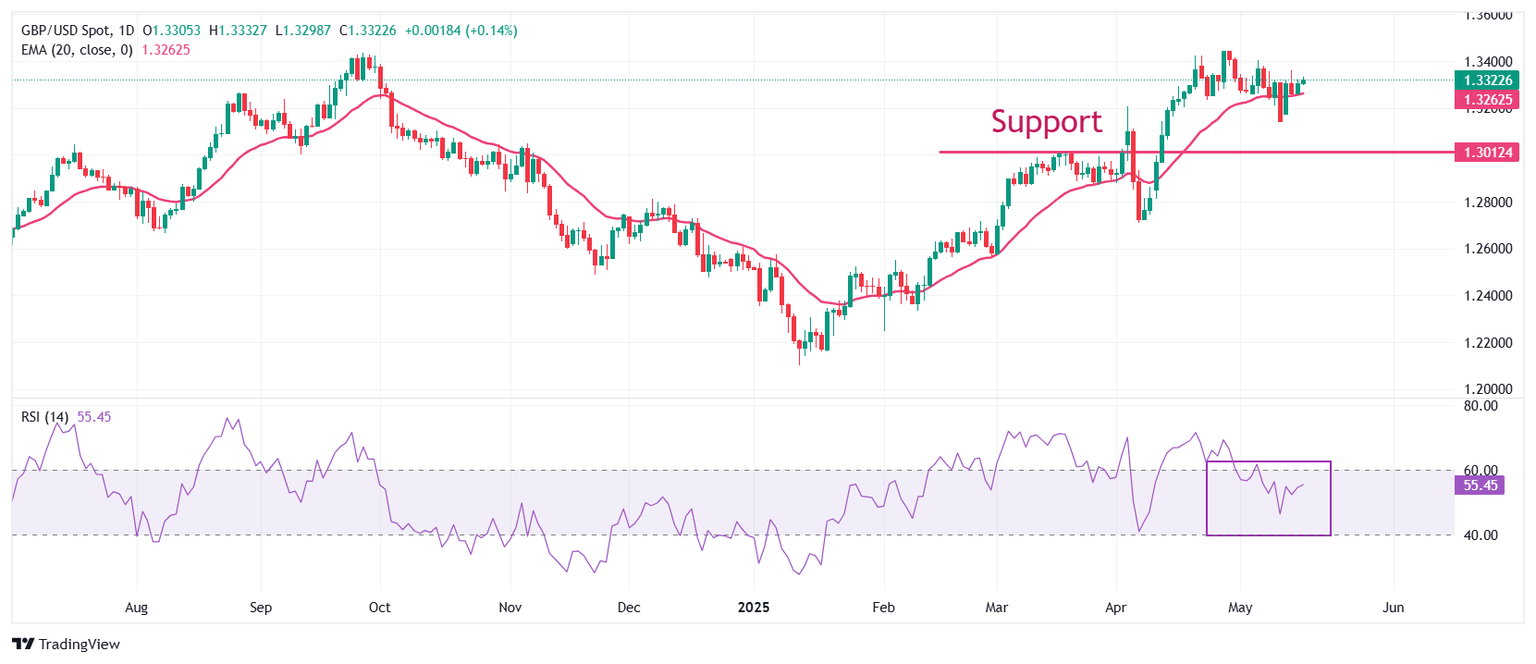

The Pound Sterling retreats against the US Dollar during the North American session, poised to end the week with minimal losses of over 0.24%. An absent economic docket in the UK on Friday left traders adrift to US data, which revealed that consumers are becoming pessimistic about the economy. The GBP/USD trades at 1.3276, down 0.39%. Read More...

Pound Sterling weakens against USD even as Michigan Sentiment data slides again

The Pound Sterling (GBP) turns upside down below 1.3330 against the US Dollar (USD) in Friday’s North American session. The GBP/USD pair gives up intraday gains and turns negative as the US Dollar (USD) claws back losses after the release of the preliminary US Michigan Consumer Sentiment Index (CSI) and the Consumer Inflation Expectations data for May. Read More...

GBP/USD drifts higher above 1.3300 on softer US Dollar, upbeat UK GDP data

The GBP/USD pair edges higher to around 1.3310 during the Asian trading hours on Friday. The Greenback weakens against the Pound Sterling (GBP) as downside surprises in the US economic data this week raise bets of more Federal Reserve (Fed) rate cuts this year. Traders will keep an eye on the preliminary University of Michigan Consumer Sentiment Index, along with the US Building Permits, Housing Starts, which are due later on Friday. Read More...

Author

FXStreet Team

FXStreet