Pound Sterling Price News and Forecast: GBP/USD rises towards 1.3300 as UK economy grows above forecasts

GBP/USD rises towards 1.3300 as UK economy grows above forecasts

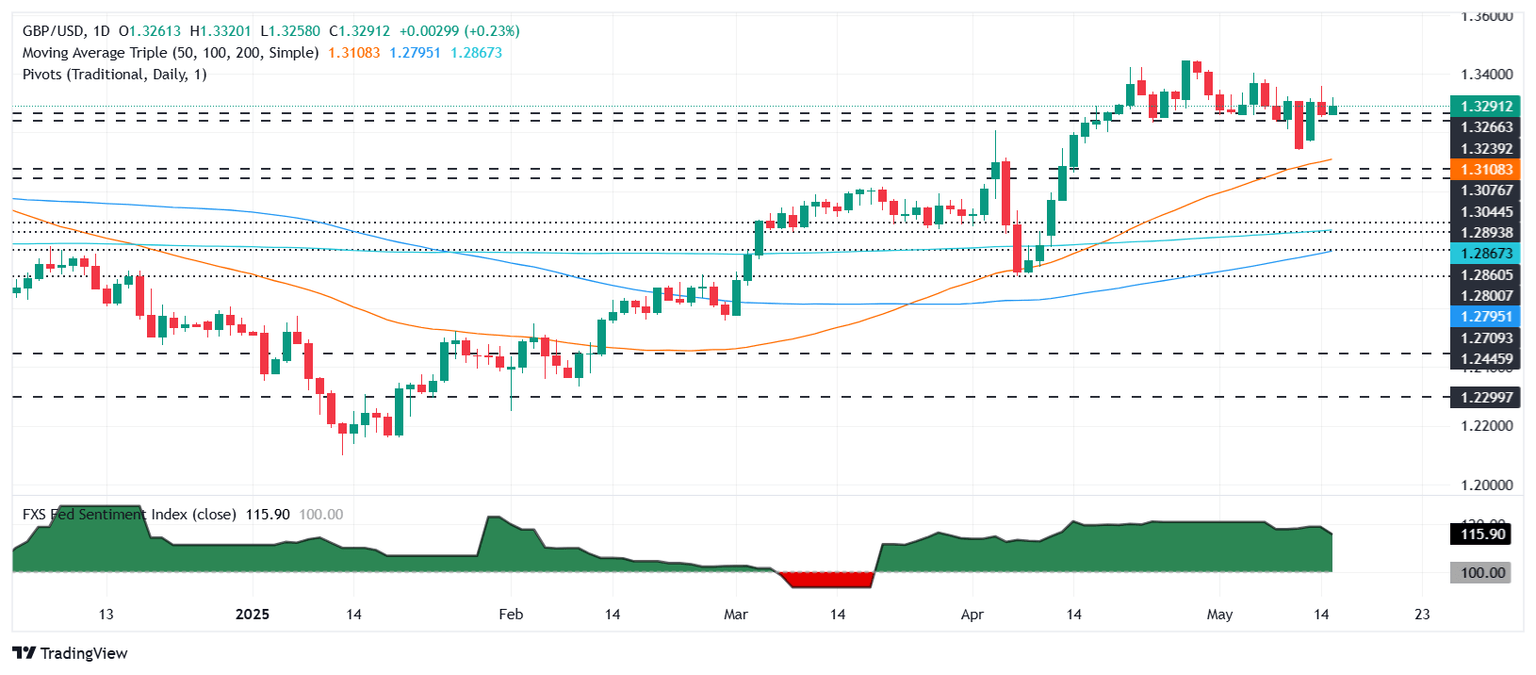

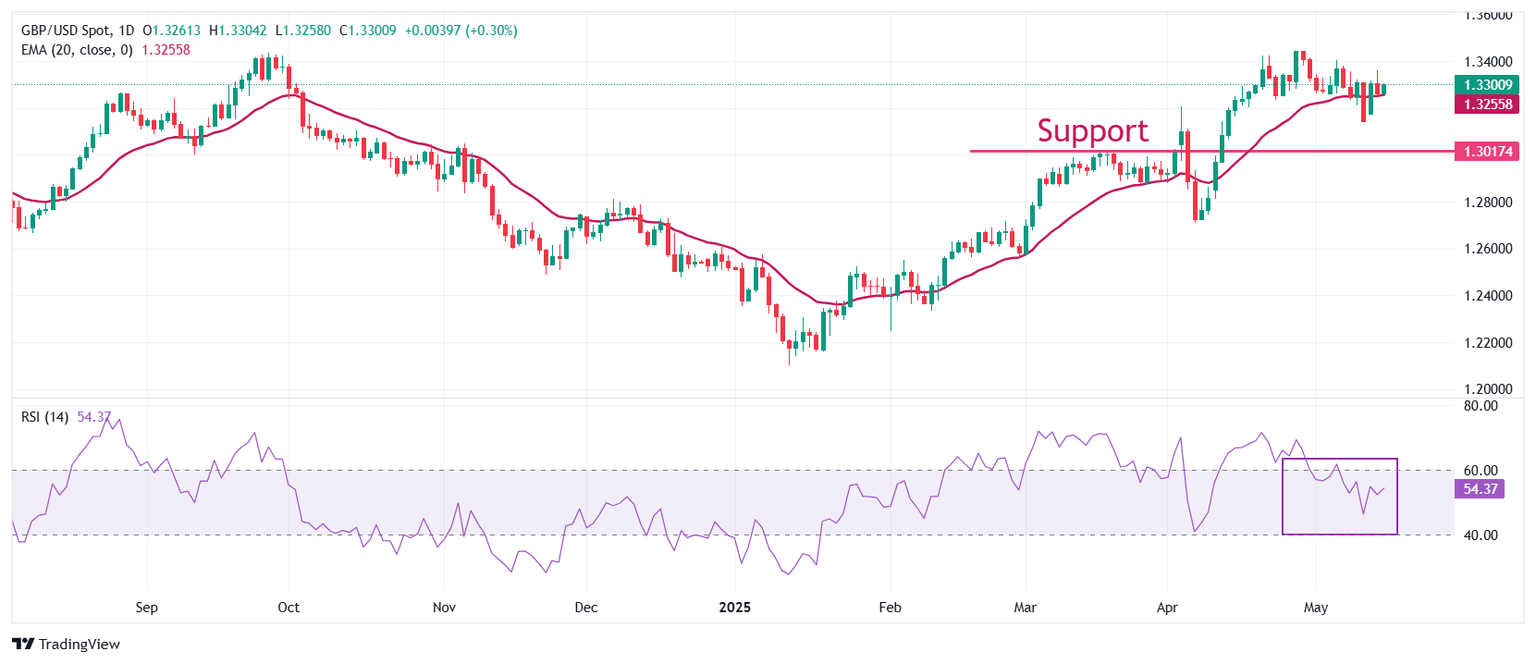

The Pound Sterling extended its gains against the US Dollar, driven by a positive reading of economic growth in the UK and softer-than-expected data in the US, which fueled speculation of a slower economic outlook. At the time of writing, the GBP/USD trades at 1.3293, up 0.31%. Read More...

Pound Sterling outperforms US Dollar on soft US PPI, upbeat UK GDP data

The Pound Sterling (GBP) jumps slightly above 1.3300 against the US Dollar in North American trading hours. The GBP/USD pair gains as the US Dollar faces selling pressure after the release of the softer-than-expected United States (US) Producer Price Index (PPI) report for April. Read More...

GBP/USD edges higher to near 1.3300 ahead of Q1 GDP data from UK

GBP/USD is rebounding from recent losses, trading near 1.3280 during the Asian session on Thursday. The pair is supported by a softer US Dollar (USD), as investors weigh ongoing trade-related uncertainties despite a slight easing in tensions. Market focus now shifts to the release of US Retail Sales and Producer Price Index (PPI) data later in the day. Read More...

Author

FXStreet Team

FXStreet