GBP/USD rallies as Moody’s cut US credit rating, UK-EU "reset" relations

- GBP/USD lifted by renewed optimism after the UK and EU agree to a landmark post-Brexit cooperation deal.

- Moody’s downgrades US credit rating to Aa1, citing years of fiscal inaction by US policymakers.

- Fed officials voice caution on tariffs; Bostic, Williams, Jefferson highlight uncertainty ahead of key US data.

The Pound Sterling (GBP) posted solid gains on Monday as the US Dollar (USD) got battered due to Moody’s lowering US debt rating to Aa1, a headwind for the Greenback. At the time of writing, GBP/USD trades at 1.3360, up 0.71%.

Sterling gains as US Dollar slumps on fiscal concerns; UK-EU “reset” adds to GBP bullish momentum

On Friday, the international ratings agency Moody’s attributed more than a decade of inaction by successive US administrations and Congress to address the country’s deteriorating fiscal position. The news weighed on the American currency, which, according to the US Dollar Index (DXY), which tracks the performance of a basket of six currencies against the buck, lost 0.65% at 100.31, reaching a seven-day low.

The British Pound remains underpinned by the so-called “reset” of relations between the United Kingdom (UK) and the European Union (EU). CNN reported that both parties “agreed to a landmark deal aimed at 'resetting' their post-Brexit relationship, easing restrictions on travel and work for hundreds of millions of people on the continent.”

Federal Reserve speakers remain uncertain about tariffs' impact

Aside from this, Federal Reserve (Fed) officials are crossing the wires. Atlanta's Fed Raphael Bostic commented that he’s leaning towards cutting once in 2025 due to uncertainty about tariffs and their impact on the economy.

Recently, the New York Fed John Williams added that monetary policy is in a good place and that the Fed can take its time on monetary policy decisions. The Fed’s Vice Chair Philip Jefferson stated that the impact of tariffs on the Fed’s mandate is “top of mind,” as the US central bank risks straying from its mandate, depending on the administration's policy choices.

Ahead this week, traders eye the release of UK inflation figures for April and Retail Sales. Across the pond, Fed speeches, Flash PMIs, housing data, and initial jobless claims will dictate price action.

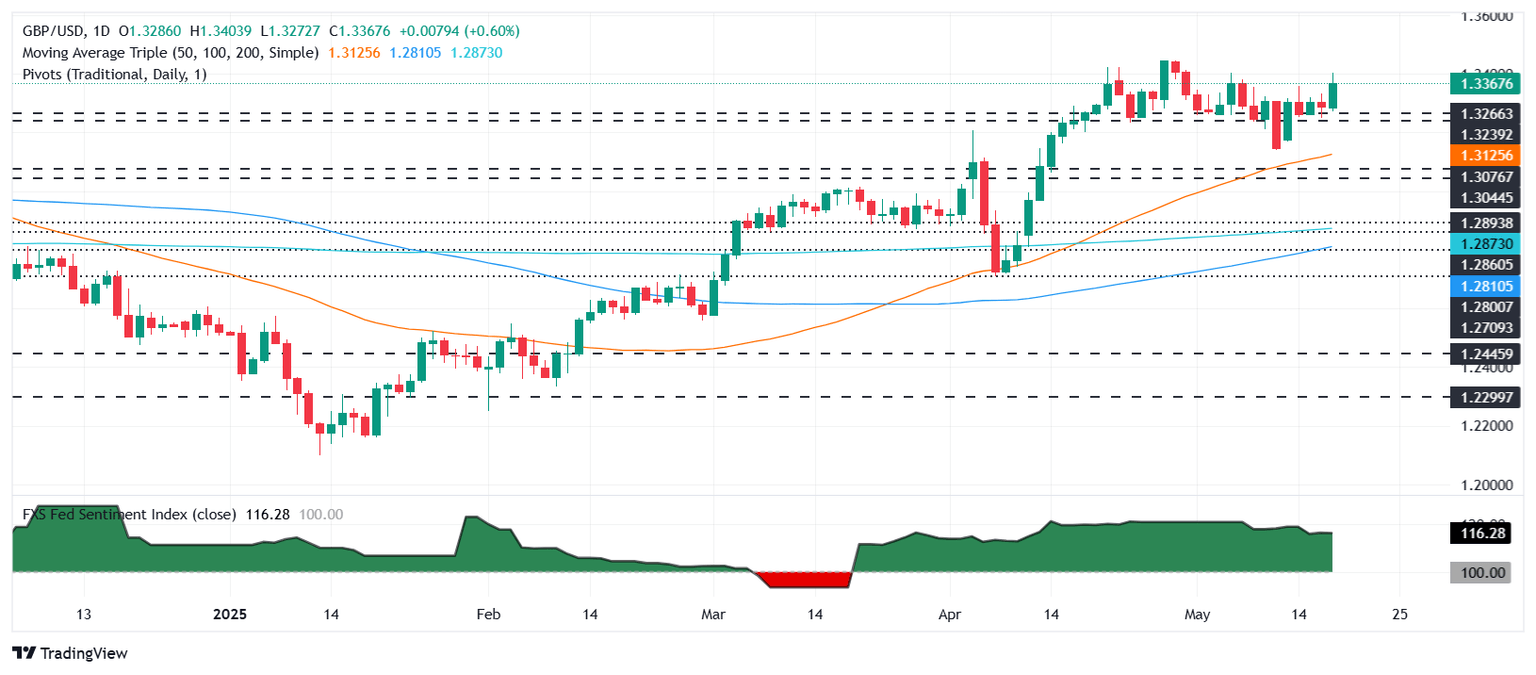

GBP/USD Price Forecast: Technical outlook

The GBP/USD is set to extend its gains if the pair remains above 1.3350. Momentum supports buyers as the Relative Strength Index (RSI) remains bullish, signaling that they’re getting traction.

Hence, further upside is seen at 1.3400, although traders would face stiff resistance at the year-to-date (YTD) high of 1.3443. A breach of the latter will expose 1.3500.

Conversely, if GBP/USD tumbles below 1.3350, the first support would be 1.3300. Once surpassed, the next stop is 1.3250, 1.3200 and the 50-day Simple Moving Average (SMA) at 1.3122.

British Pound PRICE Today

The table below shows the percentage change of British Pound (GBP) against listed major currencies today. British Pound was the strongest against the US Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.88% | -0.61% | -0.32% | -0.39% | -0.89% | -0.80% | -0.55% | |

| EUR | 0.88% | 0.02% | 0.39% | 0.32% | -0.12% | -0.09% | 0.11% | |

| GBP | 0.61% | -0.02% | 0.08% | 0.31% | -0.13% | -0.11% | 0.09% | |

| JPY | 0.32% | -0.39% | -0.08% | -0.06% | -0.40% | -0.27% | -0.17% | |

| CAD | 0.39% | -0.32% | -0.31% | 0.06% | -0.49% | -0.41% | -0.22% | |

| AUD | 0.89% | 0.12% | 0.13% | 0.40% | 0.49% | 0.03% | 0.24% | |

| NZD | 0.80% | 0.09% | 0.11% | 0.27% | 0.41% | -0.03% | 0.20% | |

| CHF | 0.55% | -0.11% | -0.09% | 0.17% | 0.22% | -0.24% | -0.20% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.