GBP/USD Price Analysis: Sticks to gains around 1.2000 mark, 200 DMA holds the key for bulls

- GBP/USD regains positive traction on Friday and reverses a major part of the overnight losses.

- The four-week-old trading range warrants caution before placing aggressive directional bets.

- Bearish oscillators on the daily chart support prospects for a break below the 200-day SMA.

The GBP/USD pair attracts some dip-buying on Friday and recovers a major part of the previous day's slide to the 1.1920-1.1915 support zone. The pair maintains its bid tone around the 1.2000 psychological mark through the early North American session and is supported by broad-based US Dollar weakness.

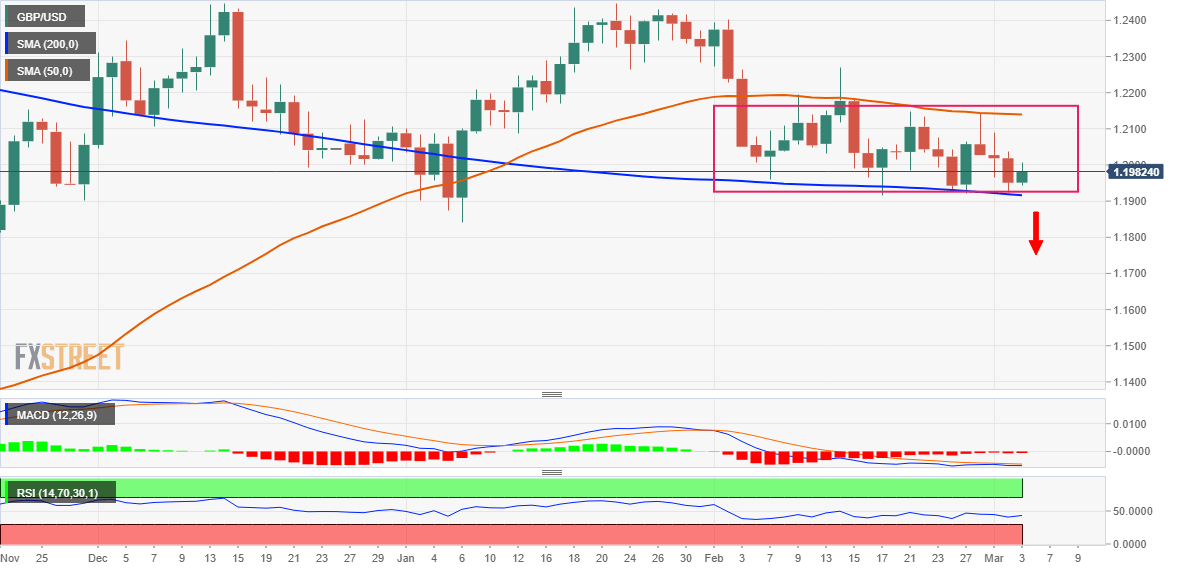

Looking at the broader picture, the two-way price moves witnessed over the past four weeks or so constitute the formation of a rectangle on the daily chart. The lower end of the trading band coincides with a technically significant 200-day Simple Moving Average (SMA) and should now act as a pivotal point.

A convincing break below will make the GBP/USD pair vulnerable to weaken further below the 1.1900 mark and test the YTD low, around the 1.1840 region touched in January. Some follow-through selling will complete a bearish double-top pattern formed near the 1.2445-1.2450 area and pave the way for deeper losses.

On the flip side, the overnight swing high, around the 1.2035 area, might act as an immediate hurdle ahead of the 1.2065-1.2070 supply zone. Any subsequent move-up could attract fresh sellers near the 1.2100 mark and remain capped near the 50-day SMA strong barrier, currently around the 1.2135-1.2140 area.

Some follow-through buying could lift the GBP/USD pair towards the 1.2200 mark en route to the February 14 peak, around the 1.2265-1.2270 region. A sustained strength beyond the latter will suggest that the slide from the 1.2445-1.2450 zone has run its course and shift the near-term bias back in favour of bullish traders.

GBP/USD daily chart

Key levels to watch

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.