Pound Sterling strengthens ahead of UK CPI data

- The Pound Sterling gains against its major peers on Monday ahead of a potential trade deal between the UK and the EU later in the day.

- Moody’s downgrade of the US Sovereign credit rating has battered the US Dollar.

- According to analysts, the Fed is unlikely to cut interest rates this year.

The Pound Sterling (GBP) trades higher against its major peers at the start of the week. The British currency moves higher ahead of the European Union (EU)-United Kingdom (UK) trade summit in London on Monday. Investors will pay close attention to a potential trade deal as it will strengthen economic ties between the economies since the announcement of Brexit.

According to comments from the Head of Trade Policy at the British Chamber of Commerce, William Bain, in a Jefferies-hosted session over the weekend, the potential deal between the UK and the EU would benefit various British industries such as defence, agriculture, and energy. Bain stated that the non-binding defence pact will unlock business worth 150 billion Euros for UK arms suppliers. The deal between European economies also aims to remove non-tariff barriers across agricultural industries.

For the last week, the British currency has performed strongly on the back of an upbeat UK Gross Domestic Product (GDP) report. The data showed on Thursday that the economy expanded at a robust pace of 0.7% in the first quarter of the year.

This week, investors will pay attention to the UK Consumer Price Index (CPI) data for April to get fresh cues about the Bank of England’s (BoE) monetary policy outlook, which will be released on Wednesday. The data is expected to show that the core CPI – which excludes volatile components of food, energy, alcohol, and tobacco – is expected to have grown at a faster pace of 3.6%, compared to the prior release of 3.4%.

Daily digest market movers: Pound Sterling outperforms US Dollar on US Sovereign credit downgrade

- The Pound Sterling jumps to near 1.3400 against the US Dollar (USD) in Monday’s North American session. The GBP/USD pair strengthens as the US Dollar faces selling pressure after Moody’s Rating downgraded the United States (US) Sovereign Credit Rating from Aaa to Aa1 on Friday in the wake of sustained fiscal deterioration. However, the agency clarified that a one-notch downgrade doesn’t indicate that its confidence in the US administrative and Federal Reserve’s (Fed) framework has diminished.

- The US Dollar Index (DXY), which gauges the Greenback’s value against six major currencies, declines to near 100.40.

- The outlook of the Greenback has improved due to a positive response from US President Donald Trump in an interview with Fox News on Friday about visiting China for direct trade talks with Chinese President Xi Jinping. Trump’s affirmation to visit China fuels hopes for a potential trade deal between Washington and Beijing, a scenario that will further diminish the risks of global economic turmoil.

- Another reason behind improving the US Dollar’s outlook is the growing expectation that the Fed will not lower interest rates anytime soon, despite the White House lowering tariffs from what they announced at the start of April.

- A report from leading investment banking firm Morgan Stanley showed that the Fed is unlikely to reduce interest rates before March 2026. “De-escalation greatly reduces the risk of a hard stop in trade flows and, in turn, the risk of a near-term recession in the economy,” economists at Morgan Stanley said, but warned of “slower growth and sticky inflation as levies are still high”.

- According to the CME FedWatch tool, the Fed is expected to cut interest rates twice this year, starting from the September meeting.

- Meanwhile, one-year consumer inflation expectations have accelerated further due to the fallout of tariffs by US President Trump. The University of Michigan (UoM) showed on Friday that flash one-year Consumer Inflation Expectations have increased to 7.3% from the prior release of 6.5% - a key trigger that would refrain the Fed from lowering interest rates from their current levels.

Technical Analysis: Pound Sterling aims to break above 1.3400

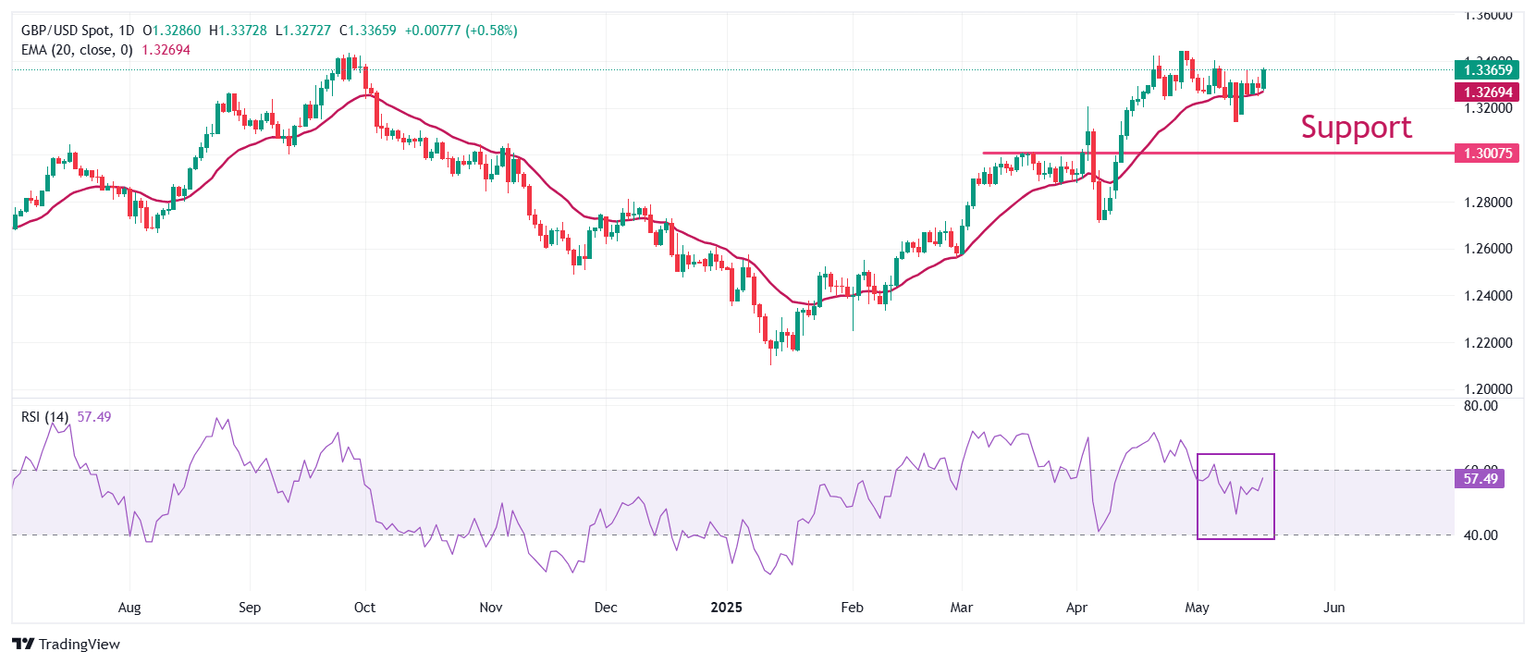

The Pound Sterling climbs to near 1.3390 against the US Dollar on Monday. The GBP/USD pair holds above the 20-day Exponential Moving Average (EMA), which trades around 1.3270, suggesting that the near-term trend is bullish.

The 14-day Relative Strength Index (RSI) points upwards inside the 40.00-60.00 range. A fresh bullish momentum would appear if the RSI breaks above 60.00.

On the upside, the three-year high of 1.3445 will be a key hurdle for the pair. Looking down, the psychological level of 1.3000 will act as a major support area.

US Dollar FAQs

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022. Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.