Pound Sterling Price News and Forecast: GBP/USD reclaims 1.3200 and beyond on poor US Payrolls

GBP/USD reclaims 1.3200 and beyond on poor US Payrolls

The Sterling now gathers some fresh traction and lifts GBP/USD back to the positive territory beyond 1.3200 the figure following the abrup loss of momentum in the Greenback in the wake of the publication of the US jobs report. Read More...

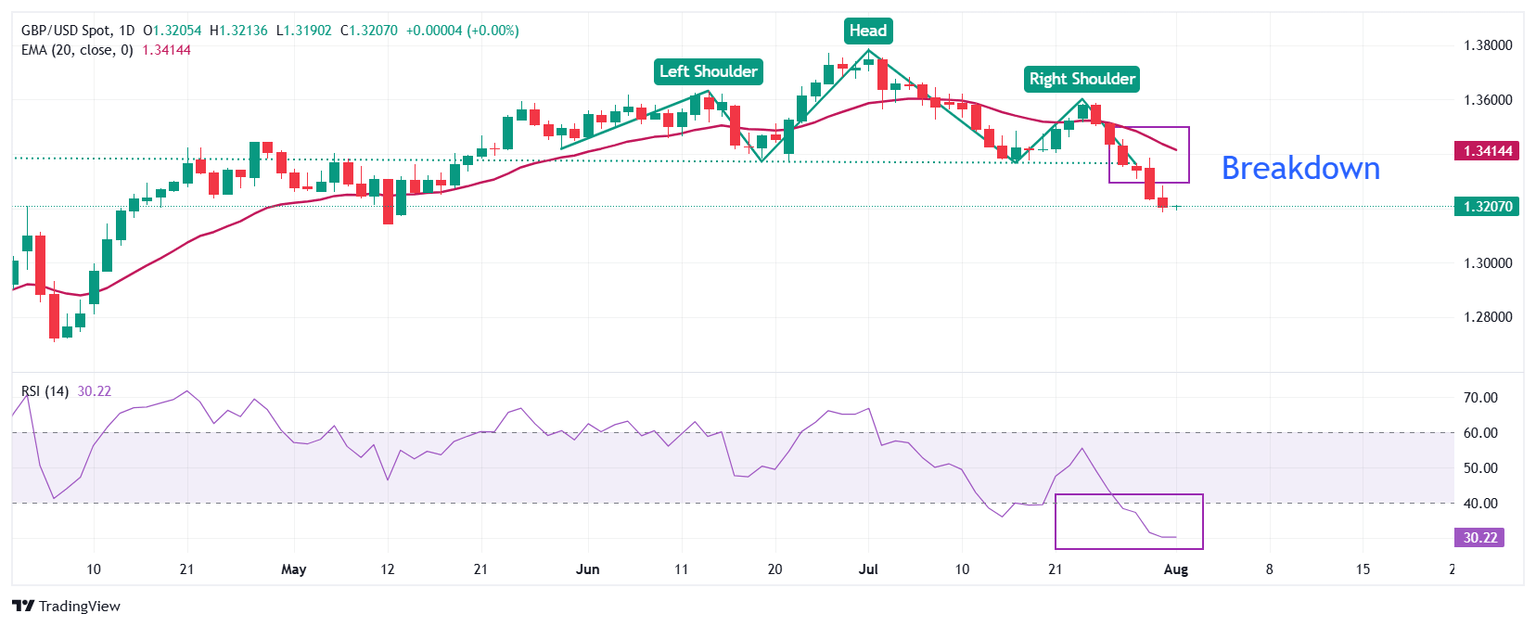

Pound Sterling slumps further against US Dollar, US NFP under spotlight

The Pound Sterling (GBP) refreshes almost 11-week low at around 1.3160 against the US Dollar (USD) during the European trading session on Friday. The GBP/USD faces selling pressure as the US Dollar extends its upside, with traders paring bets supporting interest rate cuts by the Federal Reserve (Fed) in the September policy meeting. Read More...

GBP/USD holds below 1.3200 ahead of US NFP data

The GBP/USD pair extends the decline to near 1.3195 during the Asian trading hours on Friday. The Pound Sterling (GBP) edges lower against the Greenback due to rising expectations of the Bank of England (BoE) rate cut next week. Investors brace for the US July employment data, including Nonfarm Payrolls (NFP) and the Unemployment Rate, which will be published later on Friday. Read More...

Author

FXStreet Team

FXStreet