Pound Sterling Price News and Forecast: GBP/USD sinks 1% as UK Gilt yields hit 1998 highs

Pound sinks 1% as UK Gilt yields hit 1998 highs

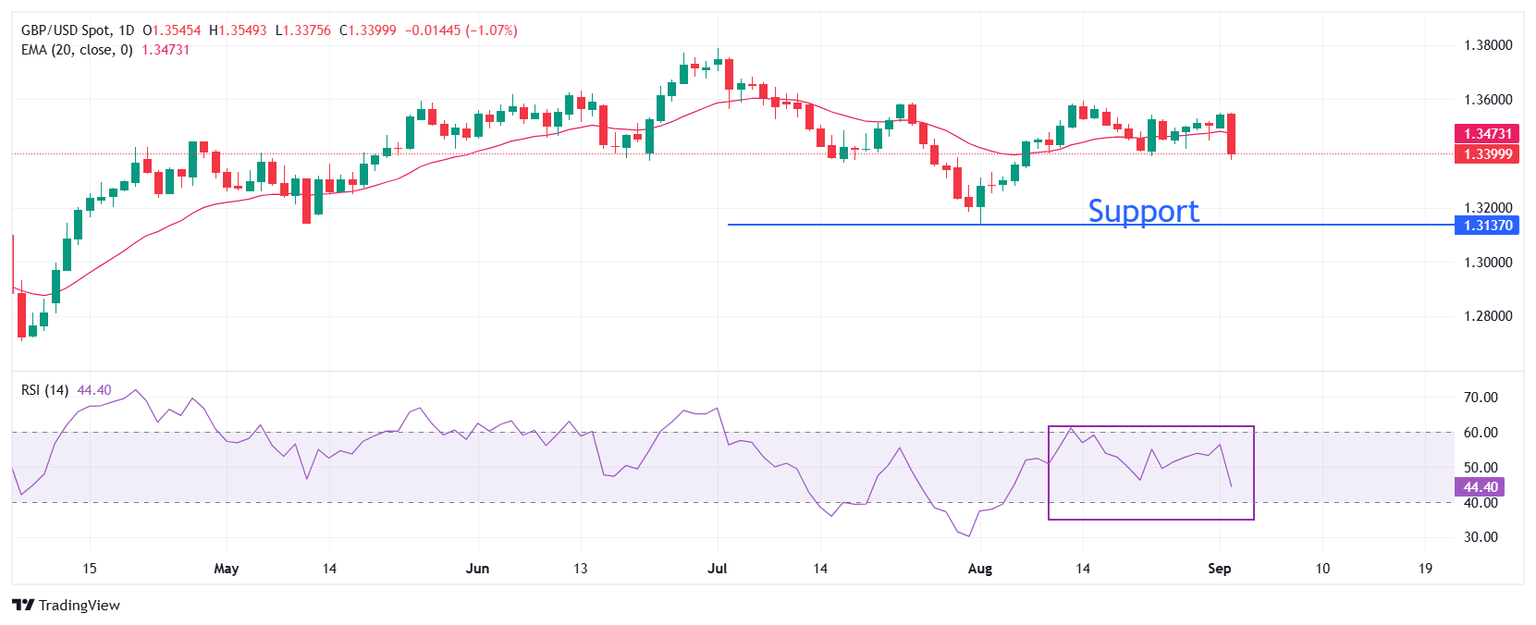

The Pound Sterling (GBP) tumbles 1% on Tuesday as UK 30-year Gilts rose to 5.697%, its highest level since May 1998, due to fiscal concerns linked to the Autumn Budget. In the meantime, US economic data was mixed, following the release of Purchasing Managers’ Index (PMIs) reports from S&P Global and the ISM. GBP/USD trades at 1.3399 after hitting a high of 1.3549. Read More...

Pound Sterling plummets as soaring UK gilt yields raise fiscal concerns

The Pound Sterling (GBP) underperforms its major peers in a light United Kingdom (UK) economic calendar week. The British currency has tumbled as soaring UK long-term gilt yeilds have raised fiscal concerns. 30-year UK gilt yields surge to near 5.68%, the highest level seen since 1998. Read More...

GBP/USD falls toward 1.3500 amid uncertain Fed policy outlook

GBP/USD retraces its recent gains from the previous session, trading around 1.3520 during the Asian hours on Tuesday. The pair depreciates as the US Dollar (USD) gains ground, driven by persistent inflationary pressures in the United States (US), which heightened uncertainty over potential Federal Reserve (Fed) rate cuts. Traders will likely observe the August ISM Manufacturing Purchasing Managers Index (PMI) later in the day. Read More...

Author

FXStreet Team

FXStreet