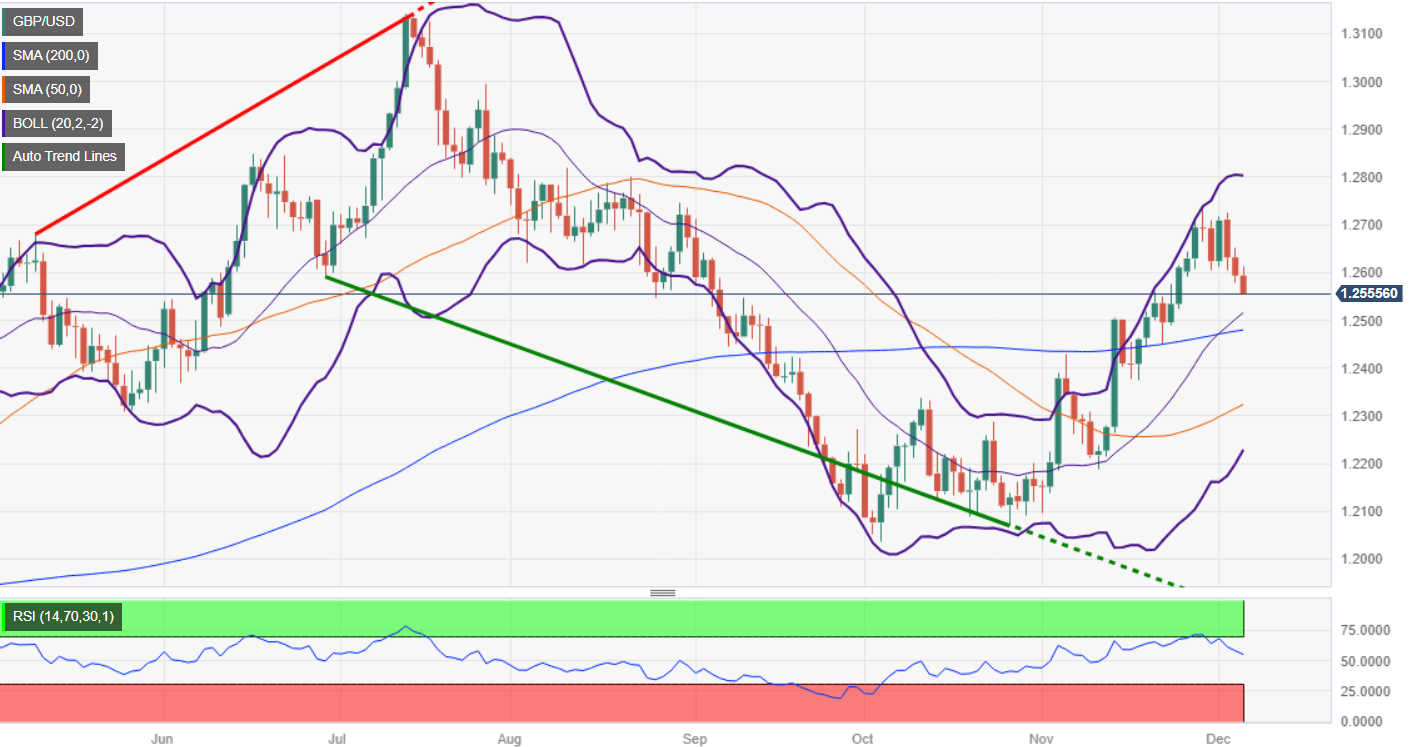

GBP/USD prolongs its agony and breaks below 1.2600 amid weak US ADP data

GBP/USD trips down and extended its losses to three consecutive days; after diving below the 1.2700 figure, the

Pound Sterling (GBP) had shed more than 1% of its value, during the week. At the time of writing, the major is trading at 1.2555, down 0.28% after hitting a daily high of 1.2613.

Read More...

GBP/USD is moving sideways around 1.2600 ahead of the US ADP report

Sterling’s recovery attempt from Tuesday’s low at 1.2575 has been capped at 1.2610 earlier on Wednesday, which has left the pair in noman;’s land awaiting the release of the US ADP employment report.

Read More...

GBP/USD snaps two-day losing streak, holds above 1.2600 ahead of US ADP data

The GBP/USD pair snaps the two-day losing streak and holds above the 1.2600 support level during the Asian trading hours on Wednesday. The modest decline of the US Dollar (USD) creates a tailwind for the pair. GBP/USD currently trades near 1.2607, gaining 0.11% on the day.

Read More...