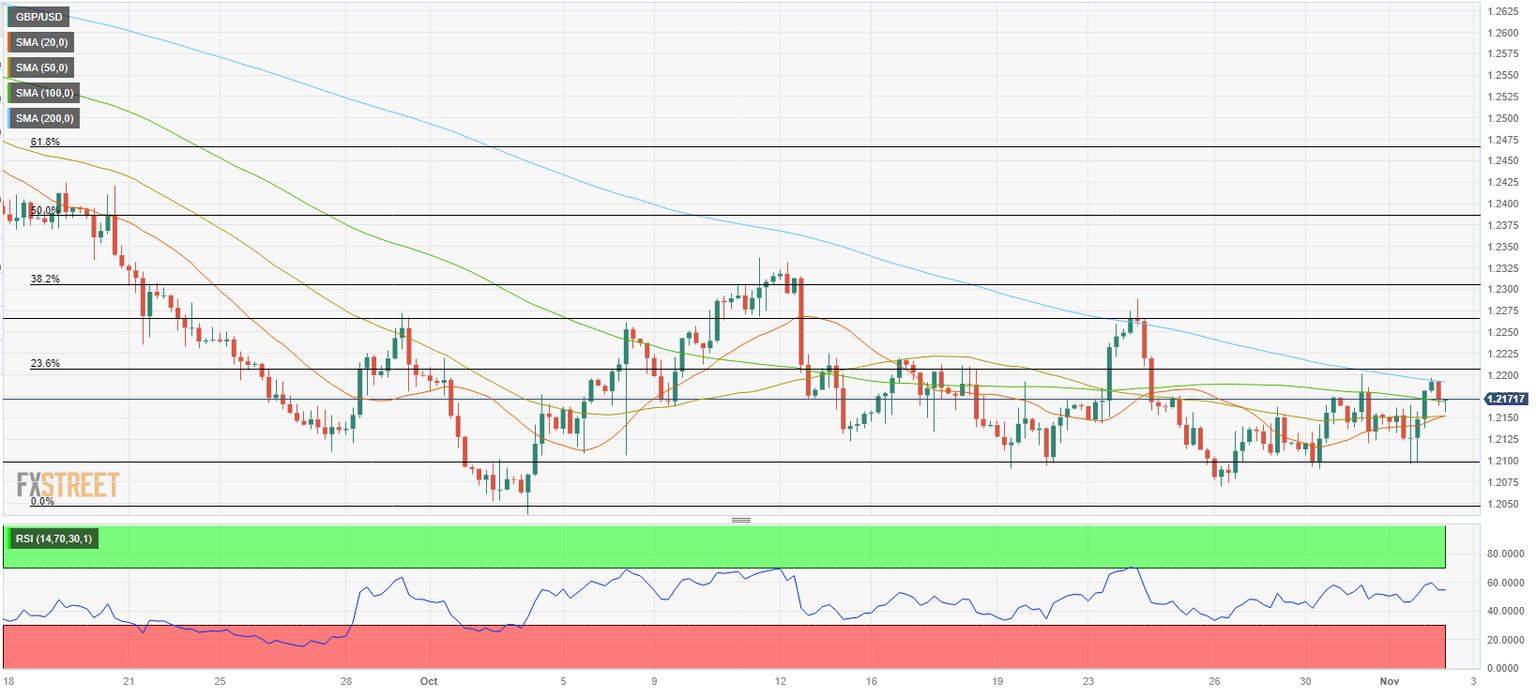

Pound Sterling Price News and Forecast: GBP/USD remains capped below the 1.2200 barrier

GBP/USD Forecast: Pound Sterling needs a hawkish BoE to clear 1.2200

GBP/USD gathered bullish momentum and registered gains on Wednesday after dropping below 1.2100 earlier in the day. The pair continued to stretch higher toward 1.2200 on Thursday but lost its traction, with investors refraining from taking large positions ahead of the Bank of England's (BoE) monetary policy announcements.

The Federal Reserve held the policy rate steady at 5.25%-5.5% as widely expected on Wednesday. Fed Chairman Jerome Powell did not rule out another rate hike in December but failed to convince markets. The benchmark 10-year US Treasury bond yield fell nearly 4% on the day and the US Dollar (USD) weakened against its major rivals, allowing GBP/USD to turn north. Read more...

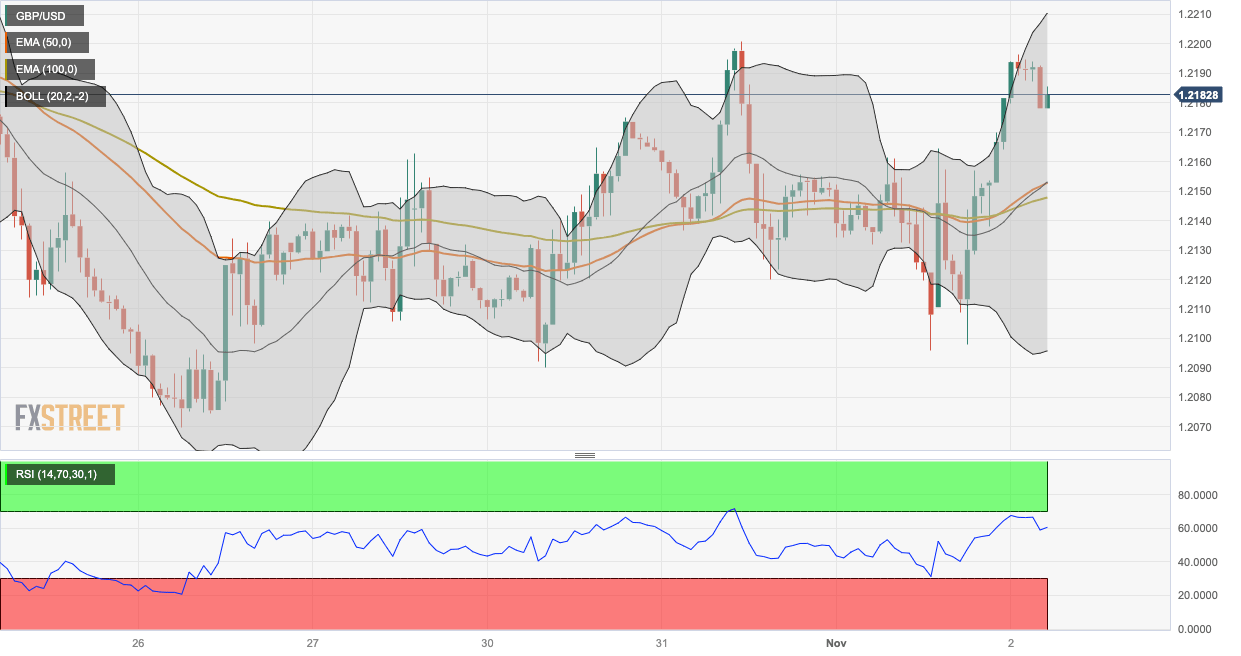

GBP/USD Price Analysis: Remains capped below the 1.2200 barrier

The GBP/USD pair edges higher during the Asian trading hours on Thursday. The uptick of the pair is supported by the weakening of the US Dollar (USD) after the Federal Reserve (Fed) maintained the interest rate steady, while odds that it may not hike rates again rose after the press conference. The major pair currently trades around 1.2184, gaining 0.28% on the day.

From the technical perspective, GBP/USD holds above the 50- and 100-hour Exponential Moving Averages (EMAs) on the one-hour chart, which means further upside looks favorable. Additionally, the Relative Strength Index (RSI) holds above 50 in bullish territory, indicating buyers retain control for the time being. Read more...

Pound Sterling soars as BoE maintains status quo

The Pound Sterling (GBP) advances strongly as the Bank of England (BoE) has kept interest rates unchanged at 5.25%, as expected. BoE policymakers: Jonathan Haskel, Megan Greene, and Katherine Mann voted for a 25 basis points (bps) rate hike while the other six policymakers including new Deputy Governor Sarah Breeden, who has replaced Jon Cunliffe, advocated for keeping interest rates unchanged. Dovish policymaker Swati Dhingra supported an unchanged interest rate decision but was expected to advocate a rate cut.

The inflation forecast report by the BoE shows that consumer inflation will soften to 4.6% by the Q4 of 2023. This indicates that UK Prime Minister Rishi Sunak would manage to fulfill his promise of halving inflation to 5.4% by the year-end. Inflation in one and two-year timeframe is seen declining to 3.1% and 1.9% respectively. Read more...

Author

FXStreet Team

FXStreet