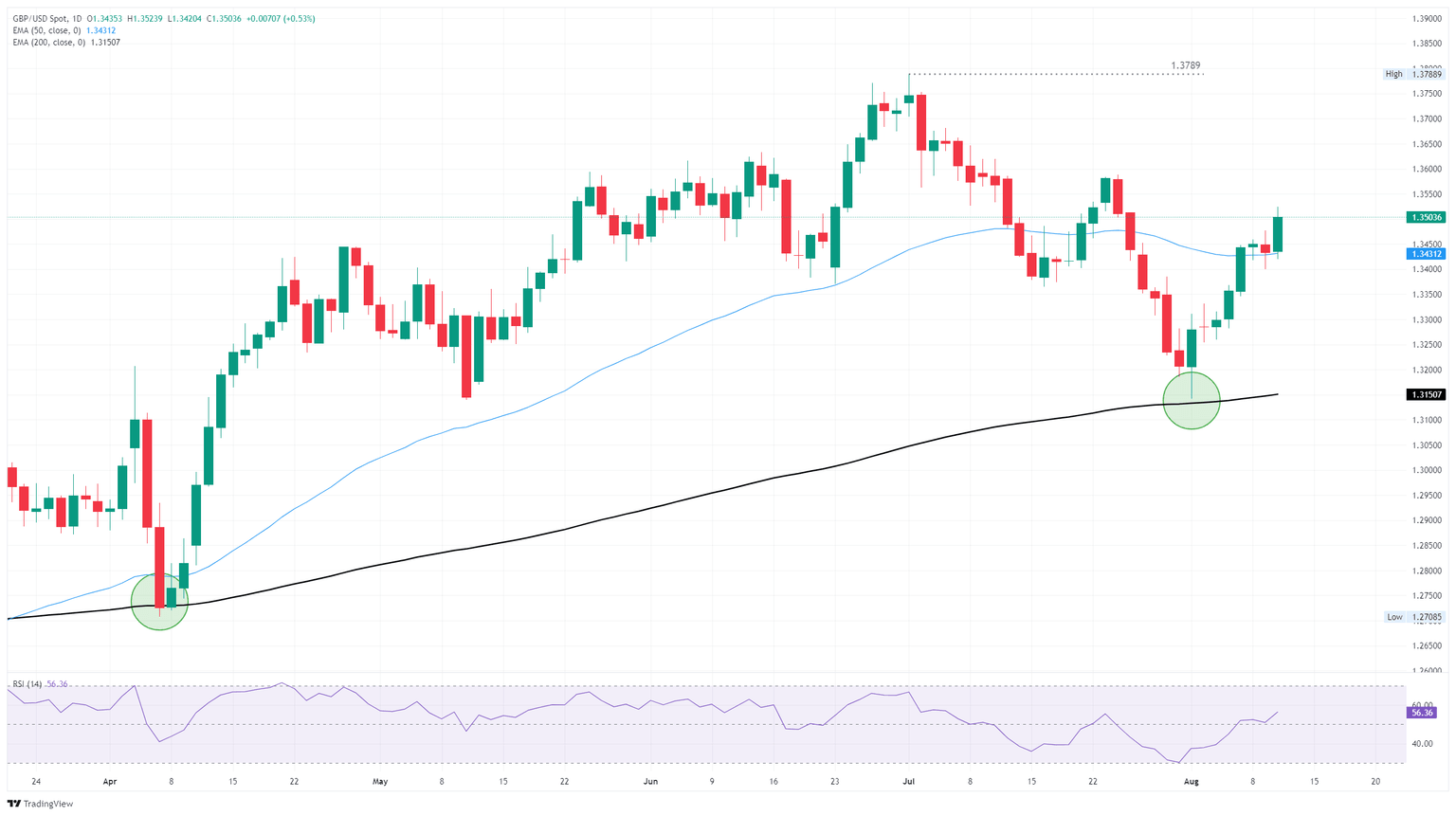

Pound Sterling Price News and Forecast: GBP/USD raises as US inflation data spark Fed dovish expectations

GBP/USD steadies around 1.3500 amid rising odds of Fed rate cuts

GBP/USD remains steady after registering 0.5% gains in the previous session, trading around 1.3500 during the Asian hours on Wednesday. The pair further appreciates as the US Dollar (USD) struggles, driven by the latest United States (US) inflation data, which strengthened expectations for a US Federal Reserve rate cut in September.

The US Consumer Price Index (CPI) climbed 2.7% year-over-year in July, matching the 2.7% increase seen in the prior month, and came in below the expected 2.8% increase. Meanwhile, the annual core CPI rose by 3.1% in July, compared to the 2.9% rise seen in June, above the market consensus of 3%. Read more...

GBP/USD springboards higher heading into a midweek lull

GBP/USD gained ground on Tuesday, climbing around one-half of one percent after economic releases from both the United Kingdom (UK) and the United States (US) tilted the scales in favor of the Pound Sterling (GBP) over the US Dollar (USD).

UK labor data broadly came in better than expected, with the number of new unemployment benefits seekers declining by 6.2K versus the expected 20.8K addition. Average Earnings also rose slower than expected, helping to trim the top off of inflation expectations. On the US side, Consumer Price Index (CPI) inflation data from July showed a complete lack of improvement, but still came in cool enough to keep market expectations of a September interest rate cut on the rails. Read more...

GBP/USD rises as US CPI data bolsters Fed rate cut expectations for September

The British Pound (GBP) strengthens further against the US Dollar (USD) on Tuesday, with GBP/USD edging higher after the release of mixed UK labor market data and the latest US inflation figures. While signs of cooling employment growth in the UK were offset by robust wage gains, a softer US Dollar following the CPI report helped keep the pair supported, as traders increased expectations that the Federal Reserve (Fed) will resume easing monetary policy as soon as September.

At the time of writing, GBP/USD is trading near the 1.3485 psychological mark, up nearly 0.37% on the day following the US inflation release, extending gains from the European session. Meanwhile, the US Dollar Index (DXY) is under pressure, hovering near its two-week low around 98.30. Read more...

Author

FXStreet Team

FXStreet