Pound Sterling Price News and Forecast: GBP/USD rallies as Moody’s cut US credit rating

GBP/USD rallies as Moody’s cut US credit rating, UK-EU "reset" relations

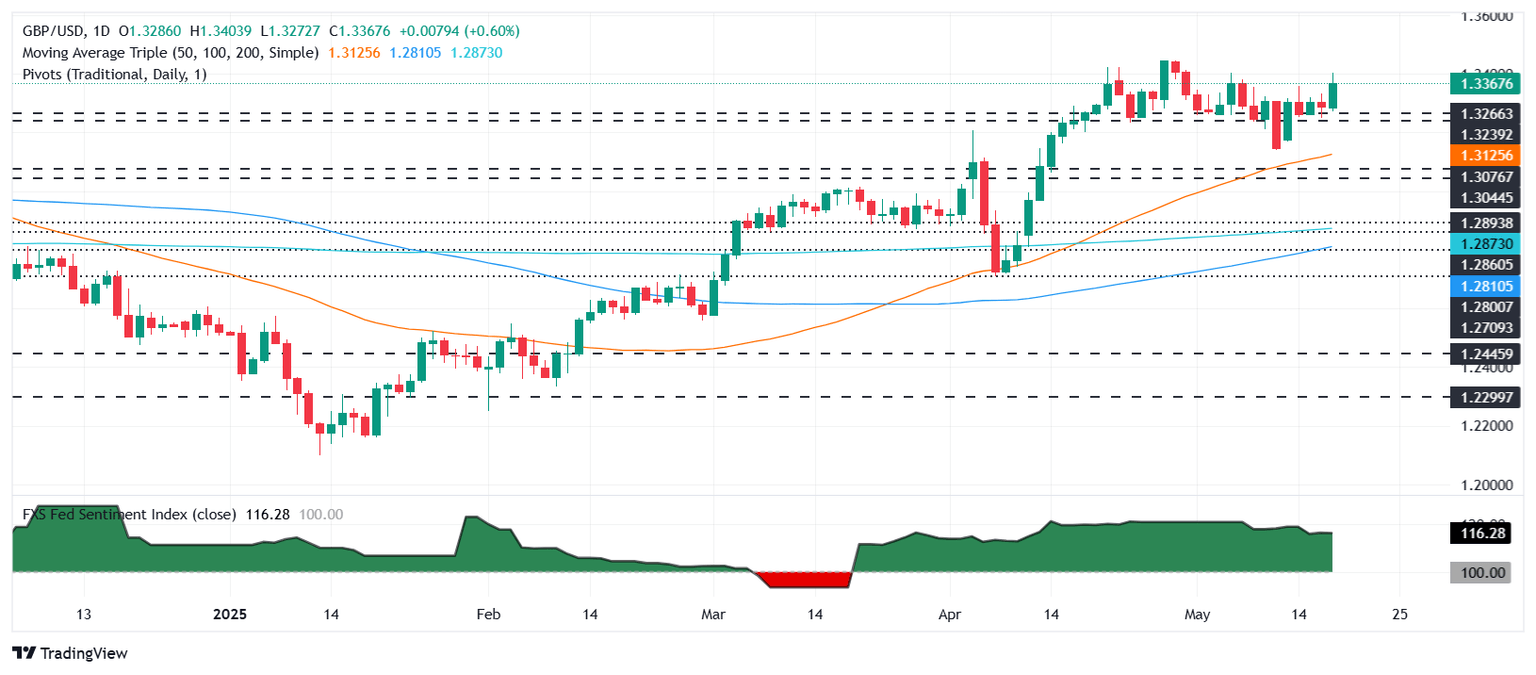

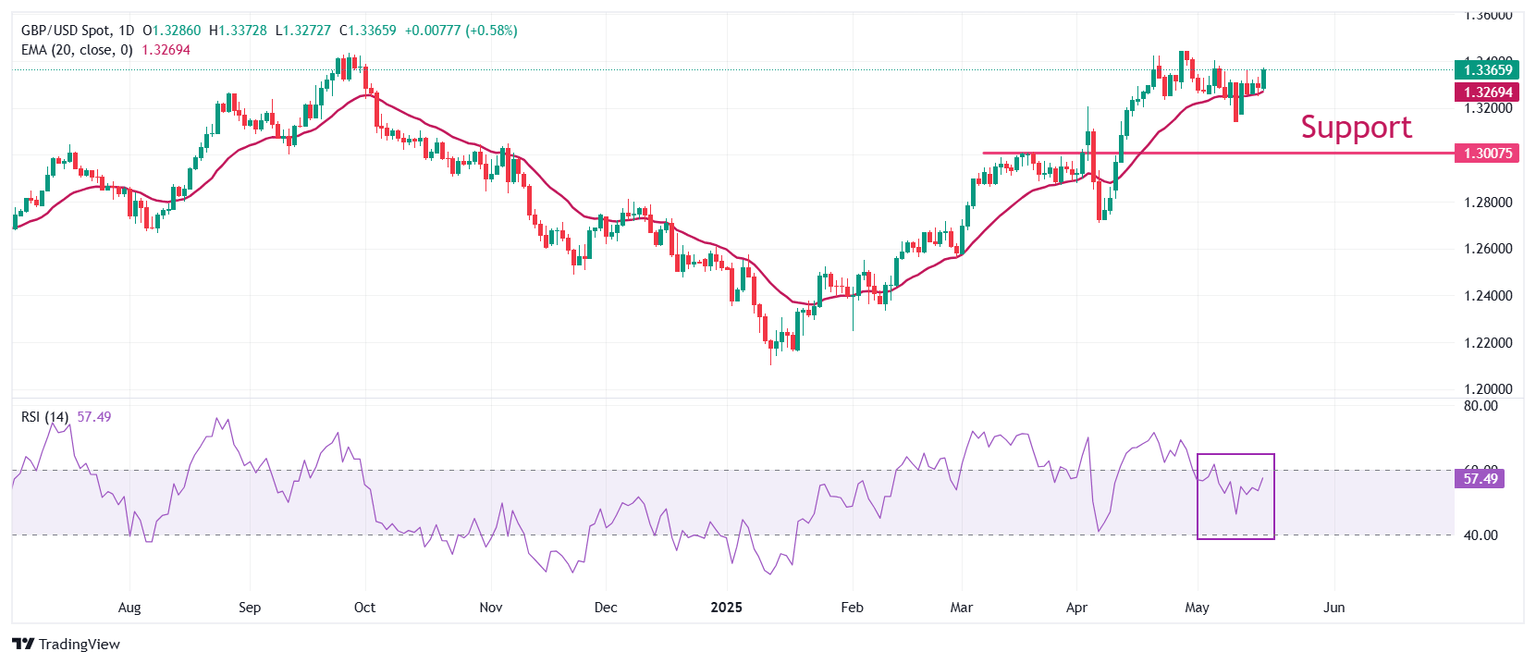

The Pound Sterling (GBP) posted solid gains on Monday as the US Dollar (USD) got battered due to Moody’s lowering US debt rating to Aa1, a headwind for the Greenback. At the time of writing, GBP/USD trades at 1.3360, up 0.71%. Read More...

Pound Sterling strengthens ahead of UK CPI data

The Pound Sterling (GBP) trades higher against its major peers at the start of the week. The British currency moves higher ahead of the European Union (EU)-United Kingdom (UK) trade summit in London on Monday. Investors will pay close attention to a potential trade deal as it will strengthen economic ties between the economies since the announcement of Brexit. Read More...

GBP/USD holds gains around 1.3300 as US Dollar weakens following Moody’s downgrade

The GBP/USD pair recovered from prior session losses, trading near the 1.3300 level during Asian session on Monday. The rebound is largely driven by renewed pressure on the US Dollar (USD) after Moody’s Investors Service downgraded the US credit rating by one notch, from Aaa to Aa1. The agency cited escalating debt levels and a growing burden from interest payments as primary concerns. Read More...

Author

FXStreet Team

FXStreet