Pound Sterling Price News and Forecast: GBP/USD recedes and consolidates around 1.2230

GBP/USD recedes and consolidates around1.2230 on mixed UK data, strong US Dollar

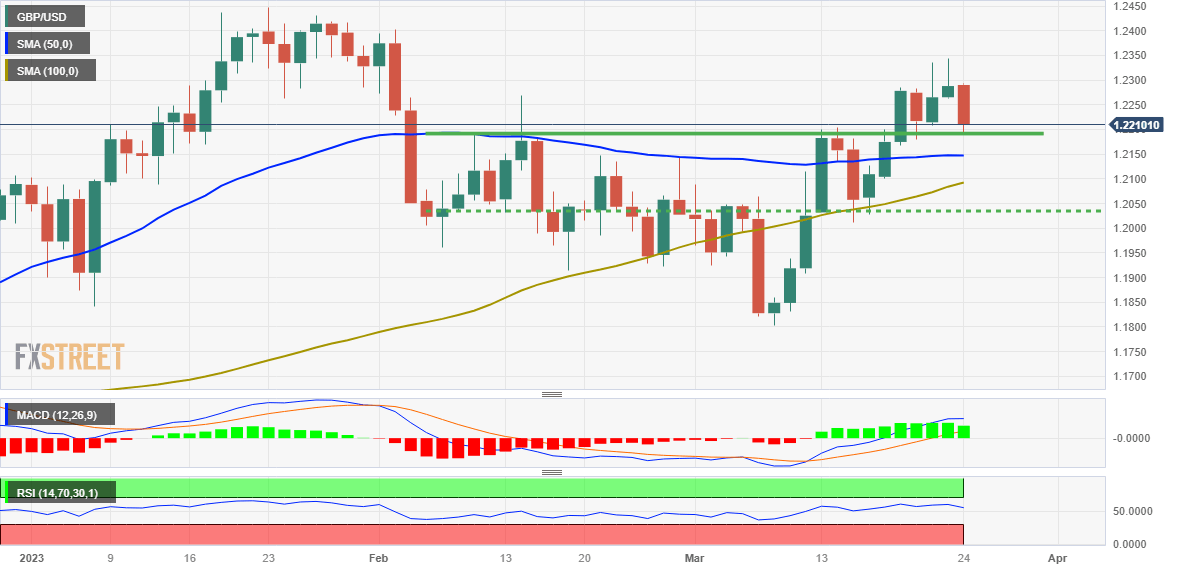

GBP/USD Price Analysis: Shows some resilience below 1.2200, 50 DMA holds the key for bulls

The GBP/USD pair comes under intense selling pressure on Friday and extends the overnight retracement slide from the vicinity of mid-1.2300s, or its highest level since February. Spot prices, however, manage to rebound a few pips from the daily low and trade above the 1.2200 mark during the early North American session, still down nearly 0.60% for the day. Read More...

GBP/USD corrects further from multi-week high, drops closer to 1.2200 on weaker UK PMIs

Author

FXStreet Team

FXStreet