Pound Sterling Price News and Forecast: GBP/USD recovered four-tenths of a percent

GBP/USD rebounds despite UK PMI miss

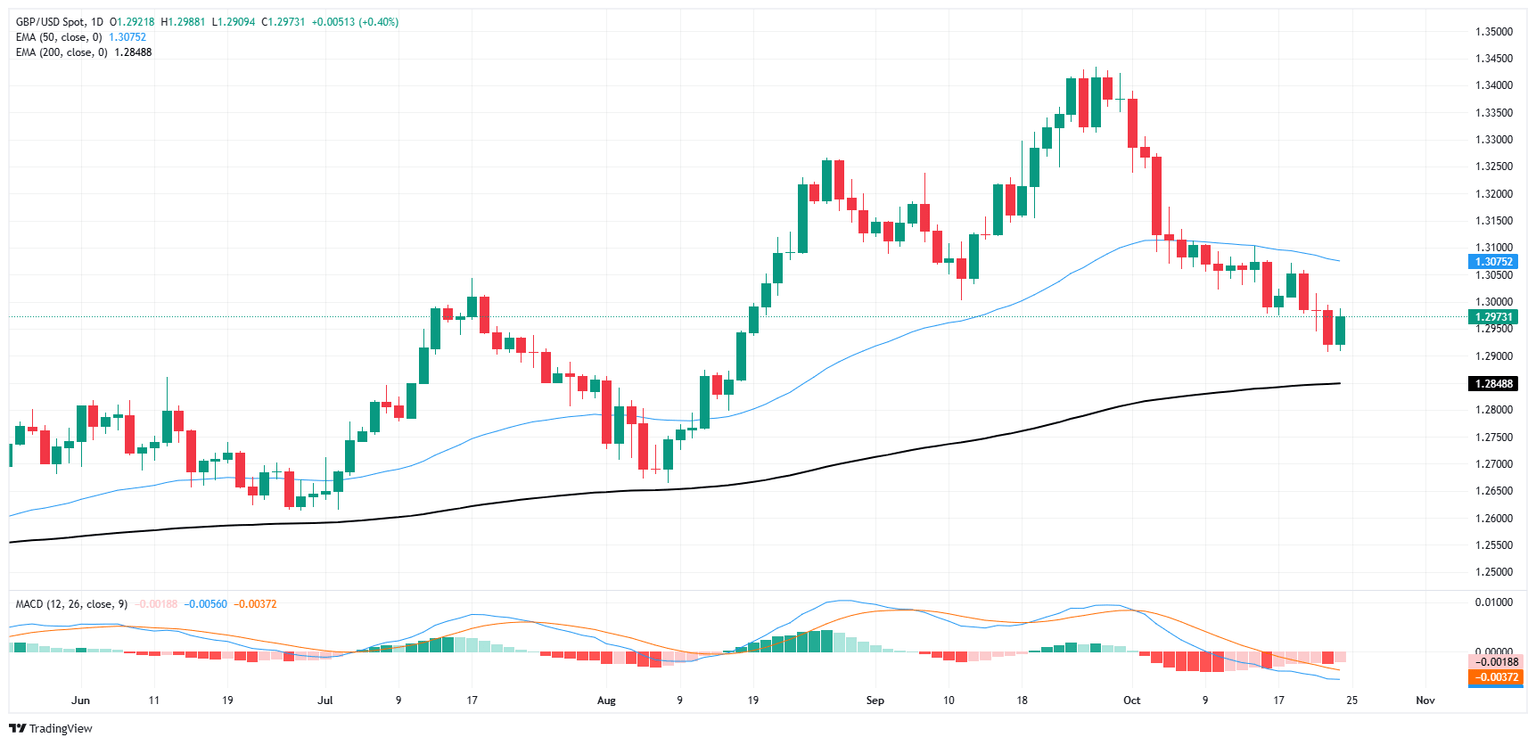

GBP/USD recovered some much-needed ground on Thursday, climbing 0.4% as Cable bidders grapple with keeping price action north of the 1.2900 handle. UK Purchasing Managers Index (PMI) figures broadly missed the mark early Thursday, but both the Services and Manufacturing PMI components held north of contraction territory below 50.0.

US PMI figures broadly beat expectations, containing US Dollar losses and keeping GBP/USD tied up just below 1.3000. US Manufacturing PMI activity figures rose to 47.8 in October, beating the expected 47.5 and climbing even further from August’s 47.3. Meanwhile, the Services PMI component bounced to 55.3, climbing from the previous month’s 55.2 and beating the expected decline to 55.0. Read more...

GBP/USD Price Forecast: Climbs on UK fiscal changes, stalls at 100-day SMA

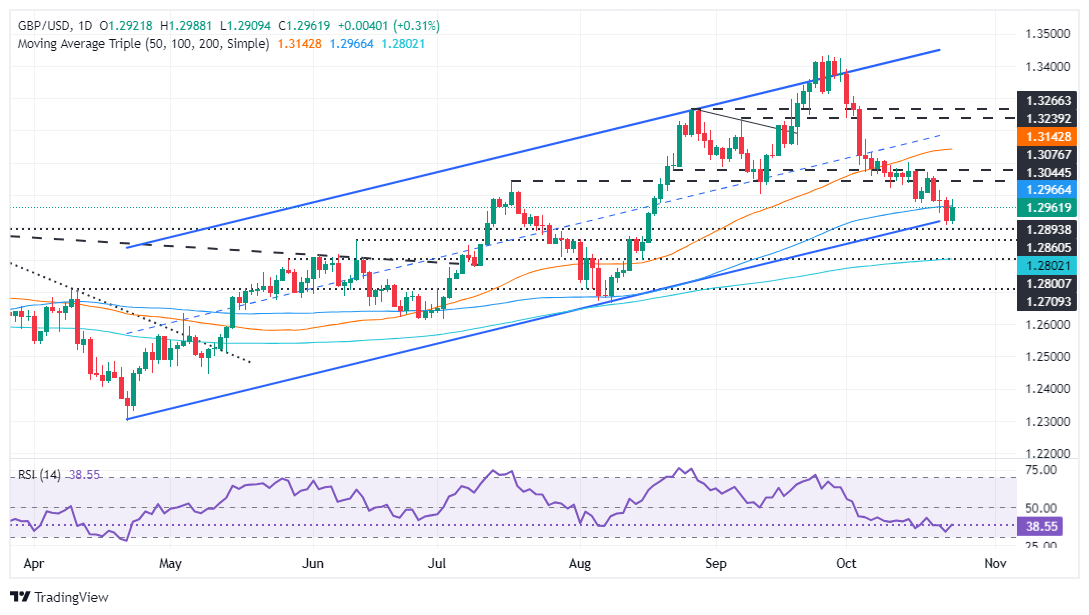

The Pound Sterling recovered some ground against the Greenback after UK GILTS yields jumped after Chancellor Reeves confirmed that a change to UK fiscal rules would help fund GBP 20 billion in investment. At the time of writing, the GBP/USD trade was 1.2974, up by 0.41%.

The GBP/USD bounced off the bottom trendline of an ascending channel after hitting a two-month low of 1.2907. Since then, the pair recovered some ground and hit a high of 1.2987, before struggling to sustain the advance above the 100-day Simple Moving Average (SMA) at 1.2964. Read more...

Author

FXStreet Team

FXStreet