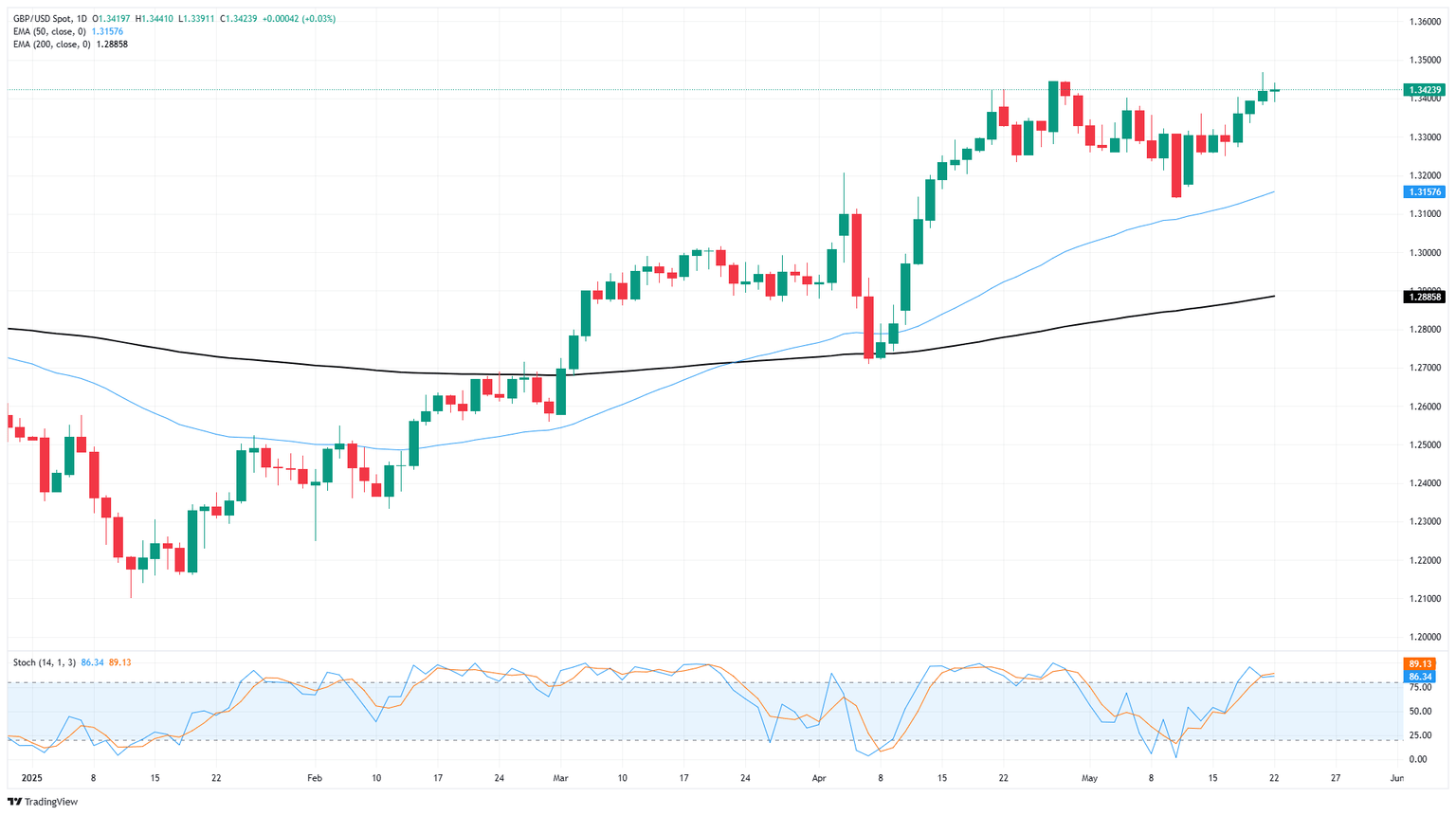

Pound Sterling Price News and Forecast: GBP/USD reached back to near 1.3468, the highest since February 2022

GBP/USD rebounds above 1.3450 toward 39-month highs, UK Retail Sales eyed

GBP/USD posts gains of about a quarter of a percent in the Asian hours on Friday, trading around 1.3450 at the time of writing. The pair edges higher as the Pound Sterling (GBP) attracts buyers after the GfK better-than-expected Consumer Confidence Index for the United Kingdom (UK) was released. Traders await UK Retail Sales, scheduled to be released later in the day, expecting a monthly decline for the third consecutive period in April.

On Friday, the UK Consumer Confidence Index rose by 3 points to -20 in May, better than the expected reading of -22 and reversing from April’s -23 reading. However, consumer sentiment remains cautious as the index remains well below its long-term average. Read more...

GBP/USD flattens ahead of UK Retail Sales

GBP/USD treaded water on Thursday, marking in a tight circle just north of the 1.3400 handle as global market sentiment suffers knock-on effects from a recent bout of worry that shot through Treasury yields this week. Investors are broadly focusing on the United States’ (US) mounting debt problems, which are poised to get a fresh injection (in the wrong direction) as President Donald Trump’s deficit-swelling “big, beautiful” tax and budget bill grinds its way through Congress.

United Kingdom (UK) Retail Sales lie ahead as the final key data release this week. UK Retail Sales in April are expected to show a third consecutive monthly decline, with median market forecasts prepped for a slide to 0.2% MoM from March’s 0.4%. Annualized Retail Sales are forecast to jump to 4.5% YoY from 2.6%, but Pound Sterling traders will be keeping a closer eye on the slowdown at the front end of the curve. Read more...

GBP/USD holds above 1.3400 as US PMI strength offsets fiscal worries

The British Pound (GBP) is navigating choppy price action against the US Dollar (USD) on Thursday, holding above the 1.3400 psychological mark to trade near 1.3410 during the American session, as traders digest the latest business activity data from both sides of the Atlantic. The pair shows signs of indecision after retreating from a three-year high of 1.3468 reached on Wednesday.

On the other hand, the US Dollar Index (DXY), which tracks the value of the US Dollar against the six major currencies, is showing a mild recovery from the two-week low, ending its three-day decline to trade just below the 100.00 mark. Read more...

Author

FXStreet Team

FXStreet