GBP/USD post losses amidst risk aversion, China’s economic woes

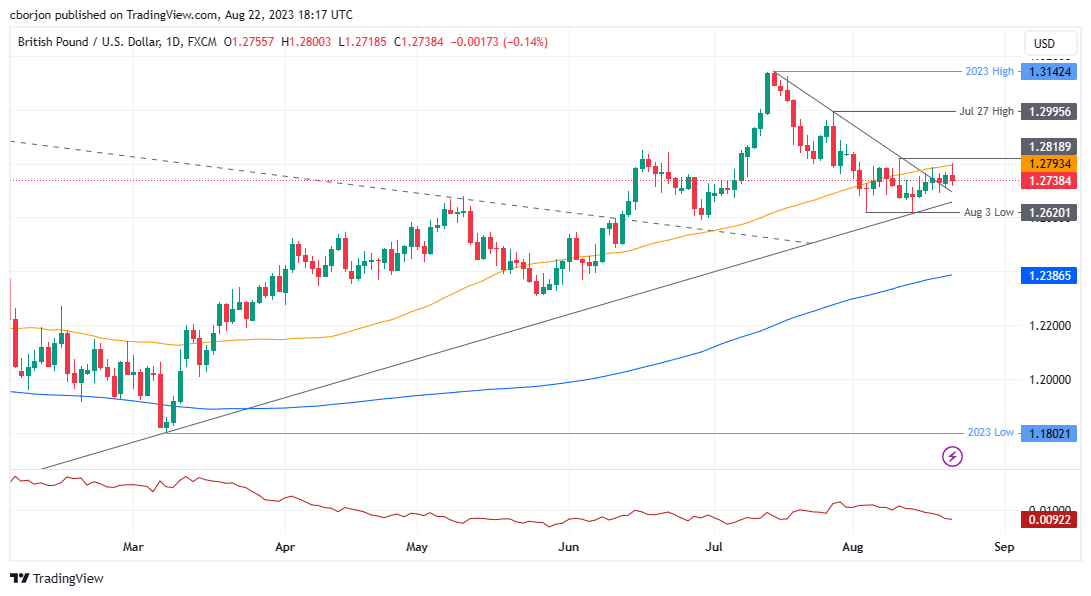

GBP/USD retreated after testing the 50-day Moving Average (DMA) but dropped mainly on high US Treasury bond yields and risk aversion spurred by the recent developments surrounding China. Fears that the country with the second largest economy in the world can sharply slow down could weigh on global trade. Hence, the GBP/USD is trading at 1.2741, registering losses of 0.12% at the time of writing.

Read More...

Pound Sterling goes south as market mood turns cautious

The Pound Sterling (GBP) fails to maintain auction near a fresh three-day high, as market sentiment turns bearish ahead of S&P Global preliminary

PMI data for August and expectations of more interest rate hikes from the Bank of England (BoE) to ensure price stability. Earlier, the

GBP/USD pair picks strength as investors hope that the current tightening cycle of the BoE will surpass the tightening peak by the Federal Reserve (Fed).

Read More...

GBP/USD: Room for further consolidation – UOB

GBP/USD is still seen navigating within the 1.2640-1.2830 range in the next weeks, according to Markets Strategist Quek Ser Leang and Senior FX Strategist Peter Chia at UOB Group.

Read More...