Pound Sterling Price News and Forecast: GBP/USD rebounds as Dollar softens, but UK risks limit upside

GBP/USD rebounds as Dollar softens, but UK risks limit upside

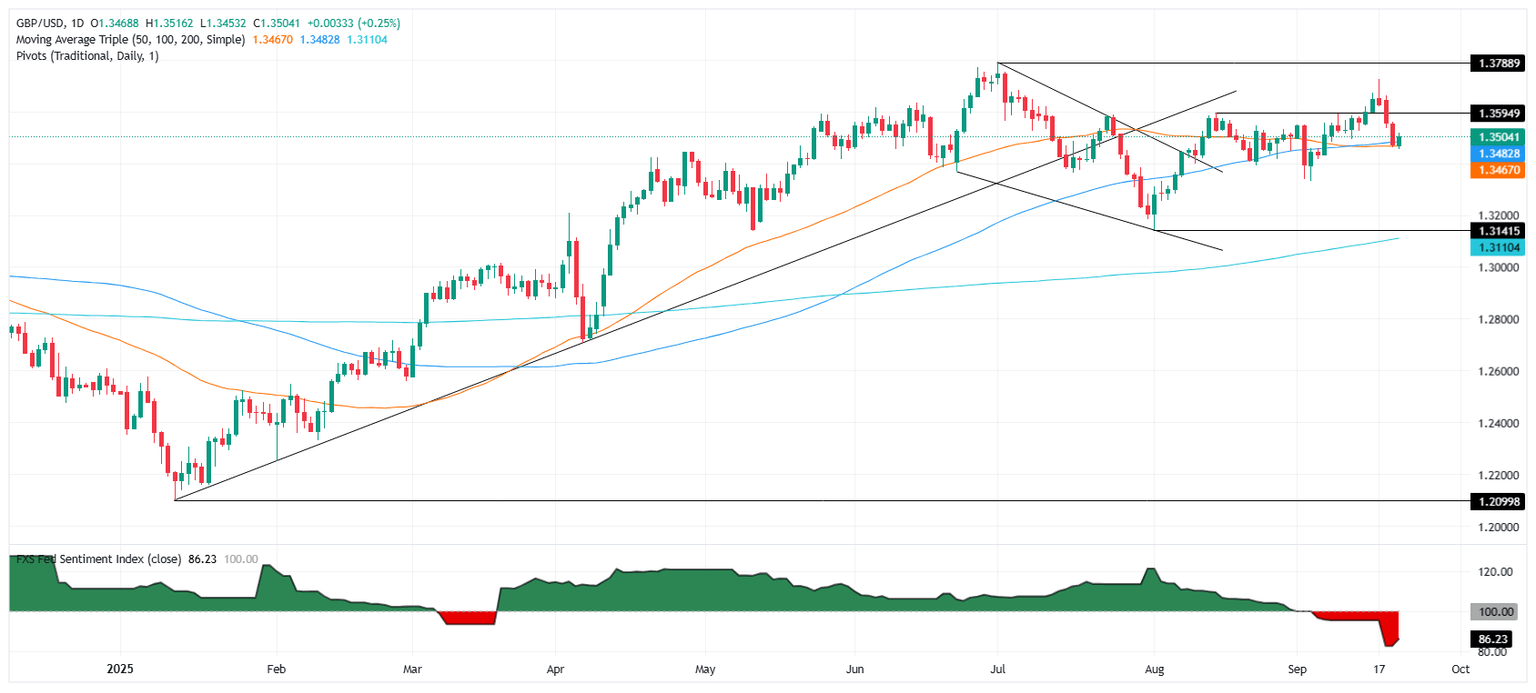

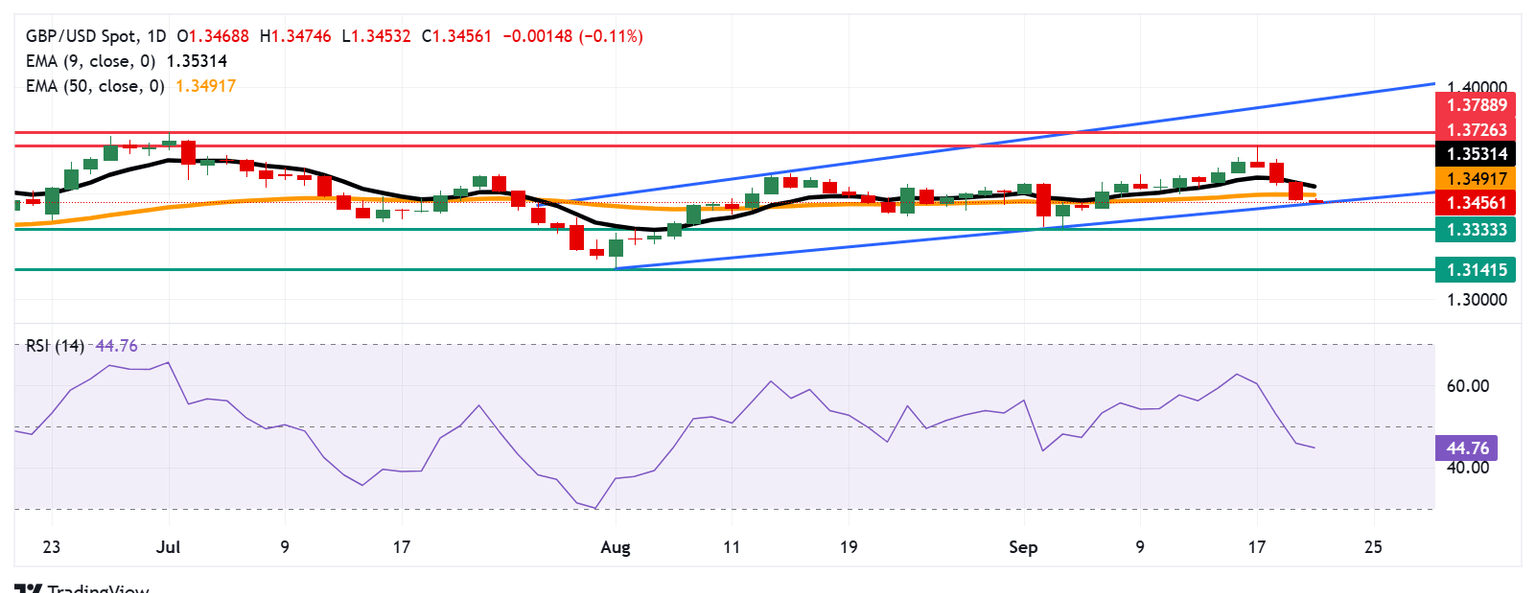

The Pound Sterling (GBP) bounces off a two-week low of 1.3453 on Monday, yet bulls are not out of the woods, after the pair hit a two-month peak of 1.3726 last week before plunging following the Federal Reserve’s decision to reduce interest rates. GBP/USD trades at 1.3496, up 0.27%. Read More...

Pound Sterling snaps three-day losing streak against US Dollar

The Pound Sterling (GBP) gains temporary ground near a two-week low around 1.3500 against the US Dollar (USD) on Monday. The GBP/USD pair rebounds after a three-day losing streak as the US Dollar falls back. Read More...

GBP/USD Price Forecast: Tests confluence zone around 1.3450 support

The GBP/USD pair continues its four-day losing streak, trading around 1.3460 during the Asian hours on Monday. The bearish shift appears as the daily chart’s technical analysis shows that the pair is on the verge of breaking below the ascending channel pattern. Read More...

Author

FXStreet Team

FXStreet