GBP/USD Price Forecast: Climbs on UK fiscal changes, stalls at 100-day SMA

- GBP/USD bounces off two-month low of 1.2907, testing resistance near the 100-day SMA at 1.2964.

- Sellers maintain control as momentum points downward, with key support at 1.2900 and the 200-day SMA at 1.2800.

- A move above 1.3000 could open the door for a test of 1.3102, with further resistance at the 50-day SMA at 1.3140.

The Pound Sterling recovered some ground against the Greenback after UK GILTS yields jumped after Chancellor Reeves confirmed that a change to UK fiscal rules would help fund GBP 20 billion in investment. At the time of writing, the GBP/USD trade was 1.2974, up by 0.41%.

GBP/USD Price Forecast: Technical outlook

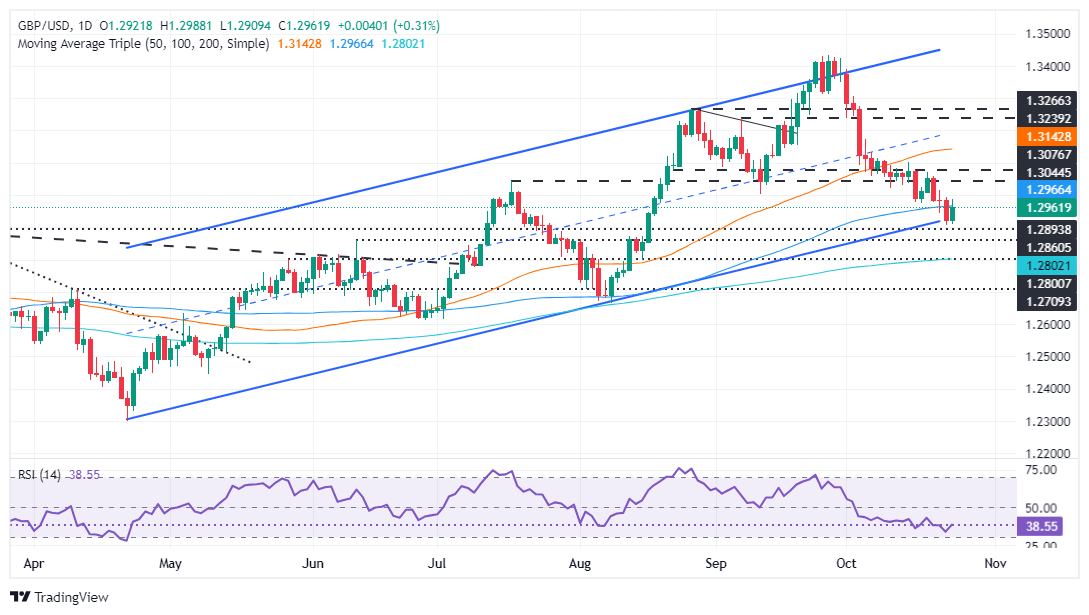

The GBP/USD bounced off the bottom trendline of an ascending channel after hitting a two-month low of 1.2907. Since then, the pair recovered some ground and hit a high of 1.2987, before struggling to sustain the advance above the 100-day Simple Moving Average (SMA) at 1.2964.

Momentum shows sellers are in charge, even though the Relative Strength Index (RSI) aimed slightly up but so far failed to clear the latest peak. Therefore, the path of least resistance is tilted to the downside.

The first support for GBP/USD would be 1.2900. Once surpassed, sellers could push prices toward the 200-day SMA at 1.2800.

On the other hand, a bullish continuation could happen if GBP/USD climbs above 1.3000 and clears the October 15 high at 1.3102. Further upside lies at the 50-day SMA at 1.3140.

GBP/USD Price Chart – Daily

British Pound PRICE Today

The table below shows the percentage change of British Pound (GBP) against listed major currencies today. British Pound was the strongest against the Canadian Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.16% | -0.31% | -0.59% | 0.09% | 0.06% | -0.03% | -0.02% | |

| EUR | 0.16% | -0.16% | -0.43% | 0.25% | 0.21% | 0.12% | 0.12% | |

| GBP | 0.31% | 0.16% | -0.28% | 0.40% | 0.36% | 0.27% | 0.28% | |

| JPY | 0.59% | 0.43% | 0.28% | 0.68% | 0.65% | 0.53% | 0.57% | |

| CAD | -0.09% | -0.25% | -0.40% | -0.68% | -0.03% | -0.13% | -0.12% | |

| AUD | -0.06% | -0.21% | -0.36% | -0.65% | 0.03% | -0.08% | -0.08% | |

| NZD | 0.03% | -0.12% | -0.27% | -0.53% | 0.13% | 0.08% | 0.01% | |

| CHF | 0.02% | -0.12% | -0.28% | -0.57% | 0.12% | 0.08% | -0.01% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

Author

Christian Borjon Valencia

FXStreet

Christian Borjon began his career as a retail trader in 2010, mainly focused on technical analysis and strategies around it. He started as a swing trader, as he used to work in another industry unrelated to the financial markets.