Pound Sterling Price News and Forecast: GBP/USD plunges below 1.2950 on risk aversion

GBP/USD plunges below 1.2950 on risk aversion

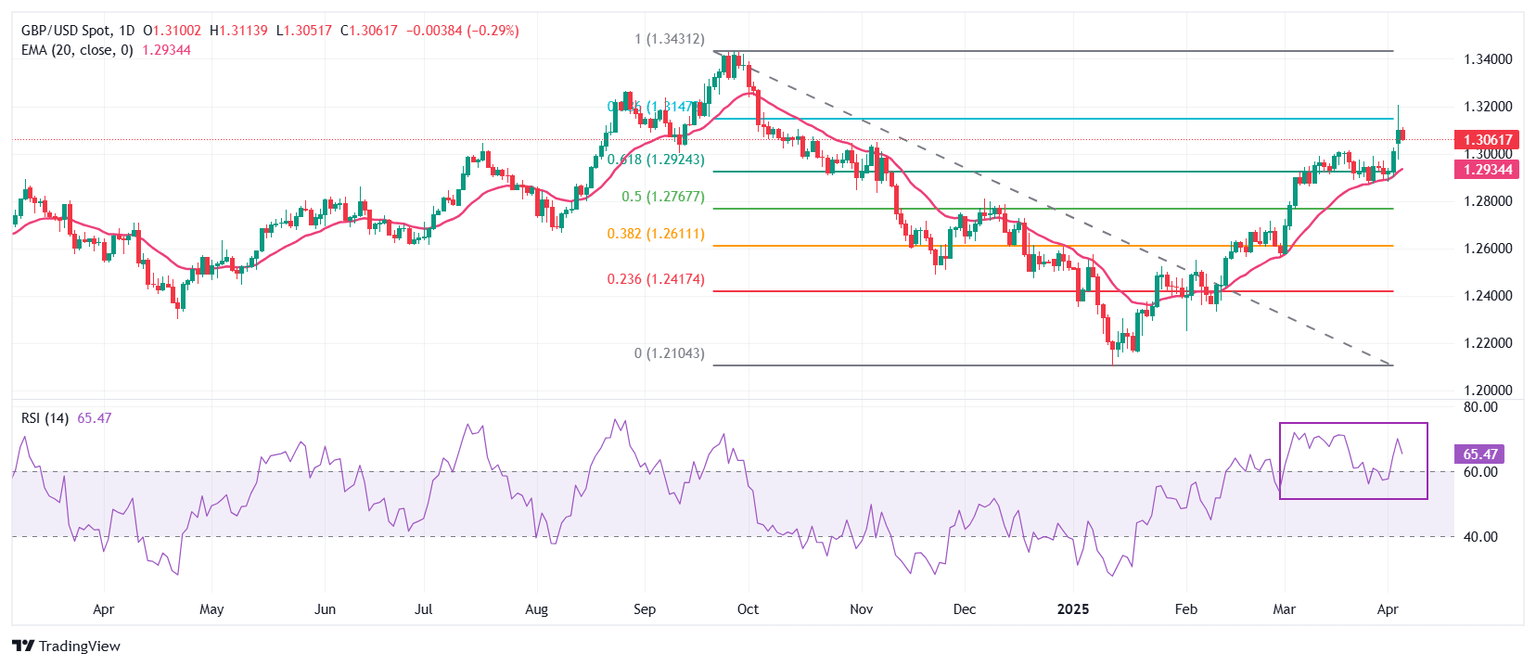

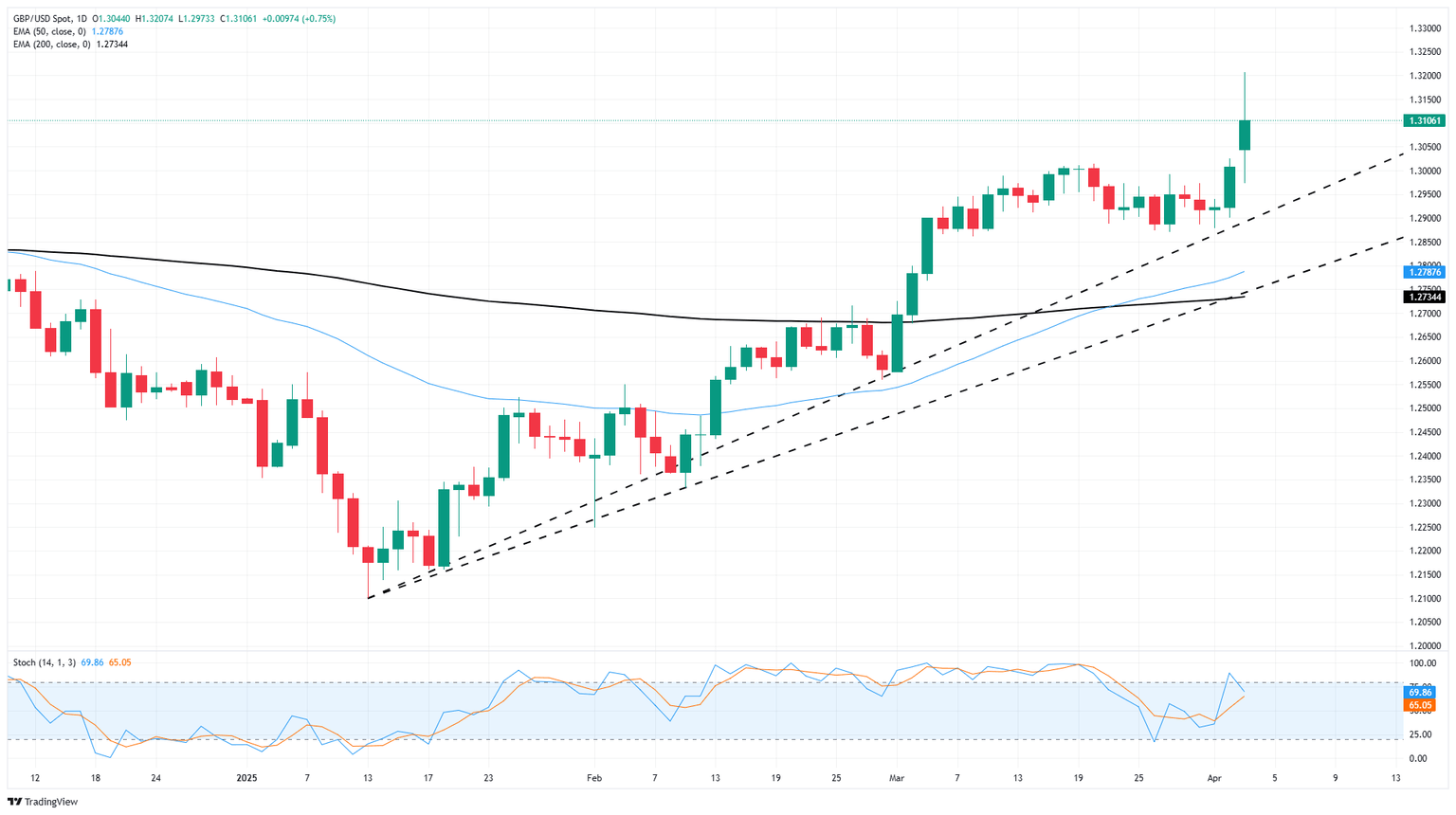

The Pound Sterling tumbles sharply against the US Dollar, falling more than 1% on Friday as risk appetite deteriorates after China imposed tariffs on US goods, which triggered a reaction from US President Donald Trump. At the time of writing, the GBP/USD trades at 1.2947 after hitting a daily high past the 1.31 mark. Read More...

Pound Sterling tumbles against US Dollar, Fed Powell's speech in focus

The Pound Sterling (GBP) gives up significant Thursday gains and plunges below 1.3000 against the US Dollar (USD) during North American trading hours on Friday. The GBP/USD pair weakens as the US Dollar (USD) rebounds after United States (US) President Donald Trump's reciprocal tariffs-driven sell-off came on Thursday. However, the outlook of the US Dollar remains weak as investors expect Trump's tariffs will stoke inflation and weigh on domestic economic growth. Read More...

GBP/USDtakes a hard rejection from fresh highs, but holds on the bullish side

GBP/USD briefly clipped the 1.3200 handle for the first time in six months on Thursday, climbing into fresh highs as the Greenback turns sour across the board. The Trump administration’s “reciprocal” tariffs and a flat tariff have kicked the legs out from beneath market sentiment, despite a delayed reaction to tariff announcements that came after US markets closed on Wednesday. Read More...

Author

FXStreet Team

FXStreet