Pound Sterling Price News and Forecast: GBP/USD retraces against US Dollar with US NFP

Pound Sterling retraces against US Dollar with US NFP under spotlight

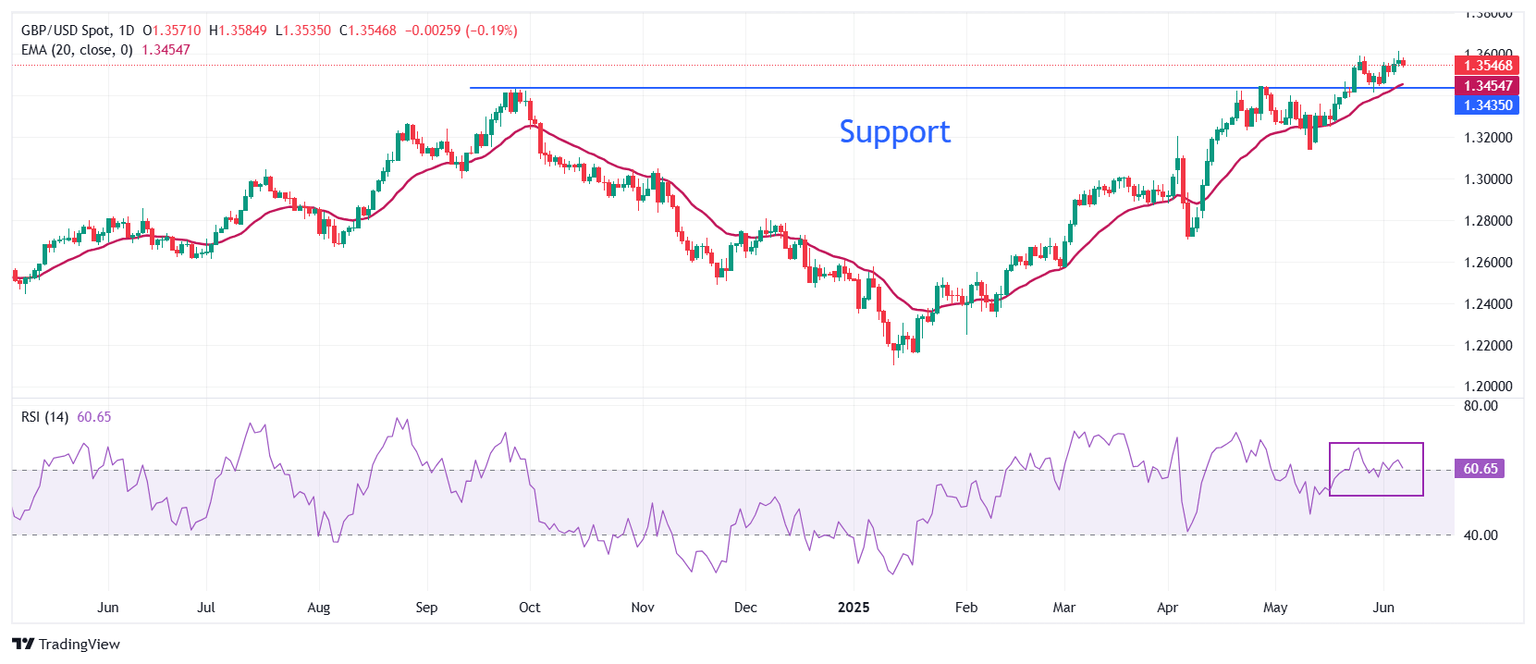

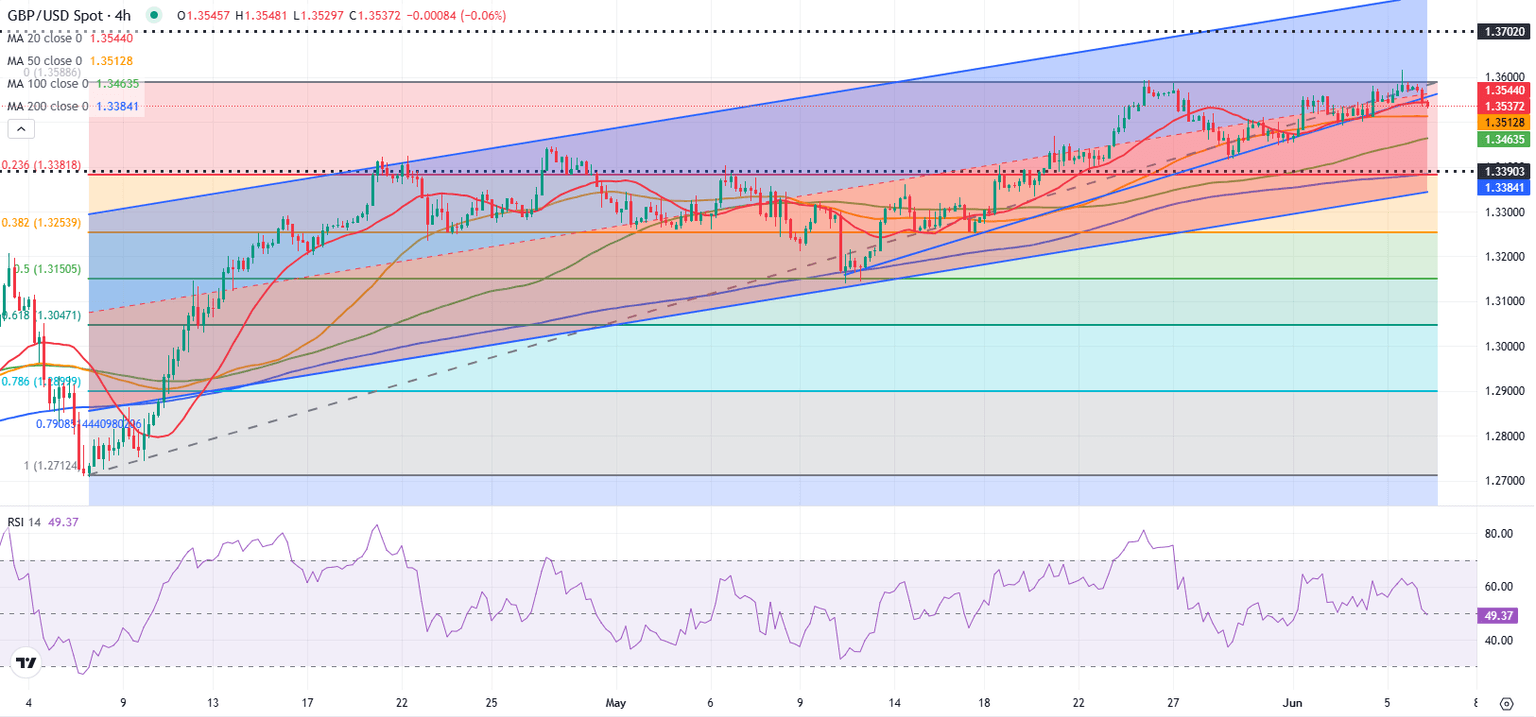

The Pound Sterling (GBP) retraces to near 1.3535 against the US Dollar during the European trading session on Friday, falling from a fresh three-year high of 1.3620 posted the previous day. The GBP/USD pair faces selling pressure as the US Dollar (USD) gains ground ahead of the United States (US) Nonfarm Payrolls (NFP) data for May, which will be published at 12:30 GMT.

The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, ticks up to near 98.85. The US official employment data is expected to influence the next move in the US Dollar as it will likely impact market expectations for the Federal Reserve’s (Fed) monetary policy outlook. Read more...

GBP/USD Forecast: Pound Sterling loses traction ahead of US employment data

GBP/USD edges lower on Friday and trades below 1.3550 after touching its highest level since February 2022 above 1.3600. The May employment report from the US could influence the US Dollar's (USD) valuation and drive the pair's action heading into the weekend.

GBP/USD gathered bullish momentum in the early American session on Thursday after the data published by the US Department of Labor showed that weekly Initial Jobless Claims rose to 247,000 in the week ending May 31 from 239,000 in the previous week. Read more...

Author

FXStreet Team

FXStreet