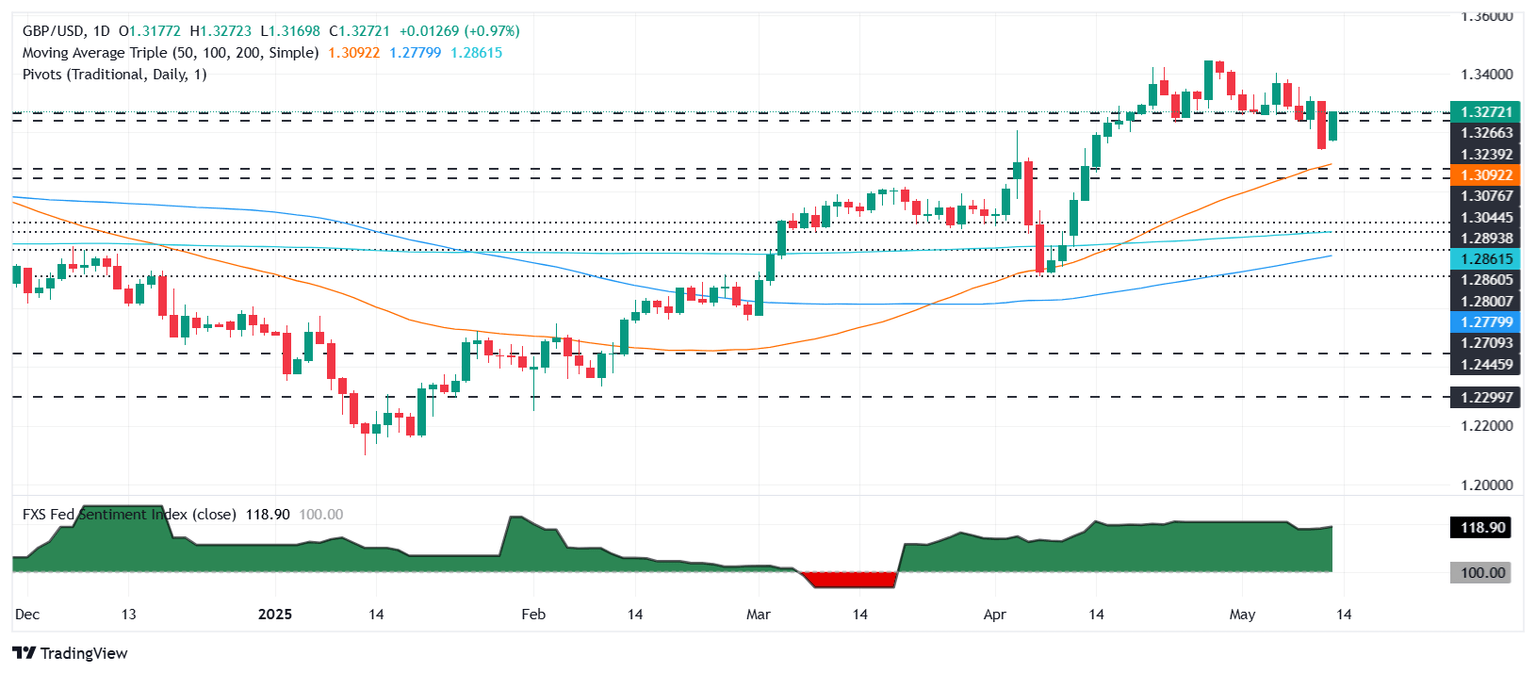

Pound Sterling Price News and Forecast: GBP/USD rebounds on soft CPI, boosting Fed cut bets

GBP/USD rebounds on soft CPI, boosting Fed cut bets

The Pound Sterling (GBP) recovered from Monday's losses and climbed over 0.35% against the US Dollar (USD) after the latest inflation report in the United States (US) kept traders' hopes high for further easing by the Federal Reserve (Fed). GBP/USD trades at 1.3226 after bouncing off a daily low of 1.3165. Read More...

Pound Sterling gains sharply against US Dollar on slower US inflation growth

The Pound Sterling (GBP) jumps to near 1.3250 against the US Dollar (USD) during North American trading hours on Tuesday. The GBP/USD pair strengthens as the US Dollar falls back after the United States (US) Consumer Price Index (CPI) report showed that inflationary pressures cooled down in April. The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, retraces to near 101.40 from its monthly high around 102.00 posted on Monday. Read More...

GBP/USD jumps to near 1.3200 ahead of UK employment, US CPI releases

The GBP/USD pair climbs to near 1.3195 during the early European session on Tuesday. The Pound Sterling (GBP) edges higher against the Greenback due to positive developments surrounding the US and the UK trade agreement last week. The UK employment and US inflation reports will be the highlights later on Tuesday. Read More...

Author

FXStreet Team

FXStreet