Pound Sterling Price News and Forecast: GBP/USD pares biggest daily loss in over a week

GBP/USD Price Analysis: Bounces off immediate support line towards 1.2100

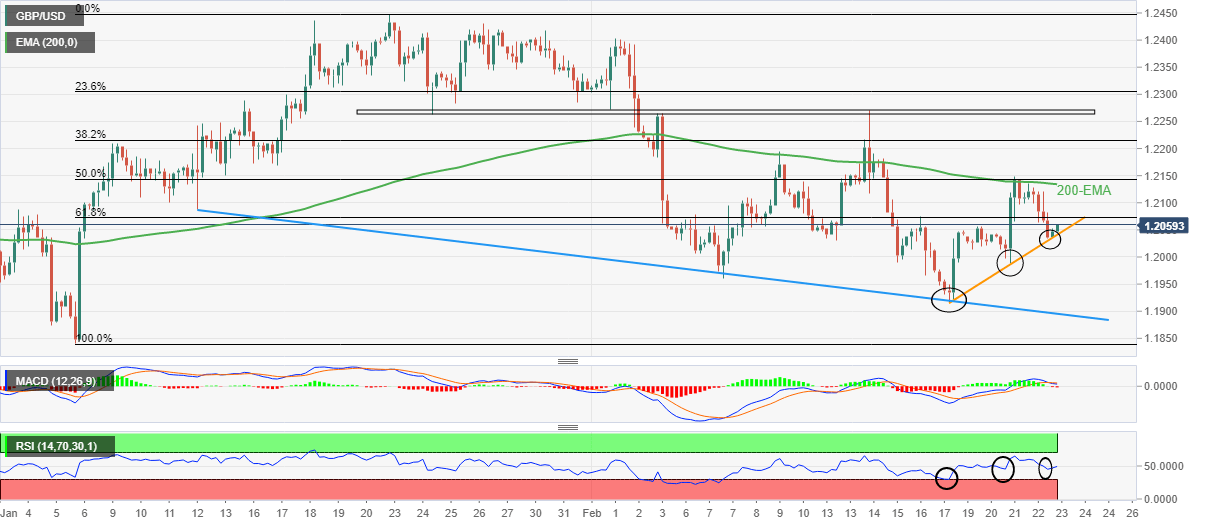

GBP/USD renews its intraday high near 1.2060 as it consolidates the biggest daily loss in more than a during early Thursday. In doing so, the Cable pair rebounds from a one-week-long ascending trend amid hidden bullish RSI divergence.

That said, the RSI (14) prints lower lows but the GBP/USD price prints higher lows, which in turn portrays a hidden bullish divergence and favors the quote’s latest bounce off the short-term key support line. Read more...

GBP/USD builds a cushion around 1.2040, volatility looks persistent ahead of US GDP

The GBP/USD pair has sensed a pause in the downside momentum after dropping to near 1.2040 in the early Asian session. It would be early to consider a loss in the downside momentum for the Cable as higher volatility might stay ahead of the release of the preliminary United States Gross Domestic Product (GDP) data for the fourth quarter of CY2022. The annualized economic data is seen stable at 2.9%

The Cable witnessed an intense sell-off in the late New York session after the release of the hawkish Federal Open Market Committee (FOMC) minutes. Federal Reserve (Fed) chair Jerome Powell and his mates are still reiterating higher interest rates for a longer period to drag the Consumer Price Index (CPI) to near 2% target. Read more...

Author

FXStreet Team

FXStreet