Pound Sterling Price News and Forecast: GBP/USD remains subdued for the second successive day

GBP/USD Price Forecast: Remains below 1.2250 barrier near nine-day EMA

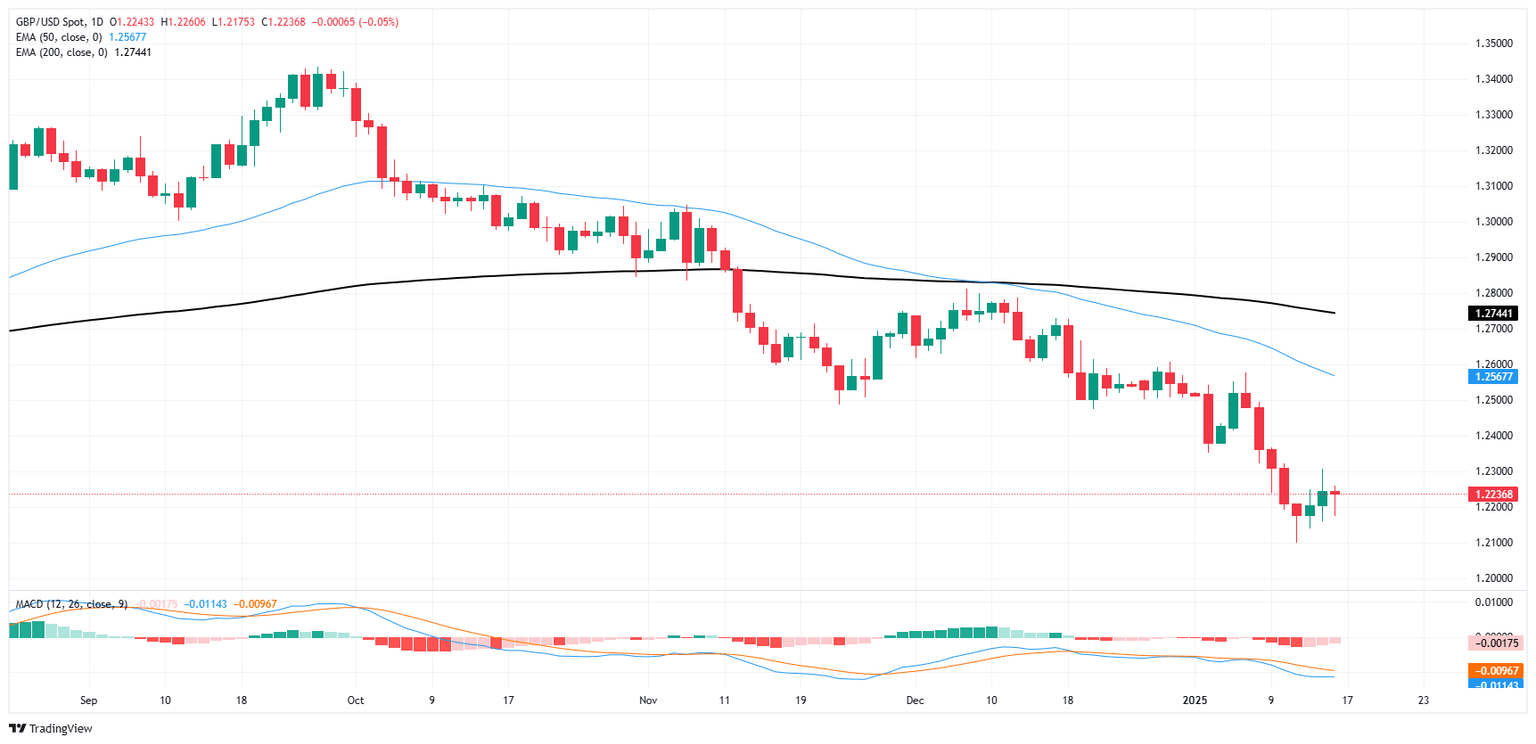

The GBP/USD pair remains subdued for the second successive day, trading near 1.2230 during the Asian session on Friday. However, technical analysis of the daily chart suggests a persistent bearish bias, with the pair continuing to move within a descending channel pattern.

The 14-day Relative Strength Index (RSI) sits just above the 30 level, indicating increased bearish momentum. Moreover, the pair remains below the nine- and 14-day Exponential Moving Averages (EMAs), signaling weak short-term price dynamics and reinforcing the downward trend. Read more...

GBP/USD snaps two-day win streak, UK Retail Sales in the pipe

GBP/USD churned chart paper near familiar levels on Thursday, chalking in a flat day after exploring some intraday downside and snapping a two-day win streak as price action gets hung up on the 1.2200 handle.

UK Gross Domestic Product (GDP) growth rebounded in November but missed median market forecasts, registering a slim 0.1% MoM, down from the expected 0.2%, and climbing only moderately from the previous -0.1% contraction. UK Industrial Production barely moved the needle in November, contracting by 0.4% and entirely missing the forecast upswing to 0.1% compared to the previous month’s -0.6% backslide. Read more...

Author

FXStreet Team

FXStreet