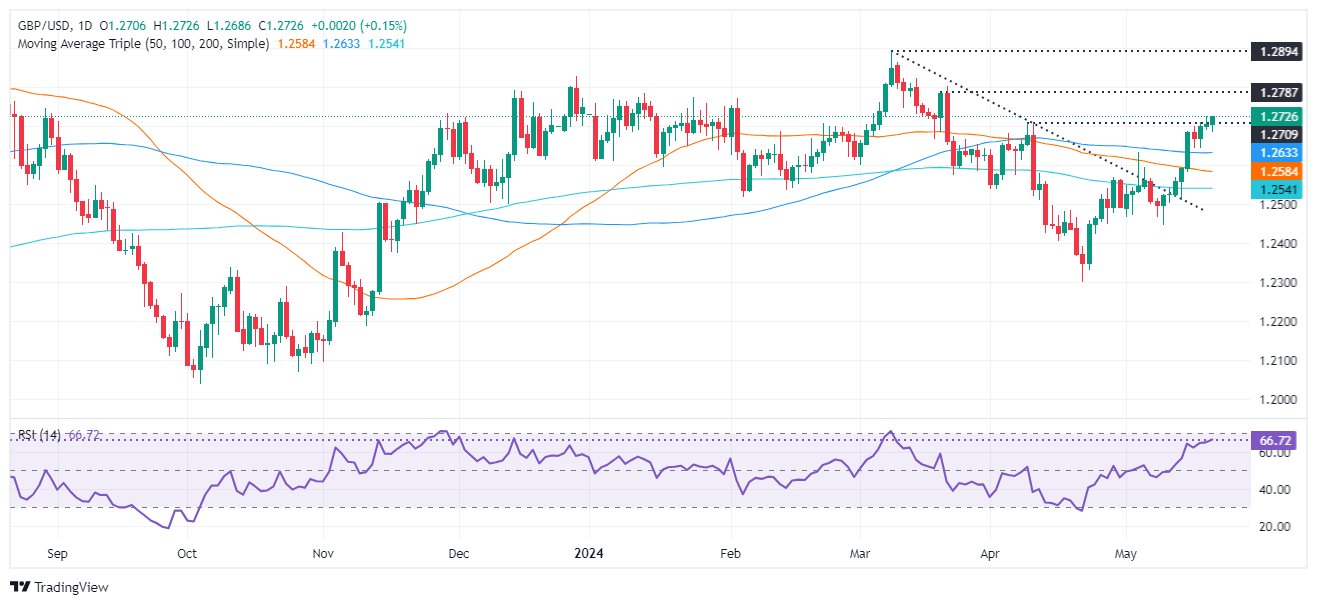

GBP/USD Price Analysis: Remains subdued above 1.2700

The Pound Sterling registered minuscule gains versus the US Dollar in early trading during the North American session. Investors’ sentiment is upbeat as most US equity indices are rising, US Treasury bond yields are falling, and the Greenback was virtually unchanged against a basket of its peers. Therefore, the GBP/USD trades at 1.2719, up 0.11%.

Read More...

Pound Sterling holds gains above 1.2700 ahead of UK inflation

The Pound Sterling (GBP) remains firm, trading slightly above 1.2700 in Tuesday’s New York session. The next move in the GBP/USD pair will likely be guided by the United Kingdom Consumer Price Index (CPI) data for April and the Federal Open Market Committee (FOMC) minutes for the May meeting, which will be published on Wednesday.

Read More...

GBP/USD extends its upside above 1.2700, investors await fresh catalysts

The

GBP/USD pair extends the rally near 1.2710 on Tuesday during the early Asian session. Investors await fresh catalysts, with different Federal Reserve (Fed) speakers set to speak later in the day. On Wednesday, the UK Consumer Price Index (CPI) inflation data and FOMC Minutes will be closely watched.

Read More...