Pound Sterling Price News and Forecast: GBP/USD declines to around 0.6520 during Wednesday session

GBP/USD attracts some sellers below 0.6550 ahead of BoE’s Breeden speech

The GBP/USD pair attracts some sellers near 0.6520 during the Asian trading hours on Wednesday. The Pound Sterling (GBP) weakens against the US Dollar (USD) amid concerns about the UK's ability to keep its finances under control. The Bank of England (BoE) Sarah Breeden is set to speak later on Wednesday.

Britain's 30-year borrowing costs rose to their highest levels since 1998, raising concerns about the Labour government's ability to exercise fiscal constraint. With the budget unlikely to come until November, the UK faces weeks of speculation about tax increases, which might affect investment and consumer confidence. Fiscal worries and a gloomy economic outlook might exert some selling pressure on the Cable in the near term. Read more...

GBP/USD tumbles ahead of full data docket

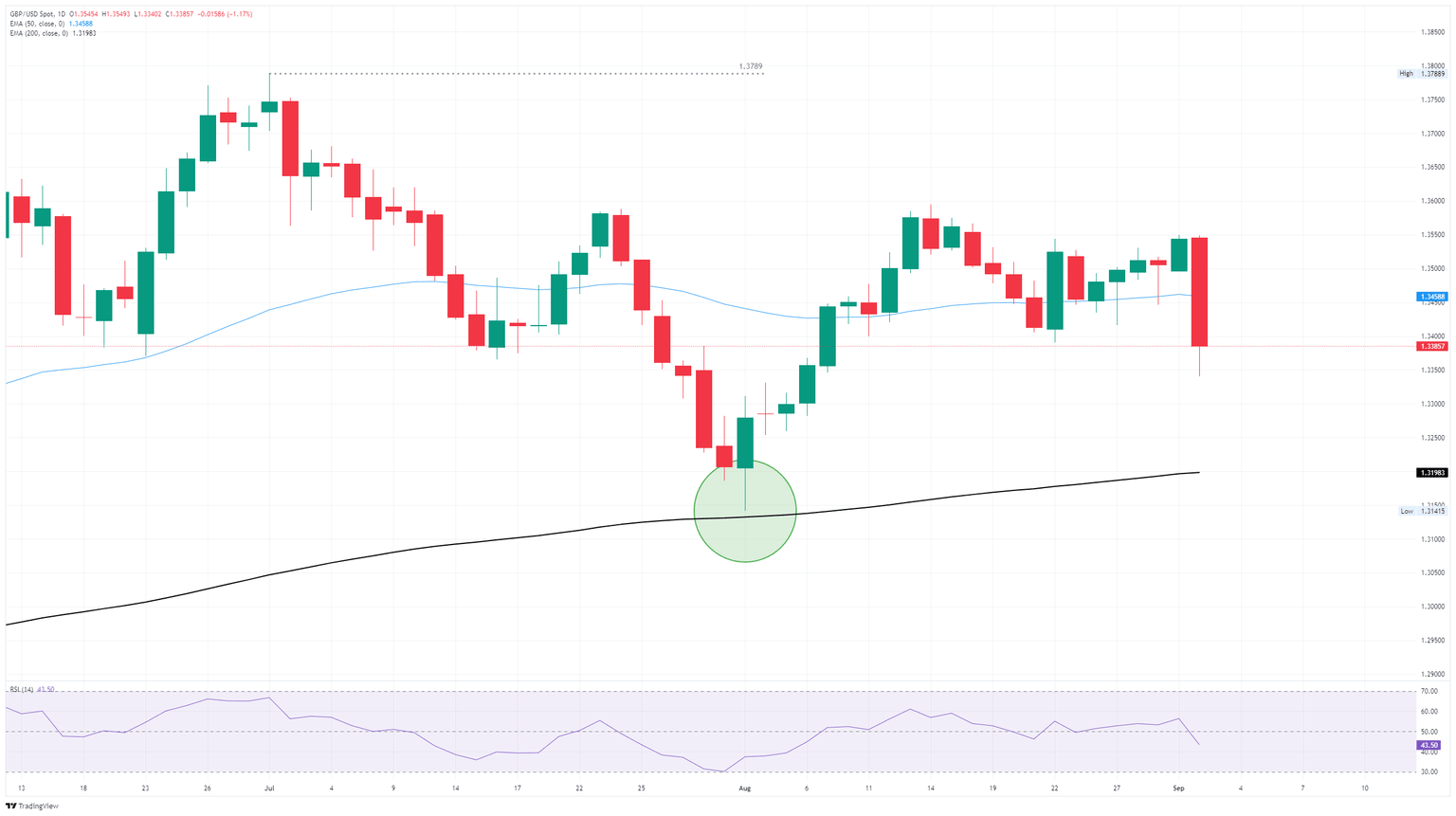

GBP/USD tumbled sharply on Tuesday, declining over 1.15% and sinking back below the 1.3800 handle for the first time in almost a month. Broad-market investor sentiment soured heading into the September trading month, with safe-haven flows into the US Dollar (USD) surging.

A smattering of speeches and public appearances from policymakers at both the Bank of England (BoE) and the Federal Reserve (Fed) are expected throughout the day. However, not much new is expected on the central banking front from either side of the Atlantic. Read more...

Pound sinks 1% as UK Gilt yields hit 1998 highs

The Pound Sterling (GBP) tumbles 1% on Tuesday as UK 30-year Gilts rose to 5.697%, its highest level since May 1998, due to fiscal concerns linked to the Autumn Budget. In the meantime, US economic data was mixed, following the release of Purchasing Managers’ Index (PMIs) reports from S&P Global and the ISM. GBP/USD trades at 1.3399 after hitting a high of 1.3549.

In the United Kingdom (UK), pressure on Finance Minister Rachel Reeves is growing. Market participants expect her to raise taxes in the next budget to remain on course for her fiscal targets, which could dent growth. Read more...

Author

FXStreet Team

FXStreet