GBP/USD post losses amidst risk aversion, China’s economic woes

- GBP/USD faces a 0.12% loss, influenced by high US Treasury bond yields and global trade apprehensions.

- US Existing Home Sales dropped 2.2% in July; limited inventory and high mortgage rates cited as causes.

- Richmond Fed’s Manufacturing Index meets expectations with -7, while the Services Index surprises with a positive 4.

GBP/USD retreated after testing the 50-day Moving Average (DMA) but dropped mainly on high US Treasury bond yields and risk aversion spurred by the recent developments surrounding China. Fears that the country with the second largest economy in the world can sharply slow down could weigh on global trade. Hence, the GBP/USD is trading at 1.2741, registering losses of 0.12% at the time of writing.

US stocks decline, Greenback strengthens: global trade tensions rise with China’s economic uncertainties.

US stocks are experiencing a decline due to the prevailing fragile market sentiment. The National Association of Realtors (NAR) released data indicating a 2.2% decrease in Existing Home Sales for July. This, however, represents an improvement compared to the preceding month’s figure of -3.3%. NAR Chief Economist Lawrence Yun attributed this decline to factors such as limited “inventory availability” and elevated “mortgage rates,” according to the report.

Other data revealed by the Richmond Fed, the Manufacturing Index plummeted -7 as expected in August, though its Services Index exceeded estimates of a -4 contraction, came at 4.

US bond yields are mixed as the short-end of the curve continues to bull-steepen, while the 10s, 20s, and 30s drop between 0.18 and 0.47 percent. However, the Greenback (USD) continues to rise, with the US Dollar Index (DXY) measuring the buck’s value vs. six currencies, advancing 0.26%, at 103.588.

In recent statements by Richmond Fed President Thomas Barkin, he emphasized that the yield shift does not indicate “inappropriate” market tightening. Instead, he views it as a reaction to robust economic data. Barkin further stated that if inflation maintains its elevated levels and the economy continues showing signs of strength, it would bolster the argument for additional tightening measures.

On the US front, the economic docket would feature Fed speakers, S&P Global PMIs, Durable Good Orders, and New Home Sales.

In the meantime, the UK economic docket would feature the release of S&P Global/CIPS PMIs, which are expected to continue to weaken; in services and manufacturing. The Manufacturing PMI is expected to slide for six consecutive months, while the services PMI is expected to climb to 51.3.

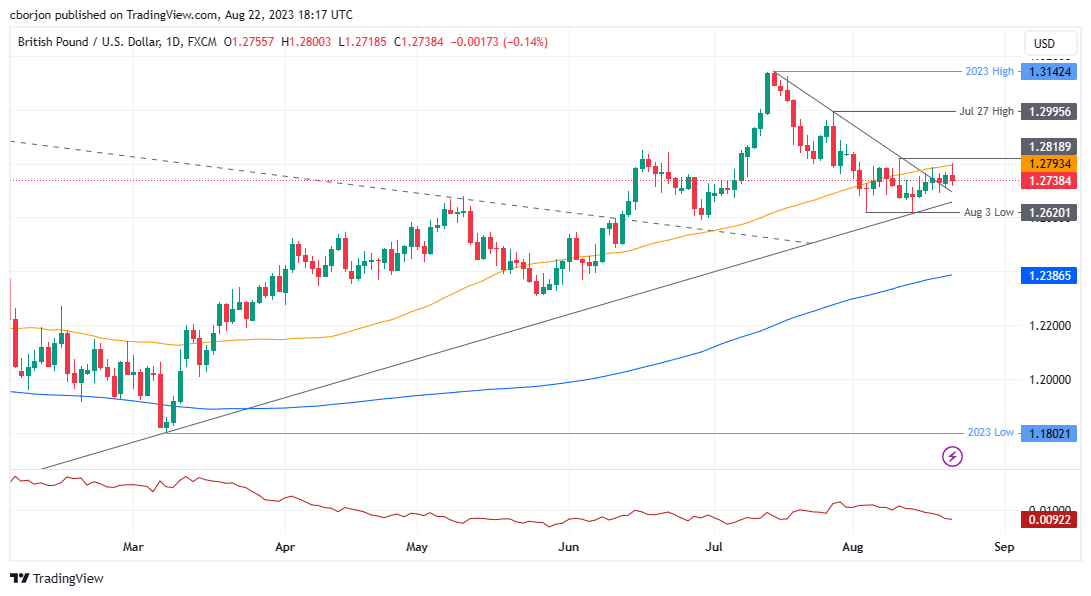

GBP/USD Price Analysis: Technical outlook

The GBP/USD remains neutrally biased but trading within the 50-day Moving Average (DMA) and the 1.2600 figure for the latest month-to-date (MTD). A bullish resumption would happen once buyers reclaim the 1.2800 mark, exacerbating a rally towards 1.3000, with 1.2900 seen as initial resistance. Conversely, if GBP/USD drops below 1.2600, that could expose the GBP/USD pair to selling pressure. Key support levels to test would be 1.2500, followed by the 200-DMA at 1.2387.

GBP/USD Price Action - Daily chart

Author

Christian Borjon Valencia

FXStreet

Christian Borjon began his career as a retail trader in 2010, mainly focused on technical analysis and strategies around it. He started as a swing trader, as he used to work in another industry unrelated to the financial markets.