Pound Sterling Price News and Forecast: GBP/USD rises as Trump's gradual tariff hikes prompt risk-on mood

Pound Sterling rises as Trump's gradual tariff hikes prompt risk-on mood

The Pound Sterling (GBP) ticks higher to near 1.2375 against the US Dollar (USD) in Wednesday’s North American session. The GBP/USD pair gains as the US Dollar struggles to hold its two-week low, with the US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, trading cautiously around 107.90 as its safe-haven demand has moderated. Read More...

GBP/USD struggles near 1.2350 as Trump’s tariff hikes proposal remains afloat

GBP/USD pauses its two-day rally, trading around 1.2330 during the Asian session on Wednesday. The pair remains subdued as the US Dollar (USD) holds onto modest gains. US President Donald Trump confirmed that the proposal for universal tariff hikes is still under consideration, although he stated, "We are not ready for that yet." Additionally, Trump issued a memorandum directing federal agencies to investigate and address the ongoing trade deficits. Read More...

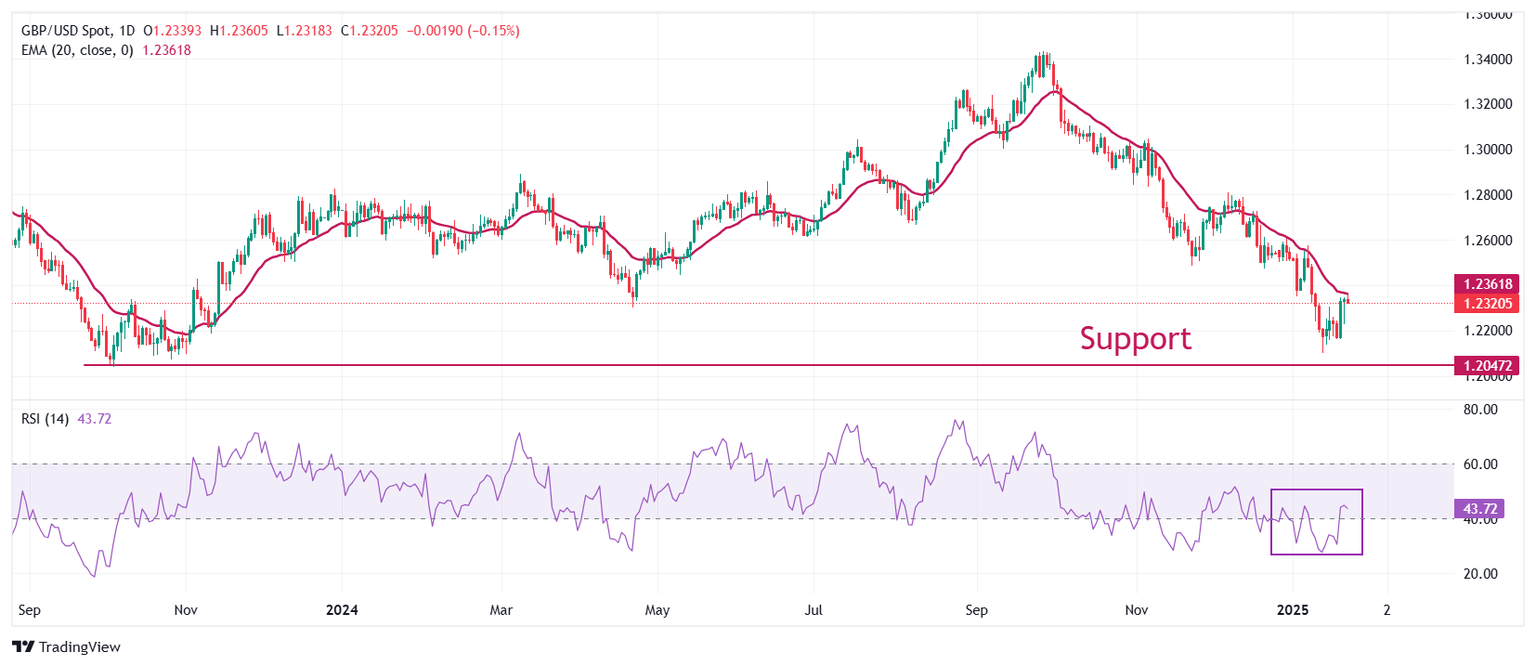

GBP/USD poised for further headline-fueled gains

GBP/USD spun in a circle on Tuesday, falling and then climbing in lockstep with global money flows into and out of the US Dollar. The Pound Sterling saw mixed labor data results from the UK, but the UK’s own labor department takes the numbers with a grain of salt. On the American side, US President Donald Trump brushed off his own campaign trail promises of instituting sweeping day-one tariffs on all of the US’ trading partners, focusing newer, more refined tariff threats on the US’ North American trade partners Canada and Mexico. Read More...

Author

FXStreet Team

FXStreet