GBP/USD slips below 1.33 as US consumer sentiment turns negative, boosts USD

- UoM Consumer Sentiment plunges to 50.8, the lowest since July 2022; inflation expectations rise sharply.

- US housing data was mixed, import prices rose unexpectedly; Powell, Jefferson caution against premature easing.

- UK data void leaves Sterling adrift; traders await key UK inflation, flash PMIs and Retail Sales next week.

The Pound Sterling (GBP retreats against the US Dollar (USD) during the North American session, poised to end the week with minimal losses of over 0.24%. An absent economic docket in the United Kingdom (UK) on Friday left traders adrift to United States (US) data, which revealed that consumers are becoming pessimistic about the economy. GBP/USD trades at 1.3276, down 0.39%.

GBP/USD wavers and is poised to end the week negatively despite dismal US consumer data

The University of Michigan revealed that the Consumer Sentiment index fell in May to its lowest level since July 2022, at 50.8, below forecasts for an improvement to 53.8 and down from April's 52.2. The poll also showed that inflation expectations for the next year rose from 6.5% to 7.3% and jumped from 4.4% to 4.6% for the next five years.

Other US data showed that import prices increased unexpectedly in April, due to a surge in the cost of capital goods and a weaker US Dollar. US housing data was mixed with housing starts rising in April, while Building Permits fell to an almost two-year low.

GBP/USD delayed reacting to US data but drifted below 1.33. On Thursday, Federal Reserve (Fed) Chair Jerome Powell revealed, "Certain aspects of the Fed's approach are permanent, such as the focus on inflation expectations.”

So far, US economic data released during the week has shown an evolution in the disinflation process. Nevertheless, Fed officials remained reluctant to ease policy as they remained uncertain about US trade policies, tariffs and their effects on inflation. Fed's Governor Philip Jefferson stressed that a reacceleration of inflation could be temporary or persistent.

On the growth front, Retail Sales continued to decelerate in April. However, the latest update from the Atlanta Fed GDP Now suggests that the US economy could grow at a rate of 2.4%, down from 2.5% a day ago, the Atlanta Fed revealed.

Next week, the UK economic docket will feature the UK-European Union meeting alongside the release of the UK’s inflation figures, flash PMIs, and Retail Sales. In the US, a flurry of Fed speakers, flash PMIs, and housing data will be eyed.

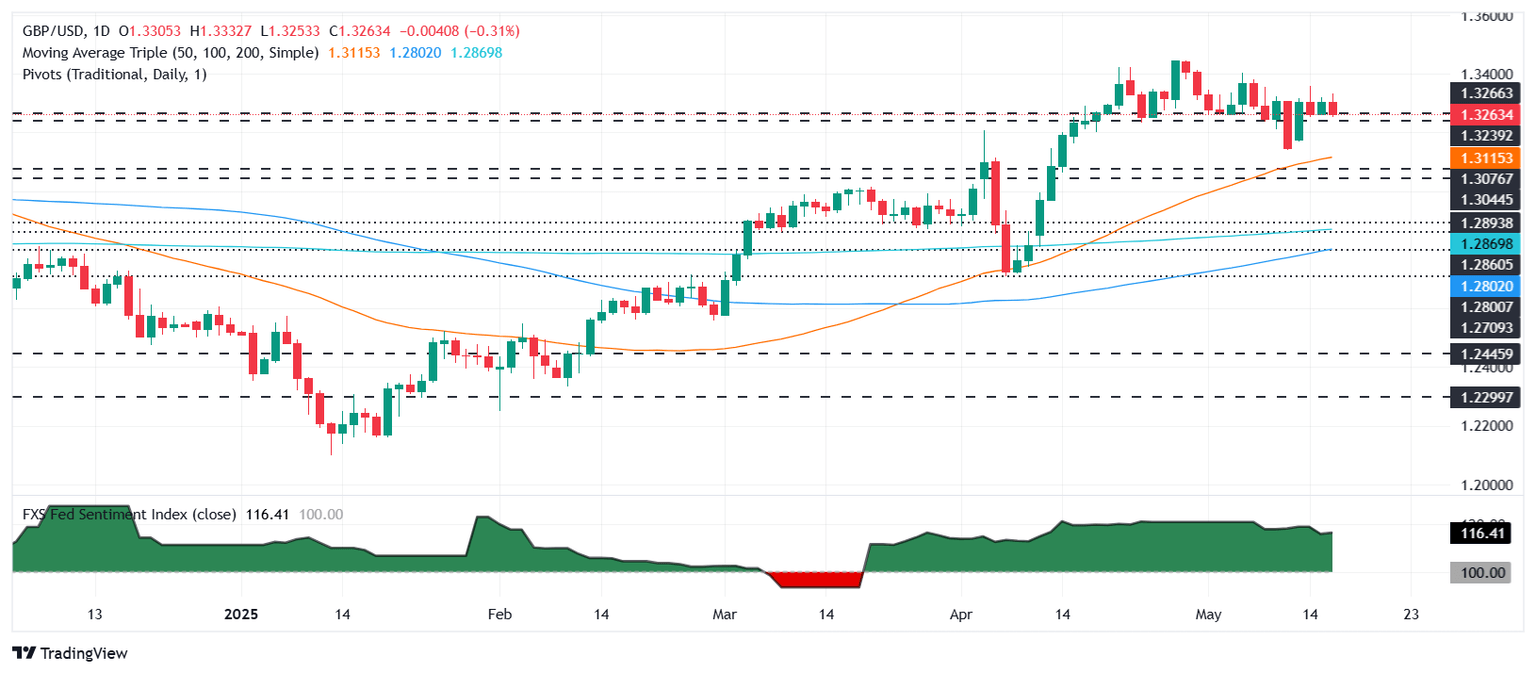

GBP/USD Price Chart: Technical outlook

GBP/USD has dropped below 1.33 and might close the week below the latter. This could pave the way for a pullback, though sellers must clear the May 15 daily low of 1.3248, so they could challenge the 50-day Simple Moving Average (SMA) at 1.3112. On further weakness, the next support would be the 1.3000 mark.

Conversely, if GBP/USD ends above 1.33, buyers could test 1.3350. A clear break of that level could expose the year-to-date (YTD) peak at 1.3443.

British Pound PRICE This week

The table below shows the percentage change of British Pound (GBP) against listed major currencies this week. British Pound was the strongest against the New Zealand Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.89% | 0.34% | -0.19% | 0.63% | 0.35% | 0.90% | 0.58% | |

| EUR | -0.89% | -0.41% | -0.50% | 0.24% | 0.10% | 0.49% | 0.17% | |

| GBP | -0.34% | 0.41% | 0.08% | 0.65% | 0.52% | 0.84% | 0.59% | |

| JPY | 0.19% | 0.50% | -0.08% | 0.82% | -0.09% | 0.23% | 0.54% | |

| CAD | -0.63% | -0.24% | -0.65% | -0.82% | -0.02% | 0.26% | -0.07% | |

| AUD | -0.35% | -0.10% | -0.52% | 0.09% | 0.02% | 0.29% | 0.05% | |

| NZD | -0.90% | -0.49% | -0.84% | -0.23% | -0.26% | -0.29% | -0.35% | |

| CHF | -0.58% | -0.17% | -0.59% | -0.54% | 0.07% | -0.05% | 0.35% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

Author

Christian Borjon Valencia

FXStreet

Christian Borjon began his career as a retail trader in 2010, mainly focused on technical analysis and strategies around it. He started as a swing trader, as he used to work in another industry unrelated to the financial markets.