Pound Sterling Price News and Forecast: GBP/USD remains near 1.2000 after US data

GBP/USD remains near 1.2000 after US data, virtually flat for the week

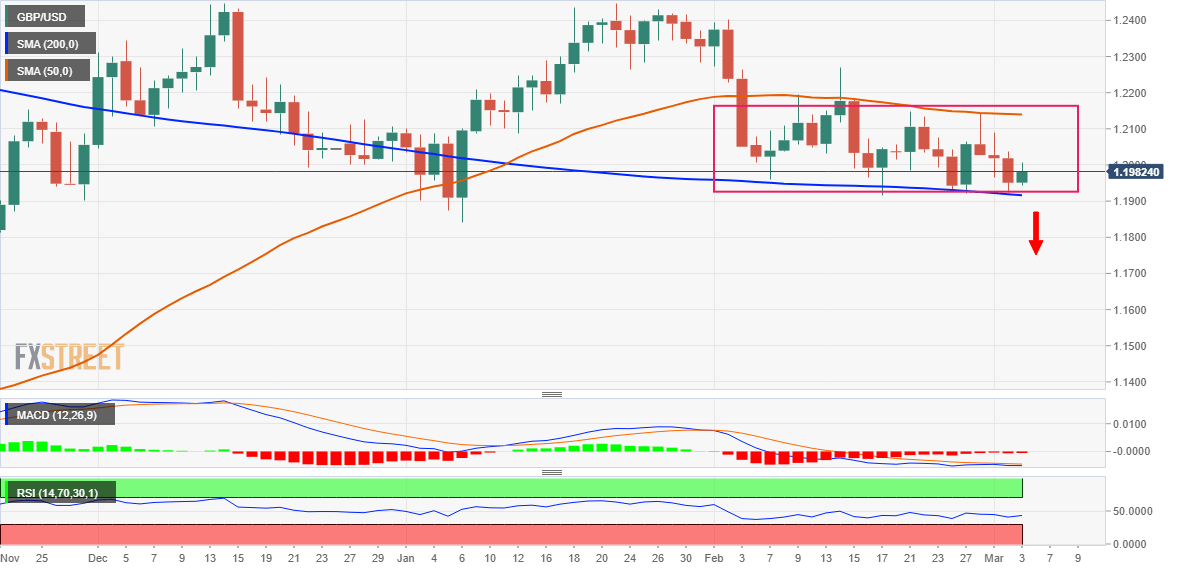

The GBP/USD fell to 1.1960 after the release of the US ISM Service PMI and then rebounded. The pair continues to move sideways, near 1.2000, virtually flat for the week. Read More...

GBP/USD Price Analysis: Sticks to gains around 1.2000 mark, 200 DMA holds the key for bulls

The GBP/USD pair attracts some dip-buying on Friday and recovers a major part of the previous day's slide to the 1.1920-1.1915 support zone. The pair maintains its bid tone around the 1.2000 psychological mark through the early North American session and is supported by broad-based US Dollar weakness. Read More...

GBP/USD steadily climbs back closer to 1.2000 mark amid broad-based USD weakness

The GBP/USD pair attracts fresh buyers in the vicinity of a technically significant 200-day Simple Moving Average (SMA) and reverses a part of the overnight losses back closer to the weekly low. The pair sticks to its intraday gains and is currently placed near the top end of the daily range, just a few pips below the 1.2000 psychological mark. Read More...

Author

FXStreet Team

FXStreet