Pound Sterling Price News and Forecast: GBP/USD remains indecisive as the BoE monetary policy decision looms

GBP/USD aptly portrays pre-BoE anxiety near 1.2630 immediate hurdle on “Super Thursday”

GBP/USD retreats from intraday high while slipping back to 1.2620 as it inks the market’s cautious mood ahead of the all-important Bank of England (BoE) monetary policy meeting. With this, the Pound Sterling pair remains unchanged on a day, printing three-day indecision of traders, heading into the London open on “Super Thursday”.

The Cable pair rose to a fresh high since April 2022 the previous day following downbeat US inflation data. However, the pre-BoE consolidation joined the US Dollar’s corrective bounce to prod the GBP/USD pair’s latest moves. Read more...

GBP/USD Price Analysis: Cable turns defensive above 1.2600 on BoE “Super Thursday”

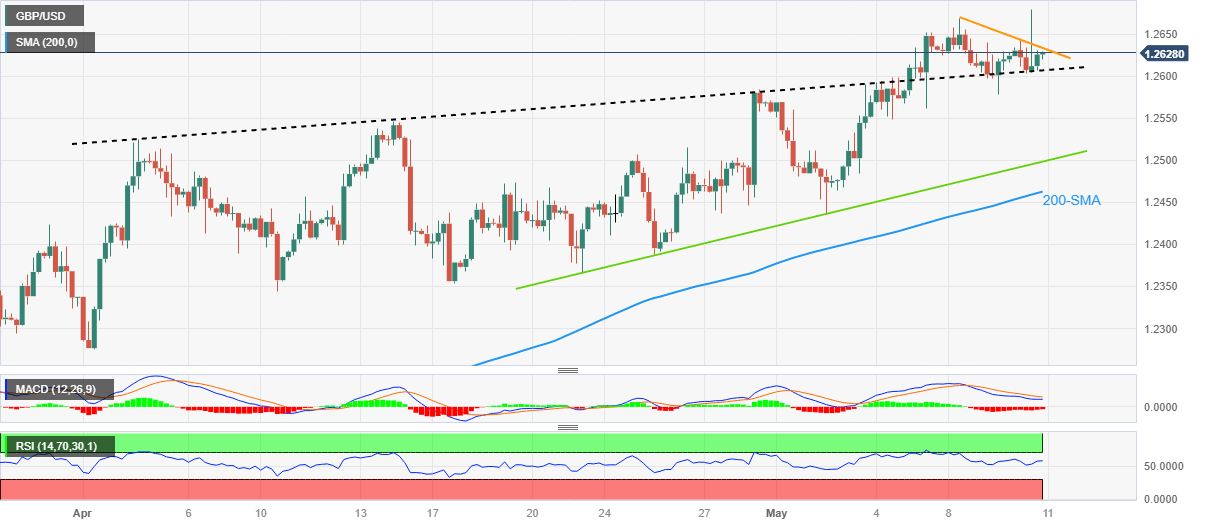

GBP/USD bulls take a breather around 1.2630 amid the early hours of the Bank of England (BoE) inspired “Super Thursday”. That said, the Cable pair rose to a 13-month high the previous day while bouncing off the resistance-turned-support line stretched from early April.

The Pound Sterling’s recovery from the previous resistance line also gained support from the firmer RSI (14) line, not overbought. However, the bearish MACD signals and a downward-sloping resistance line from Monday, close to 1.2635 by the press time, prod the Cable buyers. Read more...

Author

FXStreet Team

FXStreet